Nasdaq 100 futures (US100) are up 0.15% today, pushing toward the 26,000 mark. The index appears just one step away from record territory, even as the sell-off in several tech heavyweights such as Microsoft and Palantir continues. Meanwhile, the Q4 2025 earnings season is now clearly past the midpoint, and the market is receiving a set of signals that can be read without overinterpreting them. The picture is consistent and repeatable: companies are delivering, revisions are moving higher, and earnings growth remains in double digits.

What we know for sure (with 59% of S&P 500 companies having reported)

-

76% of companies beat EPS expectations, and 73% beat on revenues.

-

Reported earnings are, on average, 7.6% above estimates, broadly in line with history (between the 5-year and 10-year averages).

-

Revenues are, on average, 1.4% above estimates (below the 5-year average of 2.0%, but in line with the 10-year average of 1.4%).

-

The blended earnings growth rate stands at 13.0% y/y for the S&P 500. If it holds, this would be the fifth consecutive quarter of double-digit earnings growth.

-

The blended revenue growth rate is 8.8% y/y, which would be the strongest pace since Q3 2022 (11.0%) and the 21st consecutive quarter of revenue growth for the index.

-

In-season revisions: as of December 31, the market was pricing 8.3% earnings growth for Q4; today it is 13.0%, reflecting positive EPS surprises and upward drift in the aggregate.

-

Q1 2026 guidance: 23 companies issued negative EPS guidance, while 28 issued positive guidance.

-

The S&P 500’s forward 12-month P/E is 21.5, above both the 5-year average (20.0) and the 10-year average (18.8). That matters because the market is not “cheap,” so the quality of earnings delivery carries extra weight.

Why do tech and globally exposed companies look better right now?

A practical angle from the data is geographic revenue exposure. With the US dollar softer, companies generating more sales outside the US are showing clearly stronger growth.

-

Companies with >50% of sales in the US: earnings +10.0% y/y, revenues +7.7% y/y

-

Companies with >50% of sales outside the US: earnings +17.7% y/y, revenues +11.9% y/y

Here is the key analytical nuance: NVIDIA is the largest single contributor to that outperformance. Excluding NVIDIA from the “more international exposure” group, growth cools to earnings +12.0% and revenues +9.9%. The gap narrows, but it does not disappear, suggesting the FX tailwind and broader global exposure are real, with NVDA providing an extra boost.

What has lifted the growth rate in recent days?

-

Over the past week, the improvement in the earnings growth rate has been driven mainly by positive EPS surprises, led by Communication Services, Health Care, and Financials.

-

Since December 31, the largest contributions to the increase in the earnings growth rate have come from Industrials, Information Technology, and Communication Services.

-

On the revenue side (since December 31), the biggest contributors to improved revenue growth have been Information Technology, Communication Services, Health Care, and Industrials.

-

9 of 11 sectors are reporting y/y earnings growth, led by Information Technology, Industrials, and Communication Services.

-

Two sectors are reporting y/y earnings declines: Consumer Discretionary and Health Care.

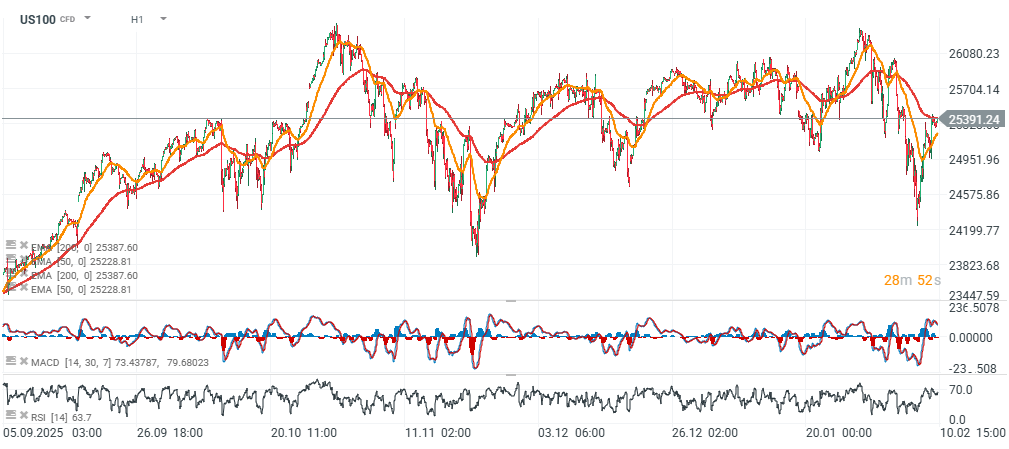

US100 (H1 timeframe)

US100 is trading above the 200-period EMA (red line) and sits roughly 1,000 points below the all-time high near 26,400.

Source: xStation5

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.