The DAX (DE30) opens slightly higher at the beginning of the week. However, initial gains have been somewhat reduced, and currently, the German index is only up by 0.20% ahead of the publication of the Ifo business sentiment index.

The forecasted reading of the index indicates a further deterioration of sentiment in Germany. In September, the Ifo is expected to drop to 85.2 from 85.7 the previous month. These levels suggest that the German economy is undergoing a significant slowdown, which is also confirmed by other macroeconomic readings. Historically, these Ifo index levels were only seen during the pandemic in 2020 and before the crisis in 2008.

The overall condition of the German economy remains weak; however, this doesn't significantly impact the main DAX (DE30) index prices for several reasons. First, the economic slowdown is not yet evident in the financial results of companies, and for now, forecasts also remain optimistic. Secondly, many companies listed on the DAX are international corporations, with a significant portion of their operations and sales occurring outside Germany. Companies like BMW, Siemens, and Bayer have a global character, which means that their results can be influenced by global economic conditions, not just those in Germany. For this reason, index quotations are more dependent on the economic climate in the USA than in Germany, which is clearly seen when comparing the chart with SP500 (US500).

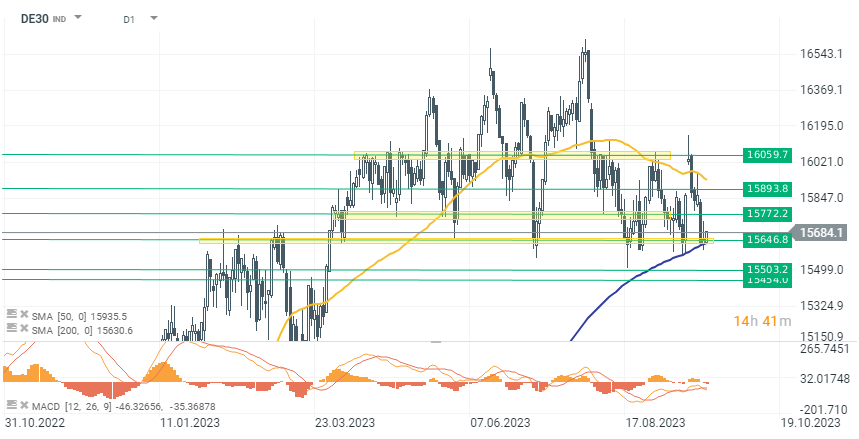

From a technical perspective, the DAX is currently testing the support level at 15,650 points again. This barrier was a significant resistance level before April this year when the index tried several times to rise above it. Since then, the mentioned level has been a key support zone, from which the index has rebounded 7 times. We are currently during the 8th test on a daily interval. However, divergence on MACD and increasingly weaker upward rebounds may indicate that the buying strength is waning, and soon the index may permanently break below the 15,650-point level. In such a case, the next support zones would be the 15,450-15,500 point area. Source: xStation 5.

📈US100 bounces back above the 100-day EMA

Market Wrap: Energy Stocks Retreat as Hopes for End to Iran War Grow 🌍 (10.03.2026)

Chart of the day: JP225 jumps on unexpected upward GDP revision 🇯🇵 📈 Japan is back in the game❓

A wild ride for markets as dizzying market U-turns dominate

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.