The euro is today the strongest G10 currency, rebounding about 0.15% against the dollar after two days of the deepest correction in two months. Nevertheless, EURUSD still trades below the psychological level of 1.1700, and the recent upward trend may be challanged by the latest U.S. GDP data and Donald Trump’s new wave of tariffs.

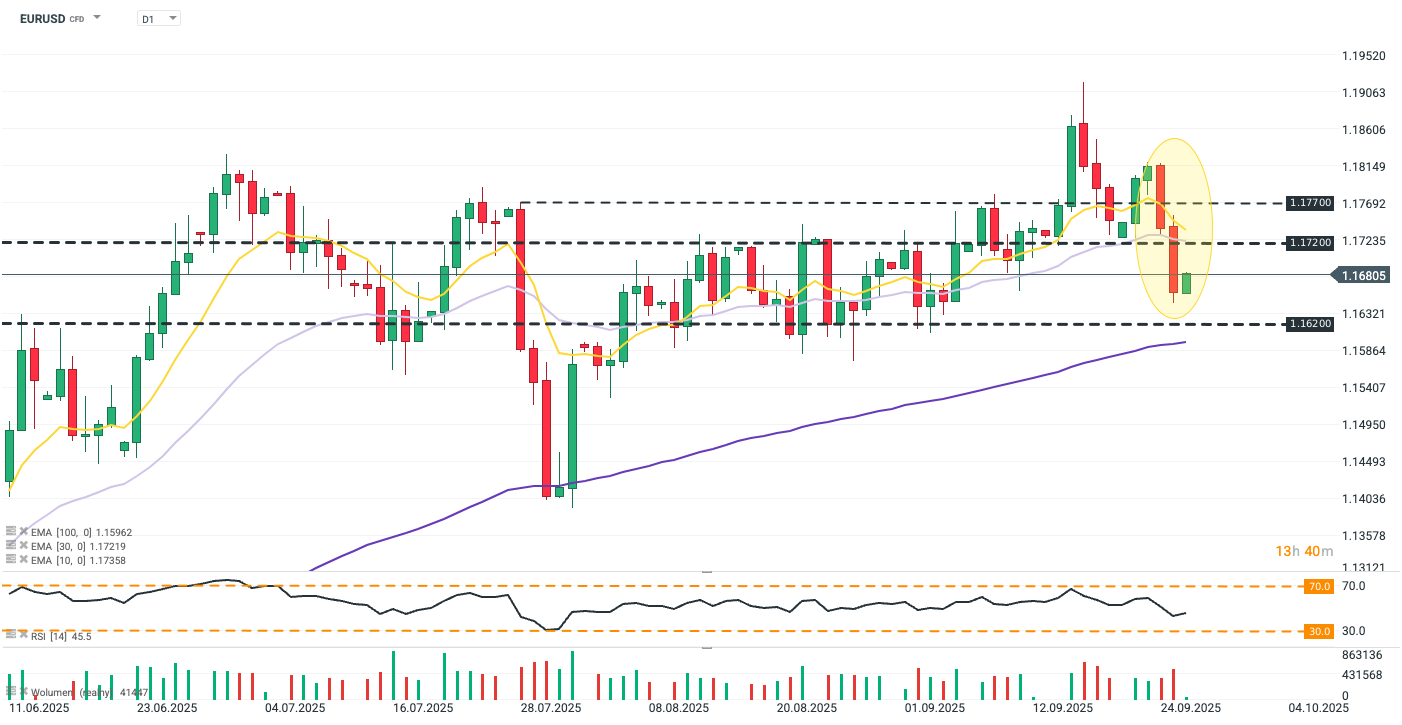

EURUSD lost 1.3% over the past two sessions, the steepest decline since the sharp selloff at the end of July in reaction to the EU–U.S. trade agreement. The pair plunged below the 30-day exponential moving average, but held safely above key support at 1.162. The scale of today’s rebound, however, will largely depend on the PCE report. Source: xStation5

What is shaping the EURUSD today?

-

Annualized U.S. GDP in Q2 was revised upward from 3.3% to 3.8%, the strongest reading since Q3 2023. A major driver was a tariff-driven boost in net exports, but private consumption — the main engine of the U.S. economy — also strengthened (revised from 1.6% to 2.5%) despite inflation and labor market concerns, as well as weak survey data.

-

The show of strength from the American consumer tempers expectations of further Fed rate cuts, especially combined with the latest labor market data, thus supporting the USD. Jobless claims unexpectedly fell below the 4-week average (218k vs. forecast 233k, prior 232k), easing fears of a rapid deterioration in the labor market. Overall, the data supports caution on the Fed’s side, but tension and uncertainty will grow ahead of today’s PCE report and next week’s NFP.

-

The core PCE index is expected to remain at 2.9%, and an in-line print should help the euro catch its breath after recent losses. On the other hand, uncertainty about Fed policy could amplify the market’s reaction in the event of higher-than-expected inflation, especially given Jerome Powell’s recent hawkish remarks about no risk-free rate path.

-

Donald Trump has announced a new round of tariffs effective October 1: 100% on branded pharmaceuticals, 50% on kitchen and bathroom cabinets, 30% on upholstered furniture, and 25% on trucks. However, details about possible exemptions are lacking — important in the context of EU and Japan agreements, which assumed no additional tariffs beyond those negotiated. The pharmaceutical tariff will not apply to companies that have begun building production lines in the U.S. (e.g., AstraZeneca, which announced a new plant in Virginia).

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.