The Norwegian krone is gaining value against other G10 currencies during this morning. This is related to today's inflation reading in Norway, which showed a slower decline in the growth dynamics of the prices of goods and services than expected by the consensus. In year-on-year terms, CPI inflation stood at 6.4%, above expectations of 6.1% and a previous reading of 6.5%. However, investors were drawn to the monthly reading, which showed a growth of 1.1% compared to expected 0.7% and a previous growth of 0.8%.

NOK has been under downward pressure in recent weeks, which was reinforced by the sell-offs in the oil market. During its last meeting, Norges Bank signaled that it would be more responsive to changes in the Norwegian krone's FX market quotes, which, with higher inflation readings, may prompt Norges Bank to raise interest rates further. At the moment, the money market is pricing in another rate hike at the June meeting with a high probability.

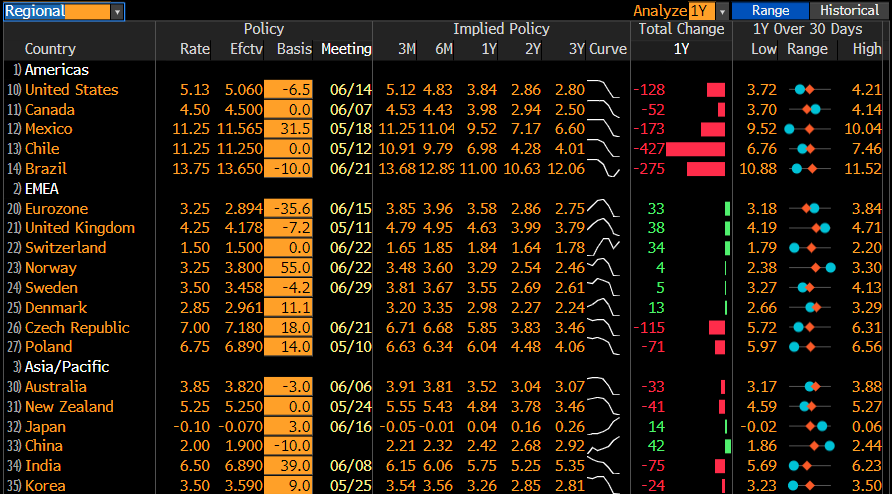

The money market implies a continuation of the cycle of interest rate hikes in Norway. Source: Bloomberg

The money market implies a continuation of the cycle of interest rate hikes in Norway. Source: Bloomberg

The USDNOK pair, daily interval. The pair is currently moving in accordance with the upward trend line set in early March 2022 (support line), which, however, is experiencing selling pressure in the 10.85 zone. Source: xStation 5

The USDNOK pair, daily interval. The pair is currently moving in accordance with the upward trend line set in early March 2022 (support line), which, however, is experiencing selling pressure in the 10.85 zone. Source: xStation 5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.