The Swiss franc plunged following the SNB rate decision yesterday. SNB hiked rates by 75 basis points but it looks like the market expected more. Expectations that SNB may front-load a 100 or even 125 bp rate hike results from an expected continuation in tightening in the eurozone. SNB does not want to fall too far behind ECB and given that it meets twice less often, there were some hopes for rate hike front-loading. However, SNB President Jordan does not exclude the possibility of making inter-meeting rate moves if the situation requires. Some more hints from SNB President may be offered today when he makes a speech at an event at 4:30 pm BST. Fed Chair Powell, as well as Fed Brainard and Fed Bowman, are also expected to make appearances today at the 'Fed listens' event today (7:00 pm BST). However, Powell will only deliver opening remarks while Brainard and Bowman will act as moderators in panel discussions.

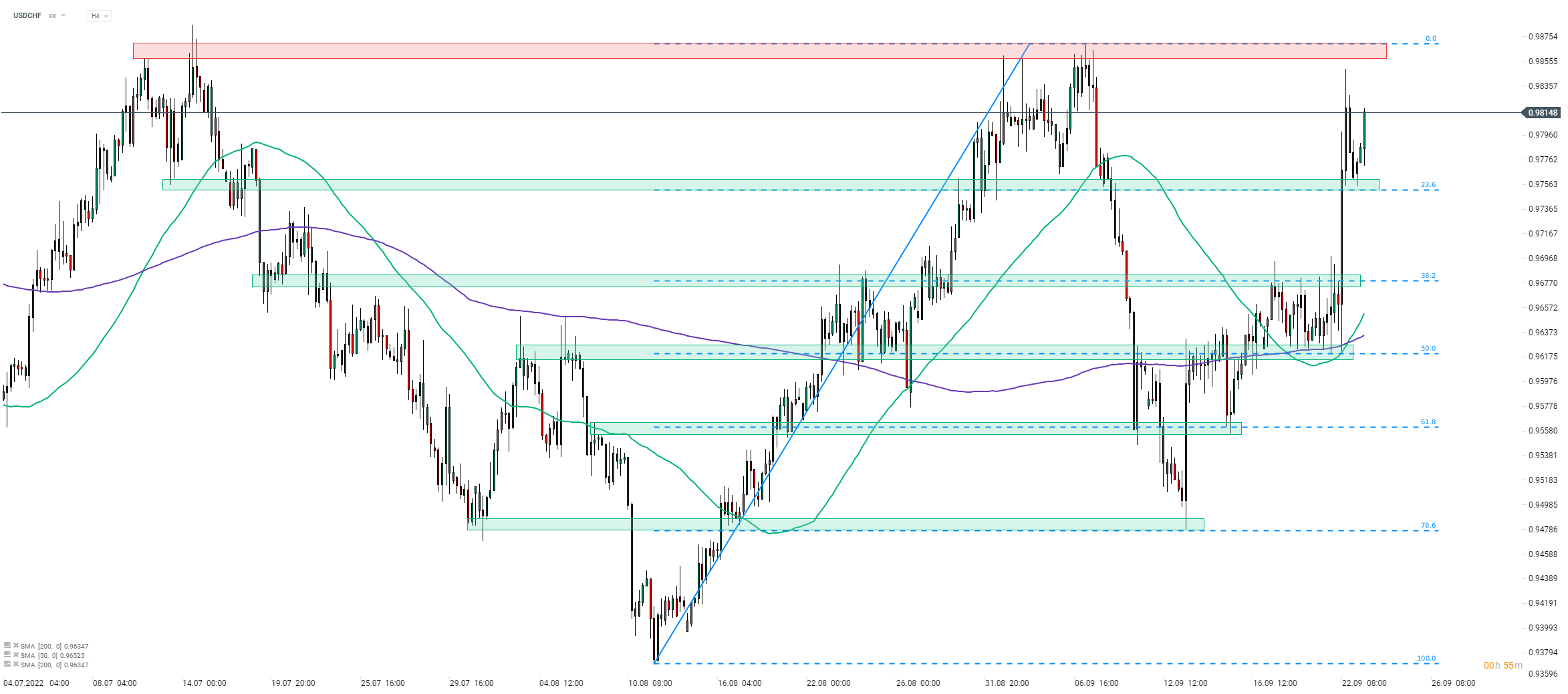

Taking a look at the USDCHF chart at the H4 interval, we can see that a strong upward move yesterday, triggered by SNB decision, pushed the pair out of the recent trading range, marked with 50 and 38.2% retracement of the upward move launched in the first half of August. The pair continued to rally and broke above resistance marked with 23.6% retracement as well. A brief pullback occurred later on, leading to a retest of the aforementioned 23.6% retracement. Following successful defense the pair resumed upward move. Recent highs in the 0.9860-0.9870 area are a key resistance to watch now.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.