CME Group shares (CME.US) are currently trading at an all-time high, near USD 300 per share, and have risen by more than 10% year-to-date, against a mixed backdrop on Wall Street. The stock is supported by strong institutional participation in the market, the growing systemic importance of the exchange, and new products that offer a prospect of improving revenue growth momentum.

- The company benefits both from elevated volatility and record-high volumes in the metals market (as the owner of COMEX), strong positioning in agricultural commodities (CBOT), trading in Bitcoin and Ethereum (where it is the clear leader), and other cryptocurrency derivatives.

- CME is also a beneficiary of very high trading volumes in the U.S. Treasury market, as well as in futures on the S&P 500 stock index (E-mini).

Will rare earth futures drive CME higher?

Yesterday, the Chicago exchange operator said it is working on the world’s first rare earth metals futures contract - according to Reuters sources, the project is expected to focus on neodymium and praseodymium (NdPr).

- The goal of the contract is to enable governments, companies, and banks to hedge exposure to the rare earths market, which is currently dominated by China.

- ICE is also considering a similar product, but according to two sources, it is at an earlier stage of development than CME.

- Rare earths (17 elements) are critical to the energy transition, electronics, and the defense sector; NdPr are particularly important because they are used to produce permanent magnets found, among other things, in EV motors, wind turbines, fighter jets, and drones.

- Sources emphasize that such an instrument is currently a “missing piece” from the perspective of markets and supply-chain risk management.

- A decision to launch the contract has not yet been made, and the main barrier is that rare earths are illiquid and represent a relatively small market compared with other metals traded on futures exchanges.

- The topic is gaining importance as the West steps up efforts to increase production of critical minerals - the U.S. has created a preferential trade bloc with allies and launched a strategic stockpile worth about USD 12 billion.

- NdPr prices are currently set mainly in China and are reflected in indices from agencies such as Fastmarkets, Benchmark Mineral Intelligence, and Shanghai Metals Market.

- In China, there are two spot exchanges for rare earths (Ganzhou Rare Metal Exchange and Baotou Rare Earth Products Exchange), and the Guangzhou Futures Exchange has signaled plans to launch rare earths futures contracts.

