- EURUSD is down around 0.3% amid broad dollar strength.

- According to French media, Emmanuel Macron is consulting on a potential parliamentary dissolution.

- Fiscal and political jitters are boosting demand for traditional safe-haven assets.

- EURUSD is down around 0.3% amid broad dollar strength.

- According to French media, Emmanuel Macron is consulting on a potential parliamentary dissolution.

- Fiscal and political jitters are boosting demand for traditional safe-haven assets.

EURUSD is down 0.3% to around 1.162 amid a global dollar rally, sliding below key support near 1.165. Since the start of the week, the world’s most traded currency pair has fallen nearly 1%, as political turmoil in France and Japan has boosted demand for classic “safe havens” such as the dollar and gold.

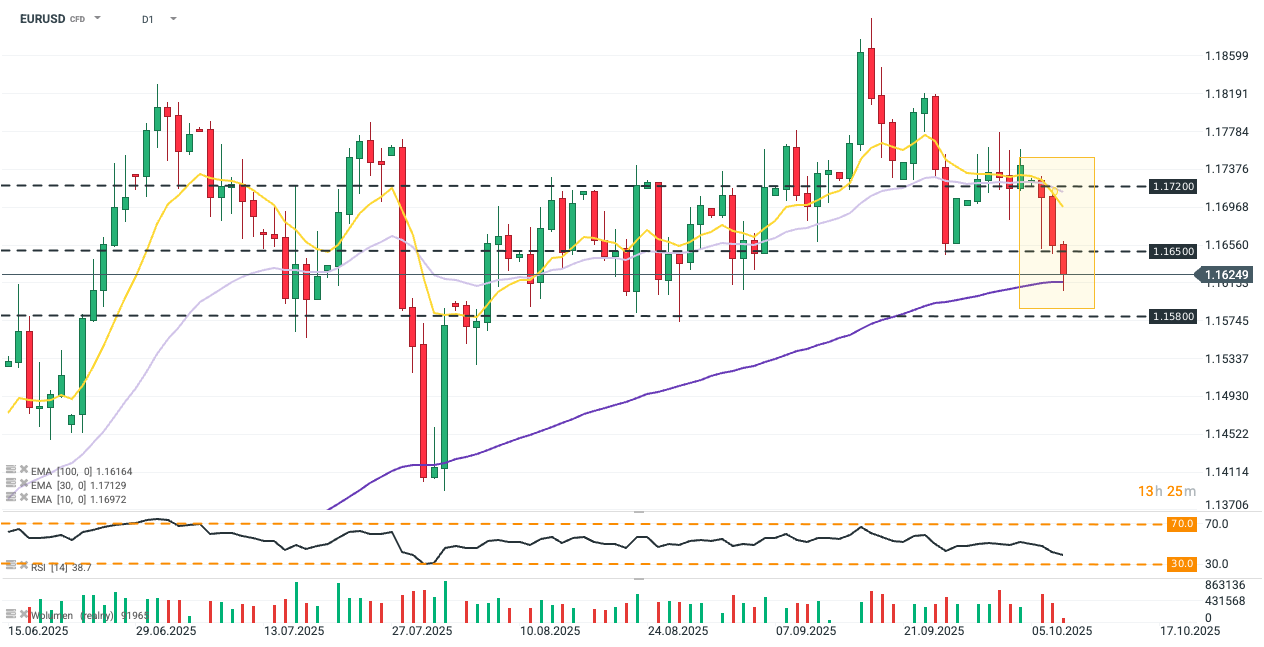

This week, EURUSD entered a sharp correction after last week’s break above 1.172, reaching a near six-week low today. The pair found support at the 100-day exponential moving average (EMA100, dark purple). Source: xStation5

What is shaping EURUSD today?

-

The dollar is strengthening against all G10 currencies as political uncertainty in France and Japan overshadows domestic U.S. concerns, i.e. the ongoing government shutdown. The Dollar Index (USDIDX) is up 0.2% today, hitting a two-week high.

-

Budget and political stability concerns in major economies have increased investor optimism toward the dollar and the overall U.S. economic outlook. The shutdown and the lack of most macro data create some uncertainty about the next Fed decision, but the effect is too small to alter market-implied expectations for an October rate cut in the U.S.

-

President Emmanuel Macron met yesterday with the presidents of France’s National Assembly and Senate to consult ahead of a potential parliamentary dissolution. French media also reported that prefectures were advised to prepare for possible elections between November 16 and 23. Political pressure is mounting on Macron to step down, complicating the outlook for the EU’s second-largest economy—especially as Prime Minister Lecornu’s resignation has dashed hopes for a timely budget approval.

-

On the other hand, there is no additional pressure on key Eurozone bonds. French 10-year yields fell about 5 bps, though they remain near historic highs, above levels seen during the last parliamentary dissolution in 2024. German 10-year Bund yields are down roughly 2.5 bps.

