-

China’s rare-earth exports fell 31% m/m in September, reaching their lowest level since February amid tighter export controls.

-

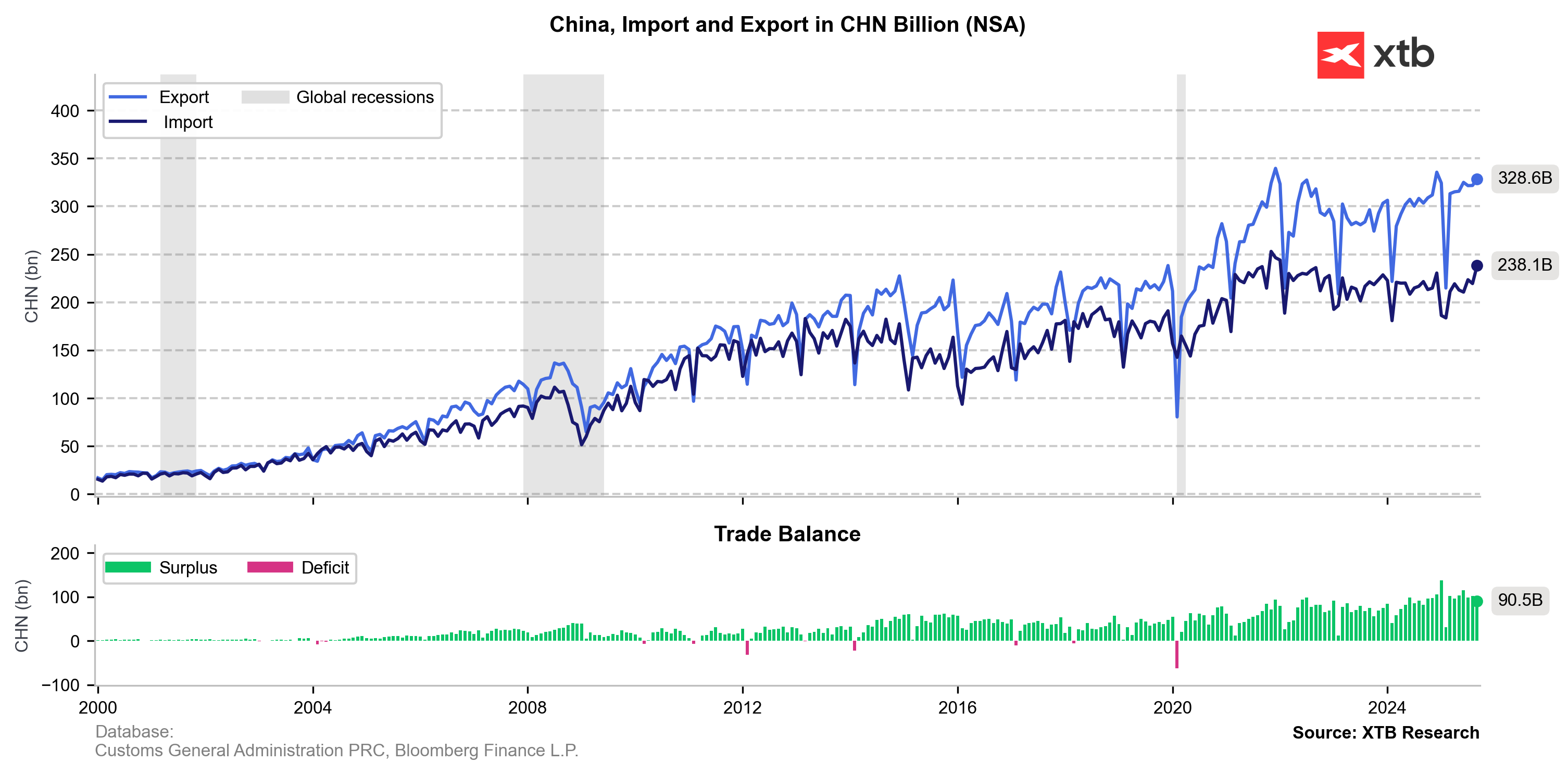

China’s exports rose 8.3% YoY (the strongest in six months), and imports climbed 7.4% YoY (the most in 17 months).

-

Record monthly imports of iron ore and soybeans highlight resilient demand.

-

The trade surplus came in at $90.5 billion, slightly below expectations due to strong import growth.

-

China’s rare-earth exports fell 31% m/m in September, reaching their lowest level since February amid tighter export controls.

-

China’s exports rose 8.3% YoY (the strongest in six months), and imports climbed 7.4% YoY (the most in 17 months).

-

Record monthly imports of iron ore and soybeans highlight resilient demand.

-

The trade surplus came in at $90.5 billion, slightly below expectations due to strong import growth.

Earlier today, we received China’s September trade data, which came in stronger than expected. Exports rose 8.3% YoY to $328.6B (the highest in six months), while imports increased 7.4% YoY (the strongest in 17 months). The trade surplus widened to $90.45B.

