Summary:

-

China’s Q3 GDP missed expectations while other releases for September turned out mixed

-

Asian stock markets rise (except NIKKEI) despite meaningful drops on Wall Street

-

PBoC vows to continue to keep prudent, neutral monetary policy and mentions ‘low valuations of its stock market’

The China’s economy expanded at a slower than forecast pace at the third quarter missing the 6.6% consensus. The 6.5% rate of growth reached in the three months through September means a decline from 6.7% seen in the second quarter but matches the overall deviation we have tended to observe earlier (0.1-0.2 percentage point deviation from the expected value). It was however the slowest rate of growth since the first quarter of 2009. This is a result of the country’s trade war waged with the US which has already put downward pressure on economic activity. Nevertheless, it is highly likely that we have yet to see the holistic effect of trade frictions on GDP growth hence one may suspect that the last quarter of this year will also show a sub-par value. Having said that, one cannot forget about a set of tools rolled out by the local authorities to bolster economic growth offsetting adverse effects coming from trade tensions. Among these measures we can single out looser monetary policy, lower currency or a fiscal boost. Note that the PBoC decided to again devalue the yuan at the Friday’s session by setting the reference rate of the USDCNY at 6.9387 compared to 6.9275 on Thursday. Is today’s release particularly disappointing? Well, the China’s GDP target for this year is around 6.5% and it looks that the country remains on track to meet this level hence the data does not look so dreadfully as it would seem on the face of it.

GDP growth in China keeps moving down along with industrial output. Retail sales appear to decouple from the two indicators. Source: Bloomberg

On top of that we were also offered a set of readings for September from China. The largest disappointment came from industrial production as it increased merely 5.8% in annual terms falling short of the median estimate of 6%. This was compensated by better prints of retail sales and fixed assets investment. The former grew 9.2% compared with the forecast of 9% whilst the latter increased 5.4% on a year-to-date basis and also beat the consensus suggesting a 5.3% rise. September was another month in a row when Chinese monthly readings from the industrial sector came in below expectations and continued slowing down. It may seem to be weird given the massive broad-based stimulatory measures introduced of late (we singled them out earlier) but the explanation may be easier than it looks - these measures probably have yet to kick in and it may take more time to see tangible effects of them. In a statement following the data the China’s Statistics Bureau said that economic fundamental remain sound even as downward pressure rises. It also added that an external environment will create some uncertainties for Chinese efforts to stabilise growth (it may be seen as a warning sign that the above-mentioned measures could not bring so many effects as one would imagine). The institution informed that it will watch for an impact from China - US trade frictions on employment and provided investors with reassurance that the economy will be able to reach the full-year growth target this year, these comments are in line with our expectations as well.

