Oil

- An official announcement of extension of additional production cuts by Saudi Arabia and exports by Russia through October is expected this week

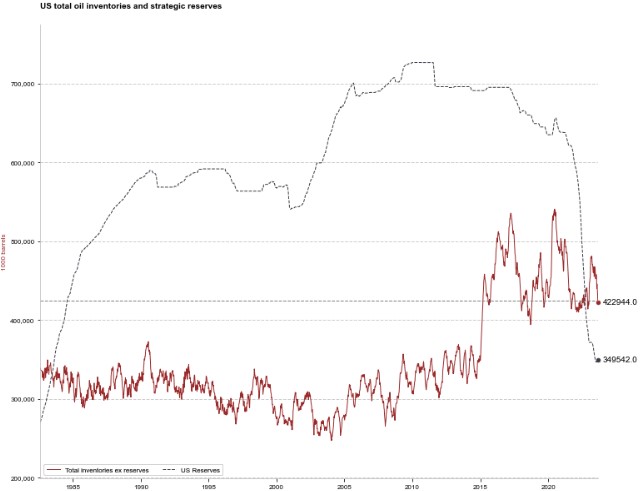

- The deficit in the global market and in the United States cannot be patched up by releasing strategic reserves in the US. These reserves have been drained to their lowest levels since the early 1980s

- Recent data from China showed that the economic situation is not improving. Services PMI dropped to its lowest level in 8 months. Very weak data was also evident in Europe, where most PMI indices dropped below 50 points

- Currently, we are observing a significant deficit in the market, which according to the IEA and EIA is expected to average around 2 million barrels per day by the end of this year. On the other hand, a significant risk is the further slowdown of the Chinese economy and a faster return of supply from OPEC+

We have observed recovery in US commercial oil stockpiles at the turn of 2022 and 2023, thanks to release of strategic reserves. However, strategic reserves will no longer be released and this is why stockpiles may drop to the lowest levels since 2015. Source: Bloomberg Finance LP, XTB

Comparative inventories are justifying current high prices of crude oil. Strong recessionary signals from all over the world would be needed to trigger a large correction on the oil market. Source: Bloomberg Finance LP, XTB

Comparative inventories are justifying current high prices of crude oil. Strong recessionary signals from all over the world would be needed to trigger a large correction on the oil market. Source: Bloomberg Finance LP, XTB

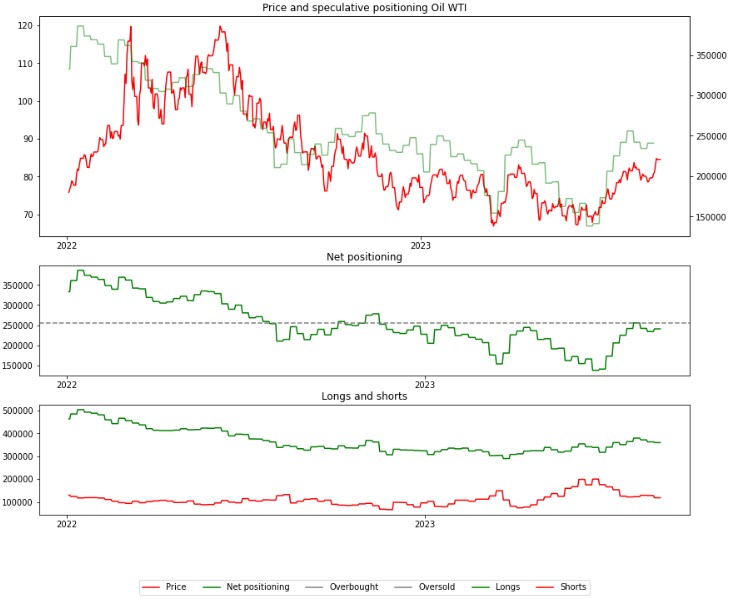

Positioning on the WTI market is supporting current market prices. Net positioning sits below the average for the past 2 years. Source: Bloomberg Finance LP, XTB

