Expectations of the Fed becoming more hawkish are on the rise following recent comments from US central bankers. Almost every Fed member that has spoken out recently called for a more hawkish policy. As a result, interest rate derivatives price in a 50 basis point rate hike at a meeting in May and it is also becoming a dominating expectation among major commercial banks. As a result, US dollar is getting a lift. However, even bigger moves can be spotted on the bond market. US yields are spiking with 10-year market rate jumping above 2.5% - the highest level since April 2019. An increase in US yields, however, means that bond prices are dropping.

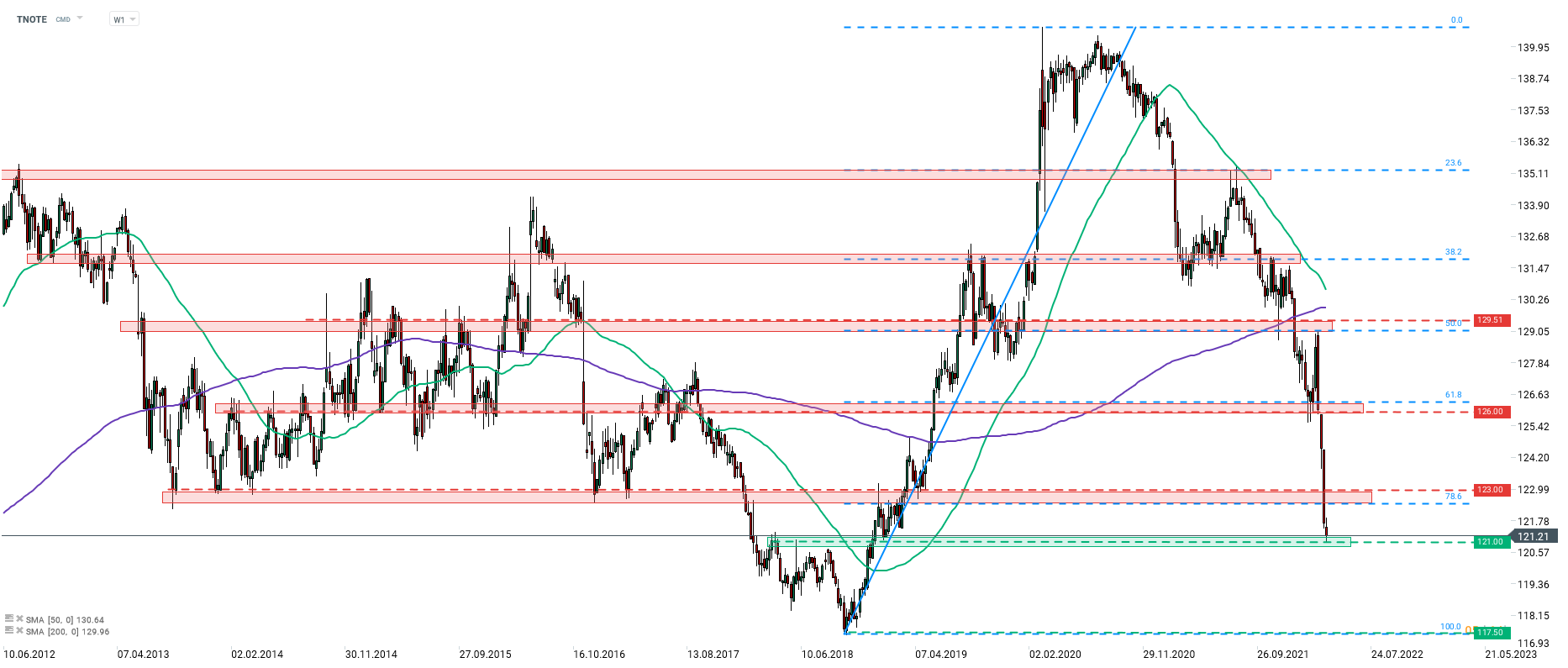

Taking a look at a weekly chart of US 10-year bond (TNOTE), we can see that price has been freefalling since the beginning of Russian invasion of Ukraine in late-February 2022. Following a strong downward move last Friday, price broke below the 78.6% retracement of the upward move launched in September 2018. Decline is being continue at the beginning of a new week with a test of the 121.00 support zone. A break below would open the way towards late-2018 lows in 117.50 area.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Markets attempt to rally on positive news from Iran

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.