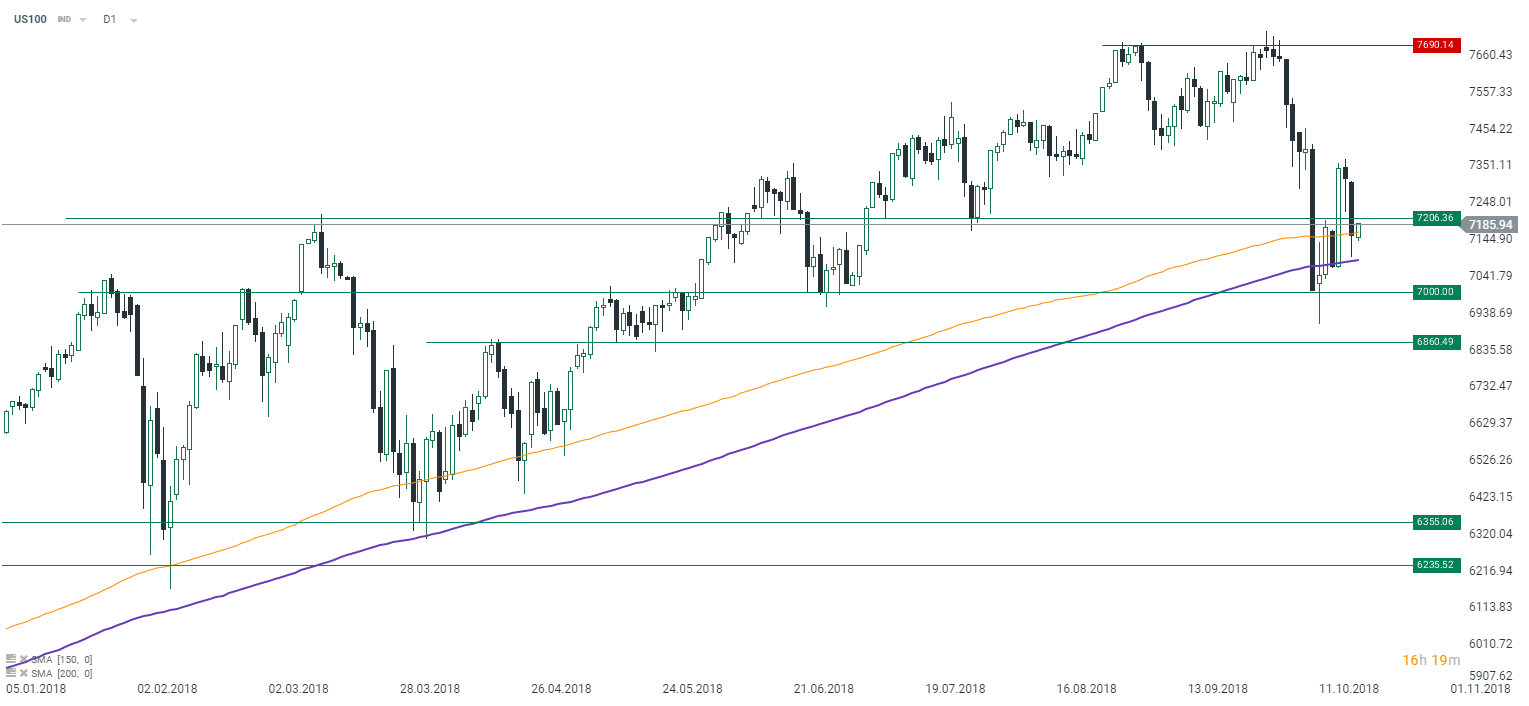

NASDAQ (US100) saw a 2.1% decline on Thursday and other indices in the US also fell. Source: xStation5

NASDAQ (US100) saw a 2.1% decline on Thursday and other indices in the US also fell. Source: xStation5

While the Asian session did not bring too much in terms of movements across currencies, one cannot say the same about stocks. Wall Street saw widespread losses yesterday with the NASDAQ slumping more than 2% but this grim mood did not visit in Asia at all. In fact, Chinese indices are trading almost 1% higher as of 6:33 am BST and only the Japanese NIKKEI (JAP225) is falling around 0.8%. Among top losers in the US one may single out United Rentals (-15%), Textron (-11,2%) and Snap-on (-9.6%). Technically the NASDAQ keeps defending the two important moving averages which have served as the crucial support in the past. If moods improve today, oney may count on a successful end of this week - the nearest short-term resistance could be localized in the vicinity of this week’s high.

Finally let’s mention comments from the PBoC as it said that the country’s stock market valuation is low. The China’s central bank also added that recent stock market fluctuations were largely due to investors sentiment and expectations (as if would say that it had nothing to do with fundamental factors of the economy). The bank suggested that the current stock market valuation is not in line with the China’s economic fundamentals claiming implicitly that the latest declines were exaggerated. The central bank concluded that it will use monetary policy tools including MLF (medium-term lending facility) to boost lending to private firms.

In the other news:

-

Japanese headline CPI grew 1.2% compared to expected 1.3% in September despite a boost from higher oil prices

-

EU Commissioners Dombrovskis and Moscovici say in a letter addressed to finance minister Giovanni Tria that Italy’s Draft Budgetary Plan for 2019 constitutes “an obvious significant deviation” from the EU rules

-

Chinese Shanghai Composite rises as much as 2% shortly before 7:00 am BST

-

US 10Y yield trades at 3.18%, SP500 futures point to a 0.3% increase

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.