Gold

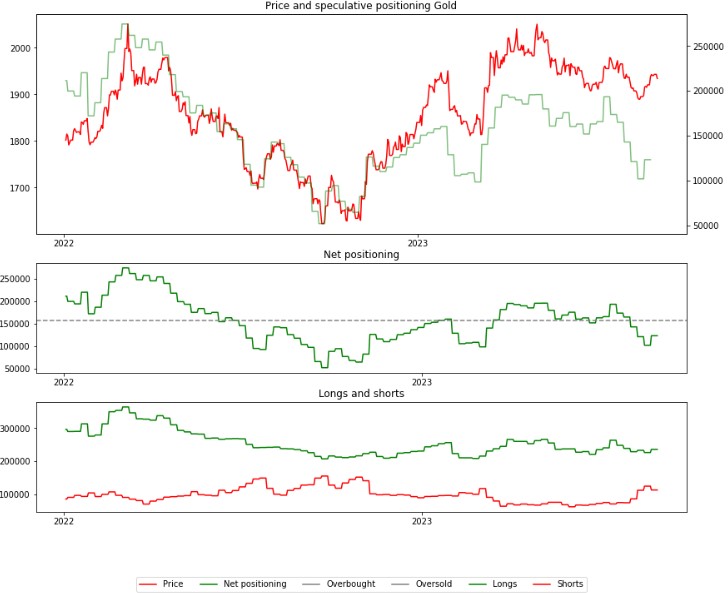

- CFTC data for gold suggests a significant exodus of speculators from this market as well as significant gold sales by ETFs

- 10-year yields remain above the 4.20% level, suggesting that gold is overbought in the short-term

- Seasonality in gold indicates a potential pullback in the coming weeks

- If the dollar begins to give back its recent gains following the Fed's decision, then gold may once again attempt to reach $2,000 per ounce by the end of this month

ETFs continue to sell out their gold holdings. Source: Bloomberg Finance LP, XTB

Positioning data does not support the current rebound in oil prices, although it should be noted that we are observing a similar low in positioning data as in March 2023. Recall that gold prices later rallied to $2,000 per ounce area. Source: Bloomberg Finance LP, XTB

Gold price pulls back and drops below 50% retracement of the latest major downward impulse. Key resistance can be found near $1,925. Seasonality suggests that declines may last until the third week of September. Source: xStation5

Copper

- Promises regarding support for the Chinese economy made by the Chinese authorities once again turned out to be mere slogans. Yuan has resumed decline, which could also lead to a pullback in the copper market

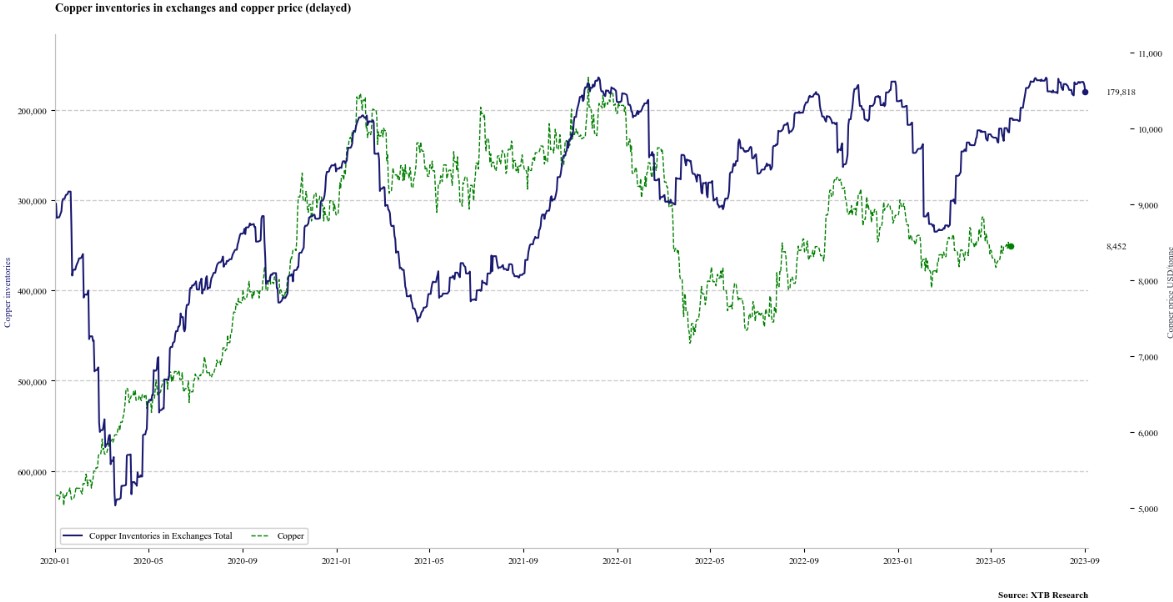

- Copper inventories on exchanges remain extremely low, preventing significant price drops