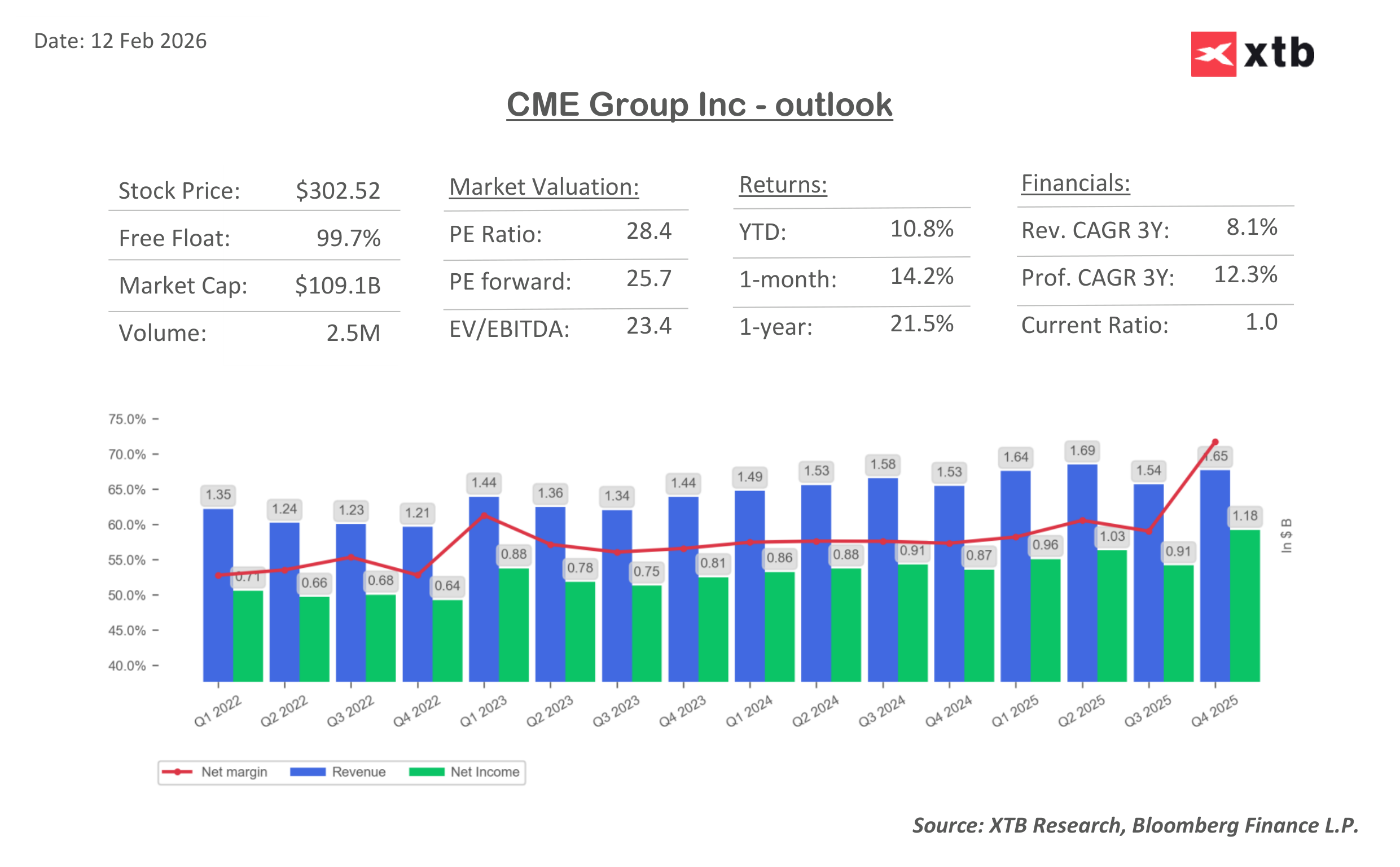

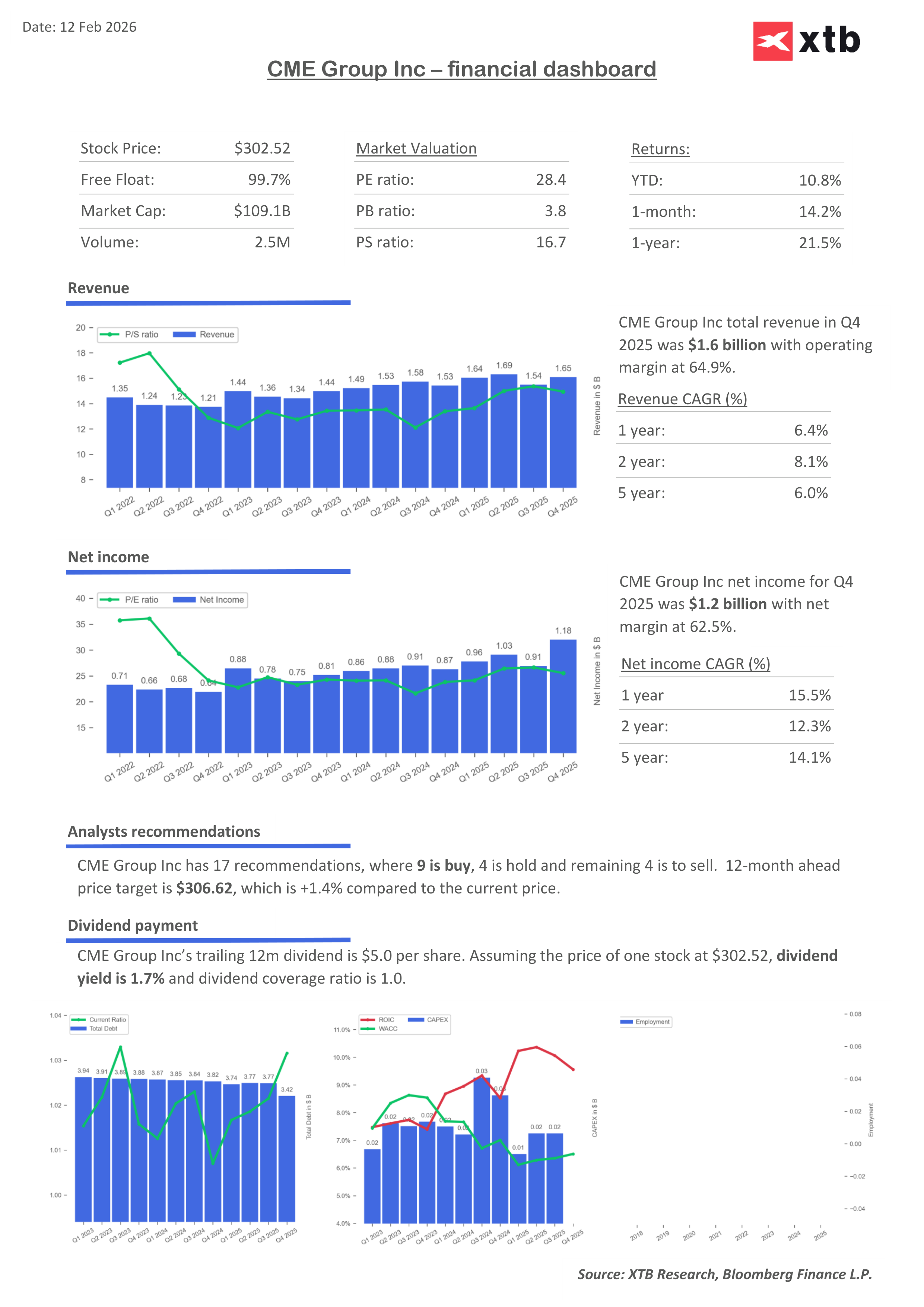

What did the company report for Q4 2025?