-

It is worth noting that a weaker euro could support the EU economy by boosting export competitiveness, provided that the French political crisis does not turn into a prolonged impasse or fiscal crisis. ECB President Christine Lagarde highlighted euro appreciation this week as a potential risk to EU growth, so a sustained EURUSD pullback from recent highs could ease the slowdown in business activity observed last month.

-

The Japanese yen did not benefit from the safe-haven flow, weighed down by Sanae Takaichi’s nomination as a prime minister candidate. Takaichi has repeatedly supported expansive fiscal policies while criticizing further interest rate hikes. Potential increases in public spending could be inflationary, and combined with yen depreciation, may accelerate a return to rate hikes by the Bank of Japan.

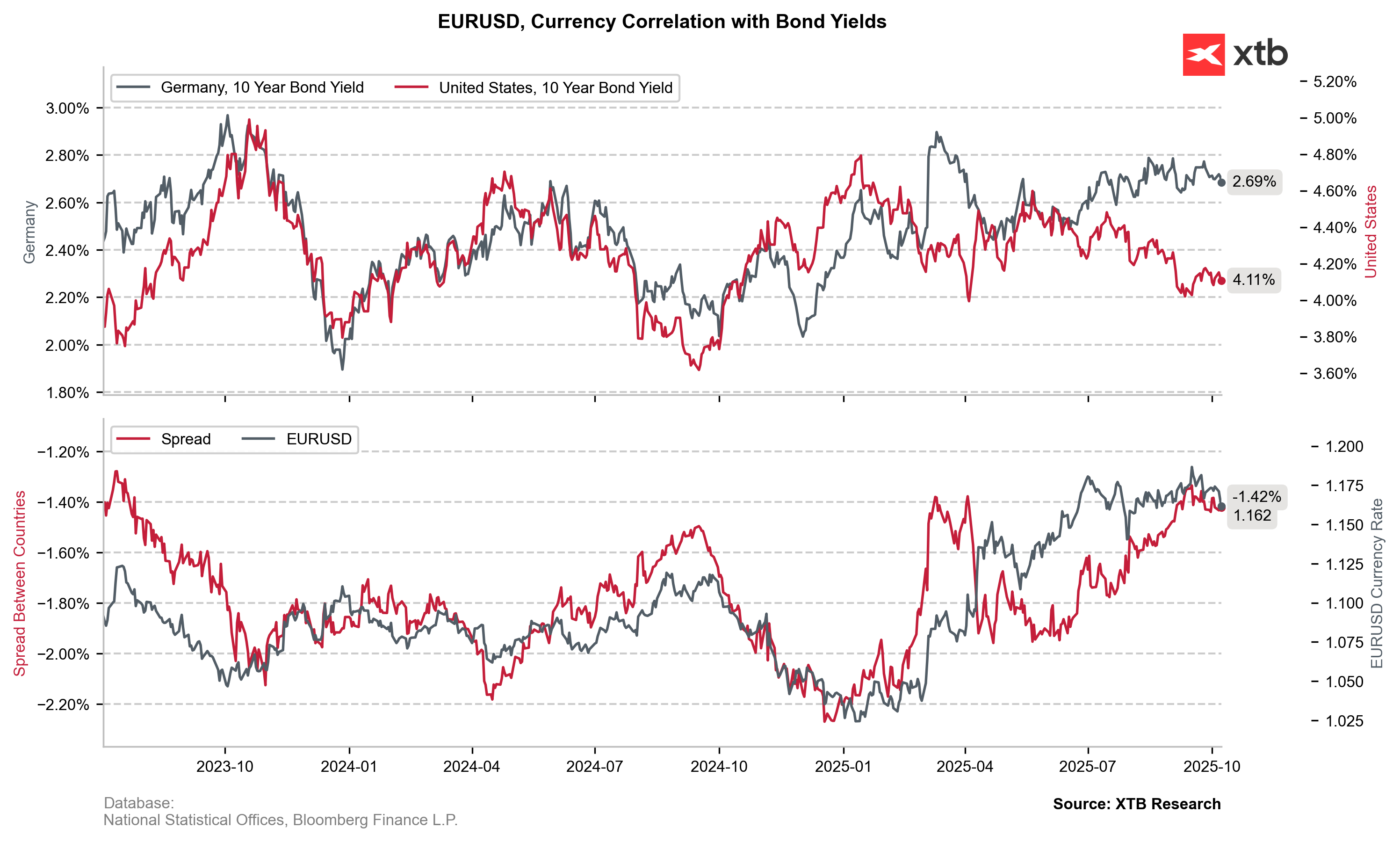

EURUSD is now reacting to the yield spread between German and U.S. 10-year bonds. Source: XTB Research

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.