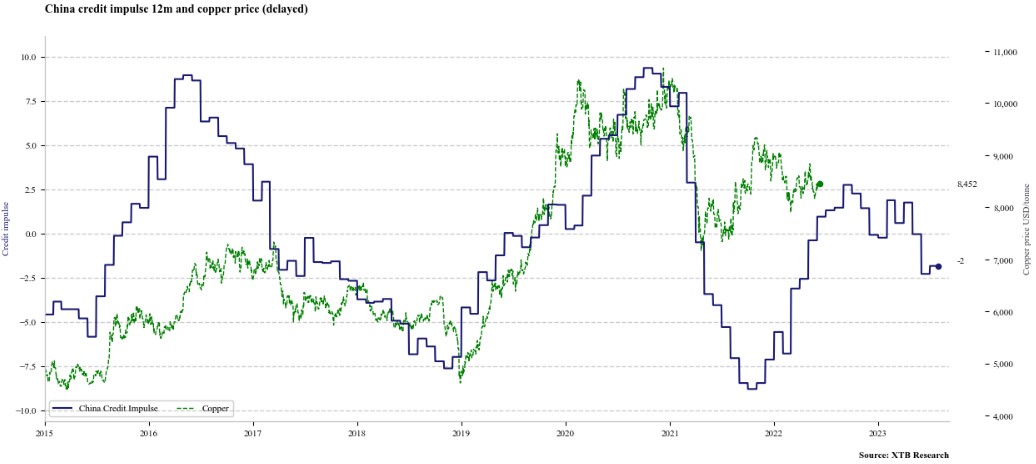

- On the other hand, the credit impulse in China is still negative when looking at the 12-month change, suggesting copper price declines in the next 12-18 months (considering the delayed impact of the credit impulse on infrastructure)

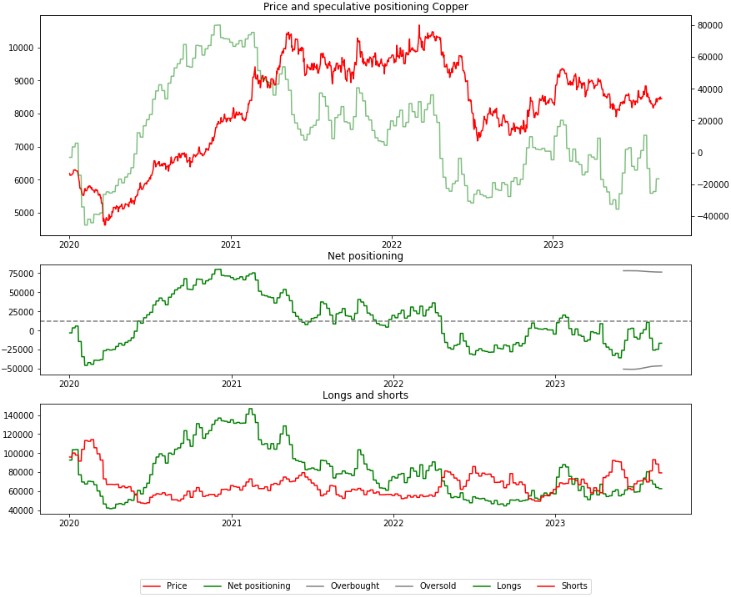

- Positioning on copper remains relatively low, although short positions have retreated from their highest level since 2020. However, there is no apparent pressure from speculators for any rebound

Inventories remain at extremely low levels, which prevents a correction on the copper market. Source: Bloomberg Finance LP, XTB

Chinese credit impulse is negative and given its lagged impact, best time for copper traders may already be over. Source: Bloomberg Finance LP, XTB

Net speculative positioning remains negative and is not expected to see any larger rebound soon. Moreover, the number of long positions may continue to be trimmed. Source: xStation5

A reversal signal can be seen flashing on the COPPER market. Unless we see price filling the gap near $8,440, a deeper correction may be looming with a potential test of the long-term upward trendline. Source: xStation5

Cocoa

- The price of cocoa surged at the end of August, erasing all previous losses

- Positioning on cocoa is still extremely high, although there has been a reduction in long positions in the past few weeks

- Cocoa inventories increased to a fairly high level in June, but since then, they have been declining clearly, which supports the price rebound. As long as inventories do not start to increase, cocoa price increases may be sustained

- Cocoa price increases are also supported by the fundamental situation and the expectation of a weak main harvest season, which will begin in October

Cocoa inventories are declining clearly (inverted axis), what support current high price levels. Source: Bloomberg Finance LP, XTB

Seasonality patterns suggest further gains on the cocoa market in the coming months, even as speculative positioning remains extremely high. Source: xStation5

3 markets to watch next week (24.10.2024)

Chart of the day: GOLD (24.10.2025)

NATGAS loses after the EIA inventories report

BREAKING: OIL gain extends to 3.5% 📈Chinese state companies stop Russian oil purchases

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.