Q4 2025 results were broadly in line with market expectations. CME highlighted broad-based growth in activity across all asset classes and a rising share of retail investors (higher volumes, among others, in interest rates, energy, metals, agricultural products, and crypto).

- Key figures: revenue of USD 1.65bn (vs. USD 1.64bn consensus; +8.1% y/y), adjusted EPS of USD 2.77 (vs. USD 2.74 forecast), adjusted EBITDA of USD 1.13bn (in line with expectations; margin 68.6%), operating margin of 61.8% (similar to last year), market cap of about USD 110bn.

- What did management point to as the quarter’s “driver”? New so-called “event contracts” and strong sales/retail activity in micro products. The company also emphasized diversification of its client base and solid conditions in both institutional and retail segments amid elevated volatility.

Key takeaways from the analyst call

-

Client base resilience amid volatility and margin changes: management pointed to solid demand from both retail and institutional clients, with rising open interest and volumes seen as evidence of a “healthy ecosystem.”

-

Prediction markets and regulatory risks: questions were raised about CME’s involvement and legal oversight; the company stressed a cautious approach and a focus on products within the CFTC framework (swap-based).

-

Pricing changes and impact across asset classes: CME spoke about diversified revenue growth from market data, selective fee adjustments (including in metals and micro products), and a review of incentive programs.

-

Durability of market data revenues in the AI era + capital returns: management argued that proprietary data remain key to clients’ strategies; the topic of buybacks was linked to the use of funds (including from a transaction in Austria) for share repurchases.

-

Migration to Google Cloud and costs: the company reported progress, and future technology spending is expected to be incorporated into overall guidance as “legacy” costs are phased out.

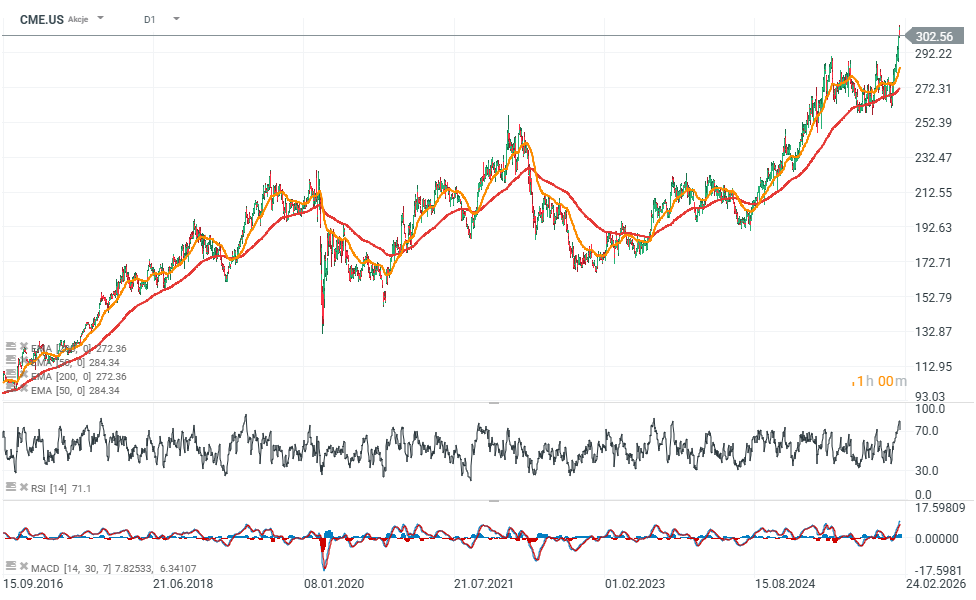

CME share price chart (CME.US), D1 interval

Source: xStation5

CME valuation

CME’s valuation, measured by the standard price-to-earnings ratio, does not appear overly demanding (P/E around 28, forward P/E 25), given the business’s high margins, relatively strong growth predictability, and a degree of “resilience,” since the company earns mainly on trading volumes — not on the direction of indices or the price moves of individual assets. Over the past five years, average annual profit growth has reached 14%, and if this pace were to be maintained over the next five years, with a similar net margin, we can reasonably say that the rise in the share price is not yet decoupled from CME’s fundamentals. The gap between ROIC and WACC indicates that the company is focused on creating shareholder value, and it offers an average annual dividend yield of around 2%.

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Navigating Middle East uncertainty and tariff risks

Market wrap: European and US stocks try to rebound rebound 📈

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.