Based on China's Hang Seng China Enterprises Index (HSCEI Index), the CHN.cash contract is gaining nearly 4.4% today supported by comments from a press conference in Beijing. The People's Bank of China, after a disappointing nine months of 2024, seems more determined to unleash the domestic stock market and economy. The Hang Seng Index had been in problematic stagnation since early spring, and had largely erased the gains of January and February. However, optimism has returned and CHN.cash is near this year's highs, having had 4 upward sessions in a row.

- The People's Bank of China (PBoC) will decide to cut rates to reawaken domestic economic growth, which has slowed badly in recent months, projecting lower consumption and stock market pessimism;

- People's Bank of China Governor Mr. Gongsheng announced at a press conference that 'in the near future' the reserve requirement rate will be cut by 0.5 percentage points in China to provide additional liquidity to the financial market (about 1 trillion yuan). The weekly reverse repo rate will also fall

- The bank will also lower the interest rate on existing mortgages and unify the ratios for mortgages' down-payment contributions. This treatment is expected to prevent a deterioration in the real estate sector. As many as 77 companies out of 82 listed on the Hang Seng rose;

- The gains today were dominated by the financial sector and developer stocks; however, tech and e-commerce companies like Alibaba (BABA.US), Pinduoduo (PDD.US), and restaurant chain Yum China (YUM.US) - available as US ADRs - also rose.

China's 'stock market stimulus'

- China will set up a swap facility that will allow brokers, investment funds and insurers to use central bank financing. The initial size of the program will be limited to 500 billion yuan (more than $70 billion), but could be expanded in the future, according to a commentary from the PBoC.

- Stock exchange regulators will begin a procedure to review mergers and acquisitions (M&A) among listed companies, requiring those trading below book value to submit plans to increase capitalization and build shareholder value; Wu Qing, chairman of the China Securities Regulatory Commission, commented on the issue.

- A special loan program will also be set up to provide listed companies and major shareholders with access to bank loans for share buybacks and increased shareholdings in companies. Shanghai-based asset managers have indicated that the Fed's rate declines will allow the country to ease monetary policy further, and it is very possible that Beijing will implement further programs.

Recall that this is not the first stimulus package (although it is good that this time all the measures were announced at one conference). Previous programs have included direct state purchase of bank stocks and exchange-traded funds (ETFs), easing restrictions on home purchases in major metropolitan areas.

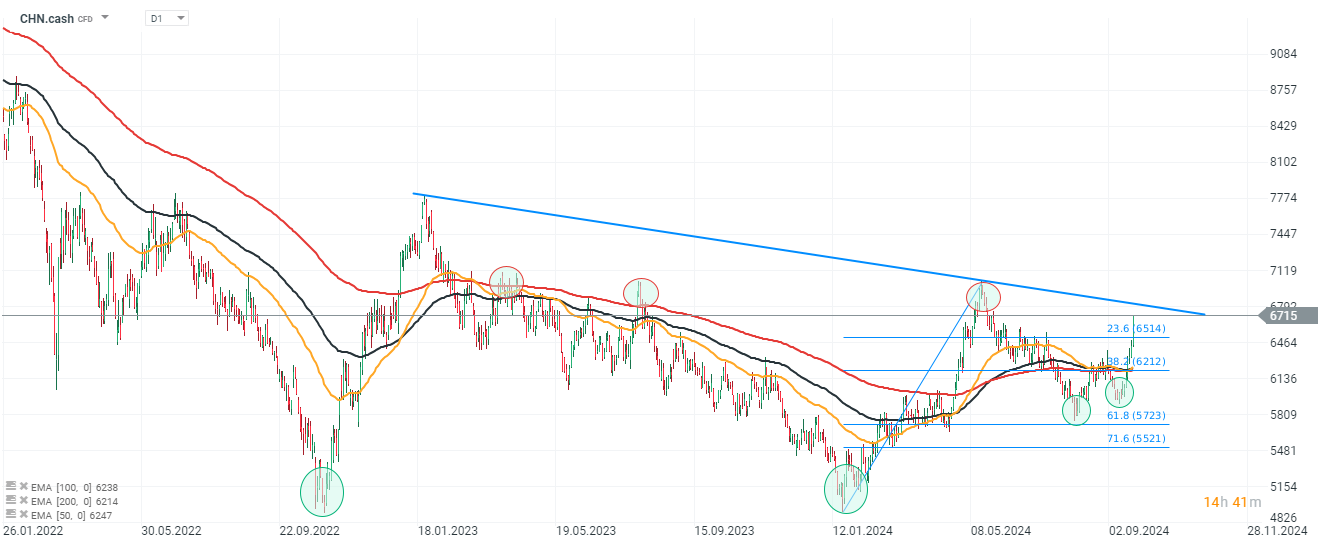

CHN.cash (D1 interval)

Having crossed all key momentum averages and Fibonacci retracements of the upward wave from the beginning of the year, the index is approaching the main resistance at the level of 6800 - 7000 points, where previous price reactions are located, and the line of least resistance.

Source: xStation5

Credit impulse in China (blue) and copper prices (green). Source: Bloomberg Finance L.P.

VIX struggle to rise higher despite uncertainty on Wall Street 🔎

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.