In October 2025, China recorded its first positive consumer price inflation (CPI) reading since June, with CPI rising 0.2% year-on-year, slightly above market expectations of zero growth. This indicates that the deflation present for most of the year is starting to ease, driven by rising consumer demand and the effects of economic stimulus measures, particularly during the national holiday period. On a monthly basis, CPI also increased by 0.2%, signaling a stabilizing trend in consumer prices.

At the same time, producer price inflation (PPI) remains in negative territory, falling 2.1% year-on-year, although slightly less than the forecast of -2.2%. This shows that deflationary pressure in the industrial sector persists, albeit at a diminishing rate, and has continued for over three years. Food prices fell 2.9% year-on-year, despite a modest 0.2% increase on a monthly basis, contributing to the moderate overall inflation dynamic in China. Taken together, these figures suggest that the Chinese economy is gradually recovering from a prolonged period of deflation, with stimulus policies focused on boosting domestic demand beginning to take effect.

The stabilization of consumer inflation in October indicates that the risk of a sudden rise in prices in the short term remains low. In practice, this allows the People’s Bank of China to maintain a loose monetary policy, which can further support consumption and investment. However, the situation requires continued monitoring, as ongoing producer deflation points to challenges in the industrial sector that could impact global supply chains.

The rise in China’s CPI also has a direct effect on global equity markets. A positive reading after a long period of deflation signals a revival in domestic demand, potentially boosting the growth of consumption-dependent companies. This improves investor sentiment, particularly on Asian stock exchanges, and positively affects global indices, increasing risk appetite. Additionally, moderate CPI growth reduces concerns over aggressive interest rate hikes, which could otherwise constrain asset valuations, further supporting equity markets. However, persistent producer deflation remains a factor that investors closely watch when assessing economic growth prospects.

China’s inflation also plays an important role in the dollar exchange rate and global capital flows. A positive signal from rising consumer inflation increases the attractiveness of investing in Chinese assets, potentially leading to capital inflows into China and strengthening the yuan against the dollar. At the same time, more stable economic prospects reduce risk aversion, supporting investment in emerging markets and influencing global capital trends.

It is also worth noting which asset classes typically benefit from higher CPI in China. Consumer stocks and commodities, particularly industrial and energy metals, usually see the strongest gains as they benefit from rising domestic demand and higher prices. Treasury bonds offer higher yields, serving as a safer haven compared with more volatile assets. Positive inflation signals also support equity markets in emerging economies, which often benefit from China’s growing consumption.

October’s inflation data in China point to the beginning of a consumption recovery and stabilization of consumer prices, which could support a loose monetary policy and foster positive sentiment in global markets. At the same time, persistent producer deflation reminds that industrial sector challenges remain and will be key to the sustainability of China’s economic recovery.

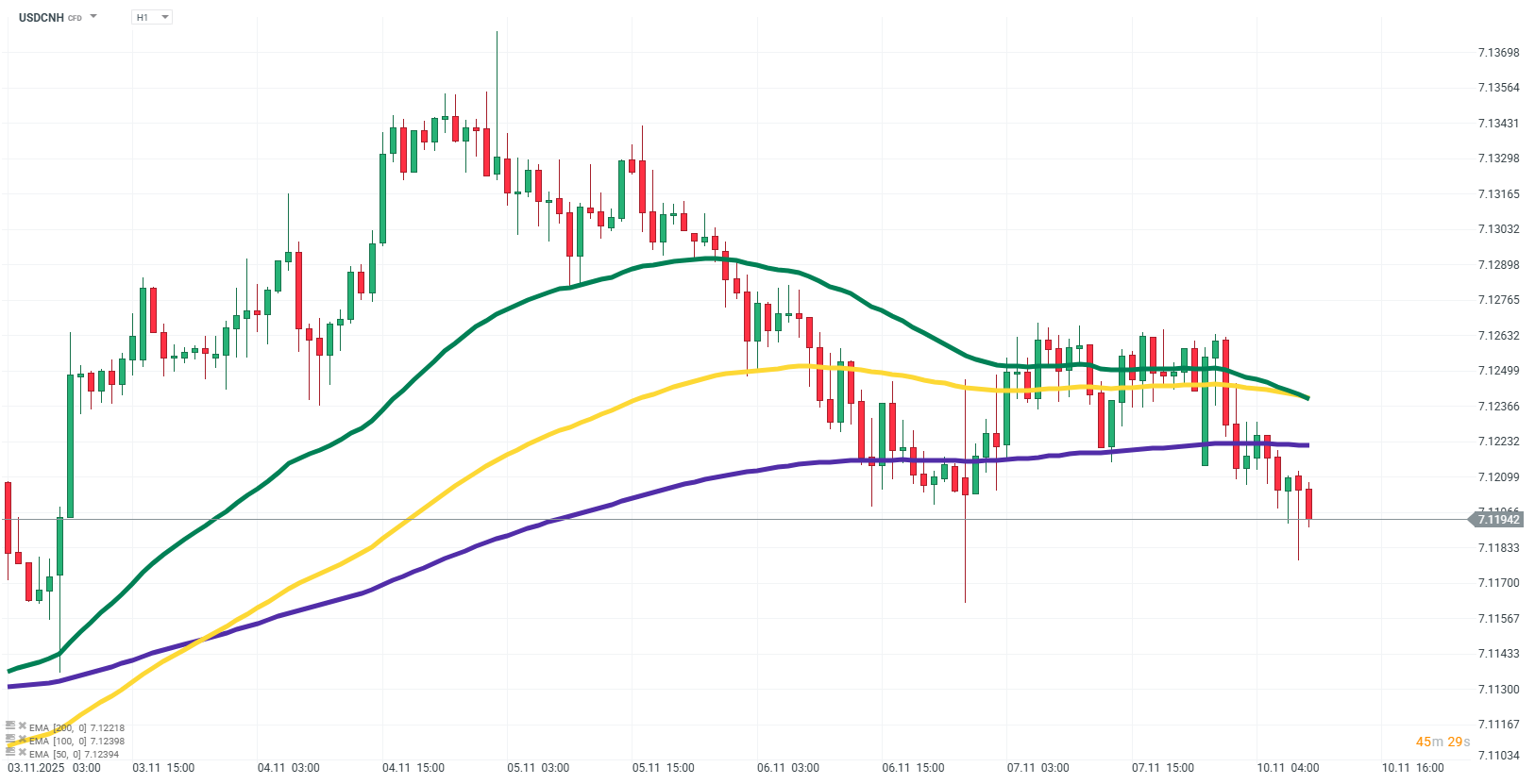

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.