- Japan’s Nikkei 225 index surpassed the 50,000 mark for the first time in history on Monday

- On a monthly basis, the JP225 index has logged its strongest month for the last 15 years

- On a yearly basis, 2025 marks the second-strongest year of gains

- Japan’s Nikkei 225 index surpassed the 50,000 mark for the first time in history on Monday

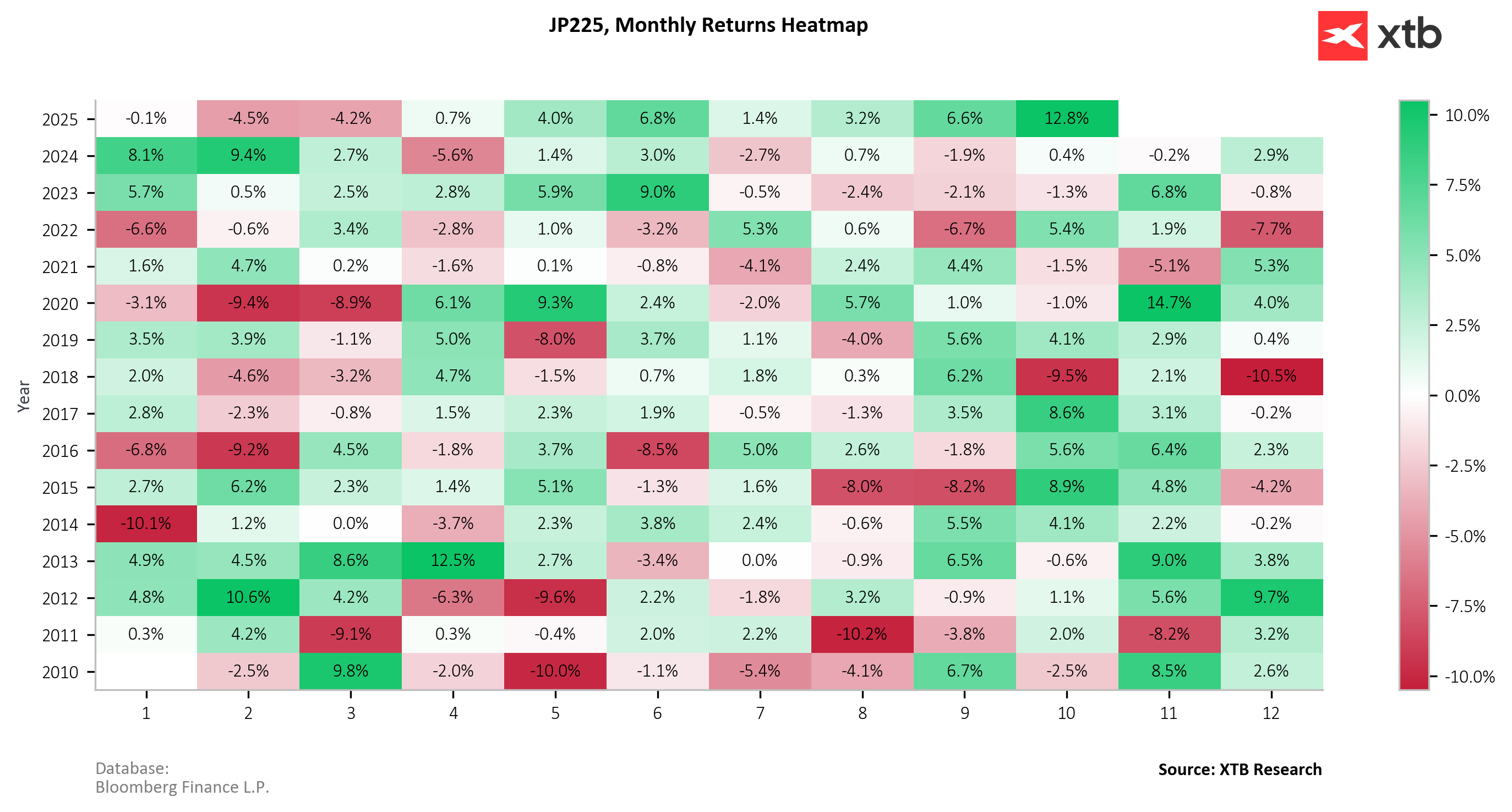

- On a monthly basis, the JP225 index has logged its strongest month for the last 15 years