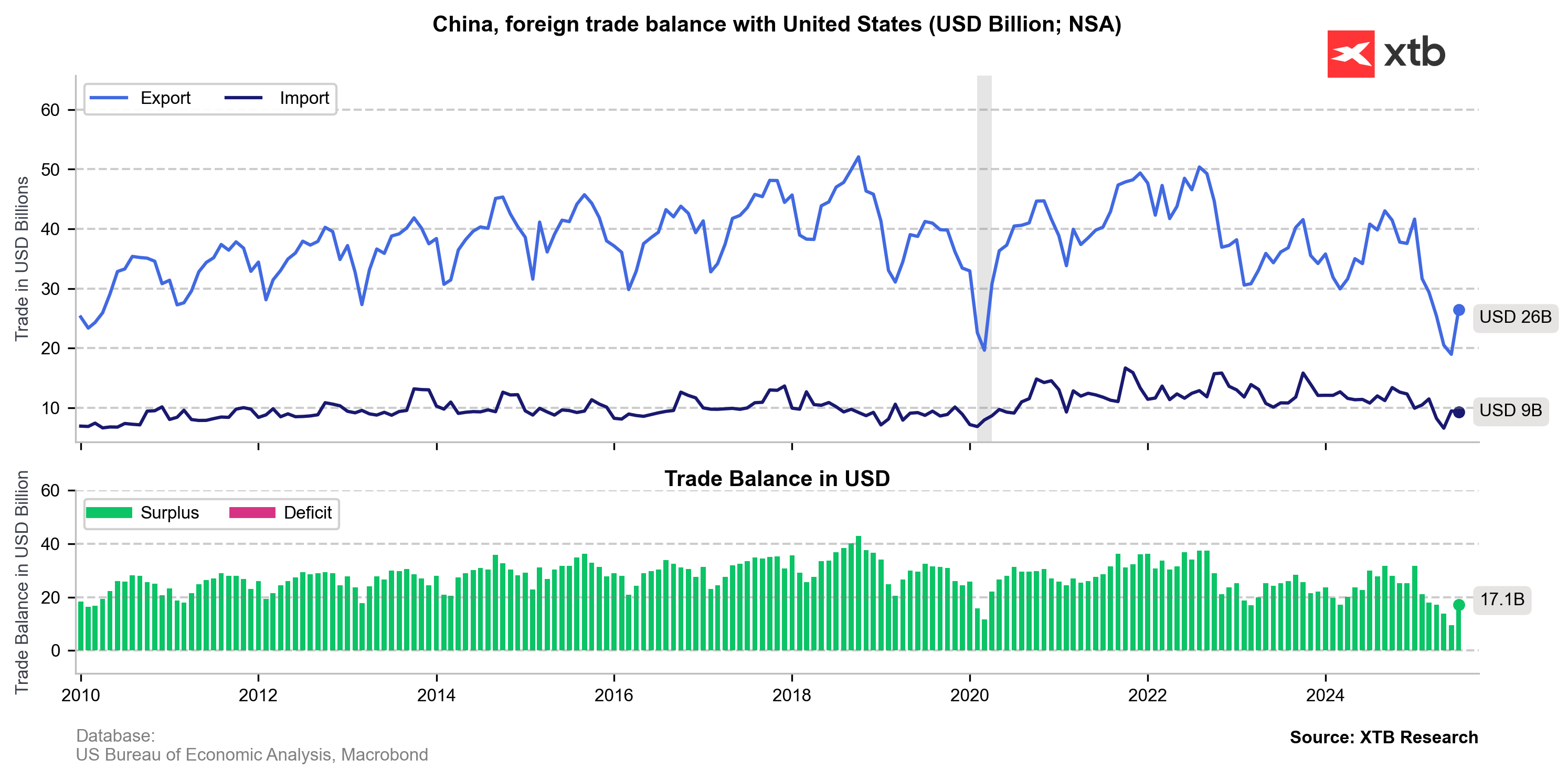

The composition of exports is key for investors. Shipments to the U.S. fell 27% YoY, but this was more than offset by double-digit growth to the EU (~14%), ASEAN (~15–16%), Africa (~56%), and other non-U.S. markets (+14.8% overall). This diversification has helped China maintain a GDP growth rate near 5%, despite earlier tariff hikes.

Exports to the U.S. have dropped sharply since the trade war began in April, while other regions have compensated for the decline. Imports from the U.S. to China, however, have remained relatively stable.

Over the past week, political risk has risen sharply. Beijing expanded export controls on rare earths and magnets, where it holds a near monopoly. The move was met with strong discontent from the U.S. administration. Trump threatened to reinstate 100% tariffs and introduce additional software export restrictions. As a result, Chinese futures fell nearly 6% by the end of Friday’s session. Investors began to fear further escalation and renewed supply-chain disruptions across industries such as automotive, EVs, batteries, aerospace, and renewable energy.

A mild de-escalation followed over the weekend after a Donald Trump post assuring that the U.S. and China will reach an agreement, noting that the trade war benefits neither side. Markets still hope for a potential Xi–Trump meeting during APEC later this month, though the range of possible outcomes has widened. In the short term, rising exports to non-U.S. markets, stockpiling of commodities (steel, coal, soybeans from South America), and trade rerouting through hubs such as Vietnam are cushioning the impact of tensions — but triple U.S. tariffs would be a major deflationary shock to China’s export sector and a blow to global risk markets.

Chinese indexes are posting a sharp rebound today, up around 3.50–4.00%. The CHN.cash index gains 3.75% to 9,175 points. Despite improved market sentiment, indexes remain more than 2.25% below Friday’s opening levels.

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.