The so-called 'soft commodities' dominated on the commodity market in 2023. Cocoa, coffee and also, up to some point, sugar have been performing really well. This was a result of weather conditions as well as issues with production, and not necessarily because of excessive demand. Gold was also performing decently but its returns lagged those of 'soft commodities' significantly. Nevertheless, gold climbed to fresh record highs this year and is on the way to finish 2023 above $2,000 per ounce. Oil, on the other hand, is about to finish the year more or less flat.

Nickel and palladium have been clear underperformers mostly due to lacklustre demand from the automotive industry. Natural gas has been trimming previous gains due to excessive inventories and reduced risk related to lack of deliveries from Russia. Grains have been performing poorly as well, what was related to still-high production and limited demand from China.

Source: XTB

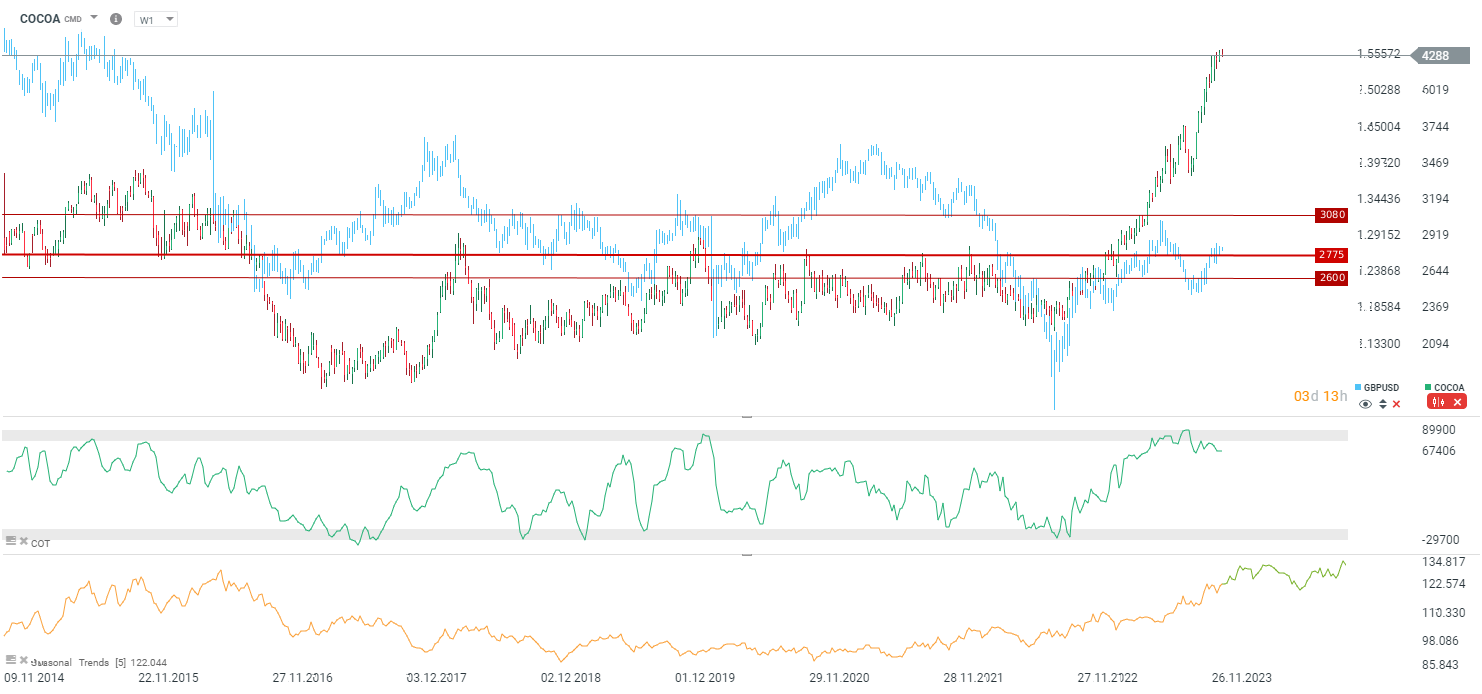

Cocoa

Cocoa market has had a phenomenal year, but not due to excessive demand, rather because of significant supply problems. Diseases and unfavorable weather conditions have caused issues with deliveries to ports in West African countries, and this trend is expected to continue throughout the rest of the 2023/2024 season. In the first quarter of this season (ending in the fourth calendar quarter), a roughly 30% decrease in deliveries to the ports of Ivory Coast is anticipated. It is worth noting that West African countries account for 70% of global cocoa production. Despite the aforementioned demand is nevertheless holding up well and rebounding after the COVID-related downturn. While the current price may seem excessive, it is important to observe that higher prices do not lead to a significant increase in investments in new plantations because the price for farmers still remains low, often close to production costs ranging from 1500 to 2000 USD per ton. With the current price exceeding 4000 USD per ton, the amount received by farmers in Ghana remains below 2000 USD per ton.

Source: xStation5

Nickel

While 2022 was tumultuous on the nickel market due to Russia's aggression in Ukraine and uncertainties in China, commodity followed a downward trajectory throughout 2023. Ultimately, it turned out that there were no access issues to supply in Russia, and additionally, production in Indonesia increased by over 30% in the first half of the year. Besides, lower demand from the electric vehicle sector led to oversupply. There is an expectation of continued oversupply in the coming year, and an increase in demand is anticipated from 2025, precisely due to the electric vehicle sector. Next year, the oversupply is projected to be 240,000 tons. However, a significant correlation with zinc may suggest that the price decline to the lowest levels since 2021 was excessive.

Source: xStation5

Gold and silver rebound after the sell-off 📈

OIL: prices continue to rise despite the US Navy escort proposal for ships📌

Trump’s plan for Strait of Hormuz fails to stop gains in oil price, as investors pause European sell off

Daily summary: Markets capitulate under the influence of the Persian Gulf

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.