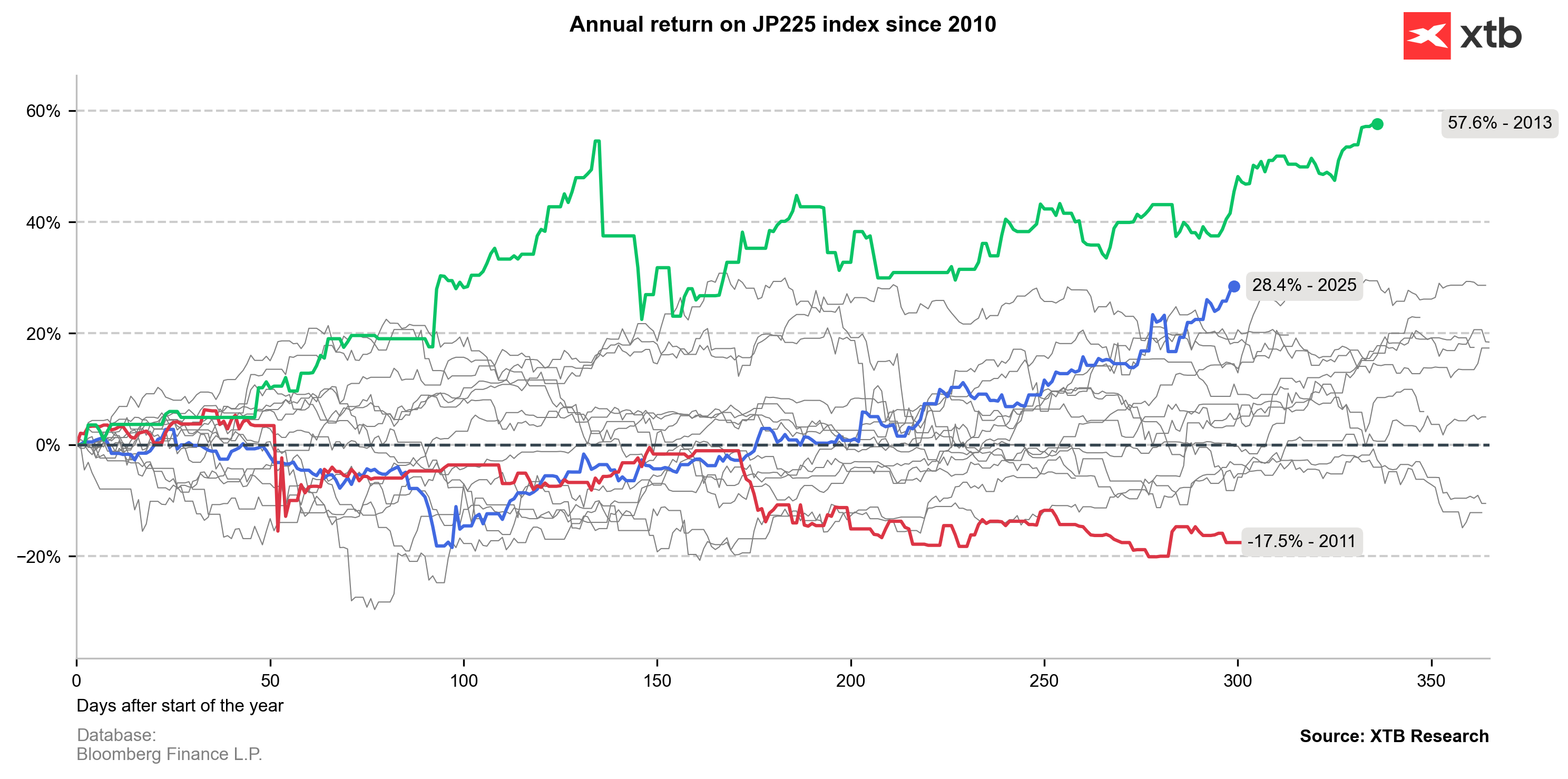

- On a yearly basis, 2025 marks the second-strongest year of gains

Japan’s Nikkei 225 index surpassed the 50,000 mark for the first time in history on Monday, closing up 2.46% at 50,512 points. The rally reflected optimism over easing U.S.–China trade tensions and strong global risk appetite following record gains on Wall Street.

Investor sentiment in Japan was further supported by expectations that the Bank of Japan will maintain its ultra-loose monetary policy at this week’s BoJ meeting, as well as by political backing for Prime Minister Sanae Takaichi’s pro-growth reforms. Her government’s planned expansionary fiscal measures have drawn comparisons to “Abenomics,” raising hopes of escaping decades-long deflation. The yen remains unusually strong today, gaining around 0.10–0.20% against other G10 currencies, while USDJPY is down 0.17% to 152.820.

Risk appetite in the Asia-Pacific region was also buoyed by news that the U.S. abandoned plans to impose 100% tariffs on Chinese imports. Investors expect Prime Minister Takaichi to meet former President Trump during his visit to Japan later this week.

On a monthly basis, the JP225 index has logged its strongest month since data collection began in 2010, rising 12.8% in just one month (October).

On a yearly basis, 2025 marks the second strongest year of gains in the past 15 years, although it’s worth noting that the rally accelerated only around midyear.

JP225 (D1 interval)

Surpassing the historic 50,000-point threshold — more than three decades after the 1989 bubble-era peak — signals a gradual revival of investor confidence in Japan’s economy. Nikkei 225 futures (JP225) traded on the XTB platform had already crossed 50,000 points late last week, following the close of Japan’s cash session.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.