-

Soybeans surged before the Trump-Xi meeting in Busan due to hopes of a breakthrough and China’s first US purchases in a long time.

-

After talks, a lack of specifics from China on further purchases led to a more than 1% drop in prices.

-

Structurally, China sources most of its imports from Brazil, and the recent US soybean purchases were symbolic rather than a turning point.

-

Soybeans surged before the Trump-Xi meeting in Busan due to hopes of a breakthrough and China’s first US purchases in a long time.

-

After talks, a lack of specifics from China on further purchases led to a more than 1% drop in prices.

-

Structurally, China sources most of its imports from Brazil, and the recent US soybean purchases were symbolic rather than a turning point.

Futures contracts for soybeans in Chicago dropped by over 1% following the conclusion of the Trump-Xi meeting in Busan, despite earlier dynamic price gains driven by hopes for a trade agreement and a resumption of Chinese soybean purchases. Ultimately, state-owned COFCO purchased three cargoes of soybeans for December and January delivery as a goodwill gesture immediately preceding the talks, marking a clear signal of change after a period of boycotting US supplies.

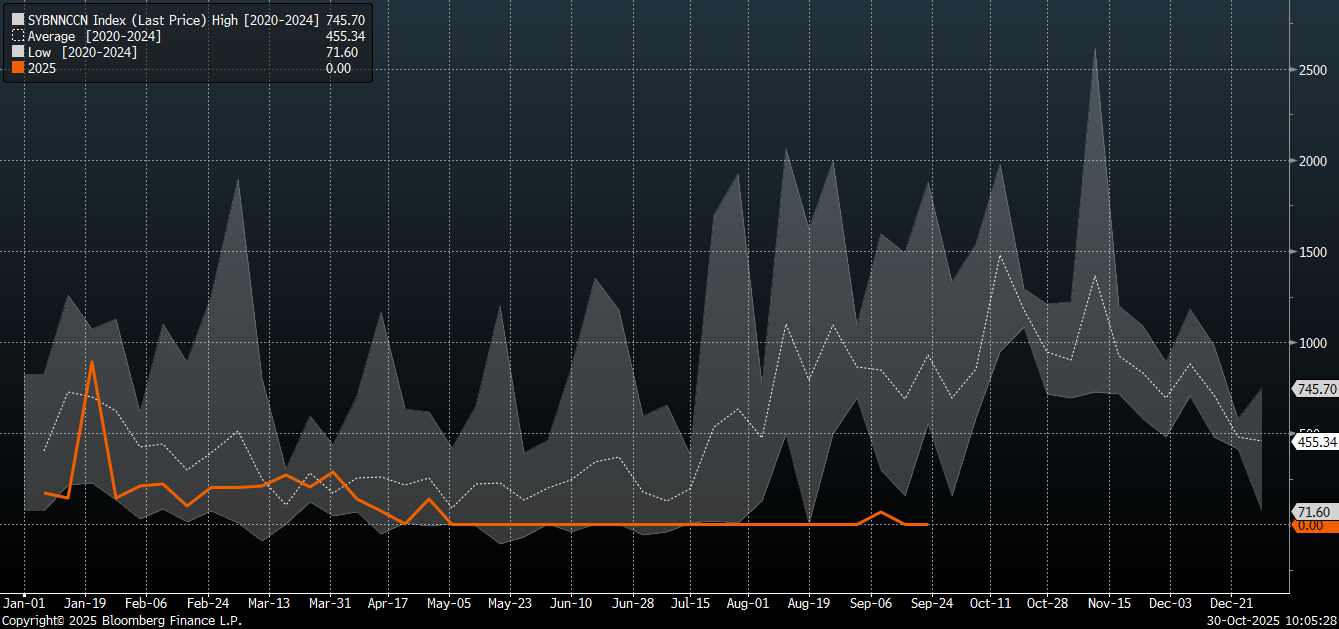

China has bought virtually no US soybeans since the trade war began in April. It is worth noting, however, that China has significantly diversified its sources of supply since the initial trade conflict. The current order may not indicate a total shift in procurement direction, as it coincides with the standard seasonal lull in supplies from South American countries. Source: Bloomberg Finance LP

Soybean prices have been rising since mid-October, and trading opened with a gap-up at the start of this week, reaching peaks near 1,100 cents per bushel—the highest level in 15 months. However, the price is reacting negatively following China's declaration. It is worth recalling that the 2020 declaration of strong purchases of soybeans and other agricultural products was never fully fulfilled. Until the details of the agreement are released, such as a full purchase schedule, investors may choose to book more profits. The position of speculators is also unknown; immediately before the US government shutdown, speculative investors maintained a net short position in soybeans.

It must be emphasized that structurally, the majority of Chinese imports are still sourced from Brazil, which met over 70% of China's demand in 2025 by exporting record volumes—an effect of the tariff war and political uncertainty. US farmers have borne the negative consequences of this policy, as historically, the peak selling season occurred in autumn. Some analysts stress that COFCO's purchases are strictly political in dimension and do not alter Brazil's position as the primary supplier. The 180,000 tonnes of soybeans bought by China are considered more of a gesture than a genuine reorientation of trade.

Technical Outlook

The price is currently rebounding from the 1,070 cents per bushel level, but a scenario where the gap created at the start of this week is closed cannot be ruled out. Key support is located at 1,058 at the 38.2% Fibonacci retracement of the last upward wave, and 1,042 at the 50.0% retracement.

Morning wrap (05.03.2026)

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.