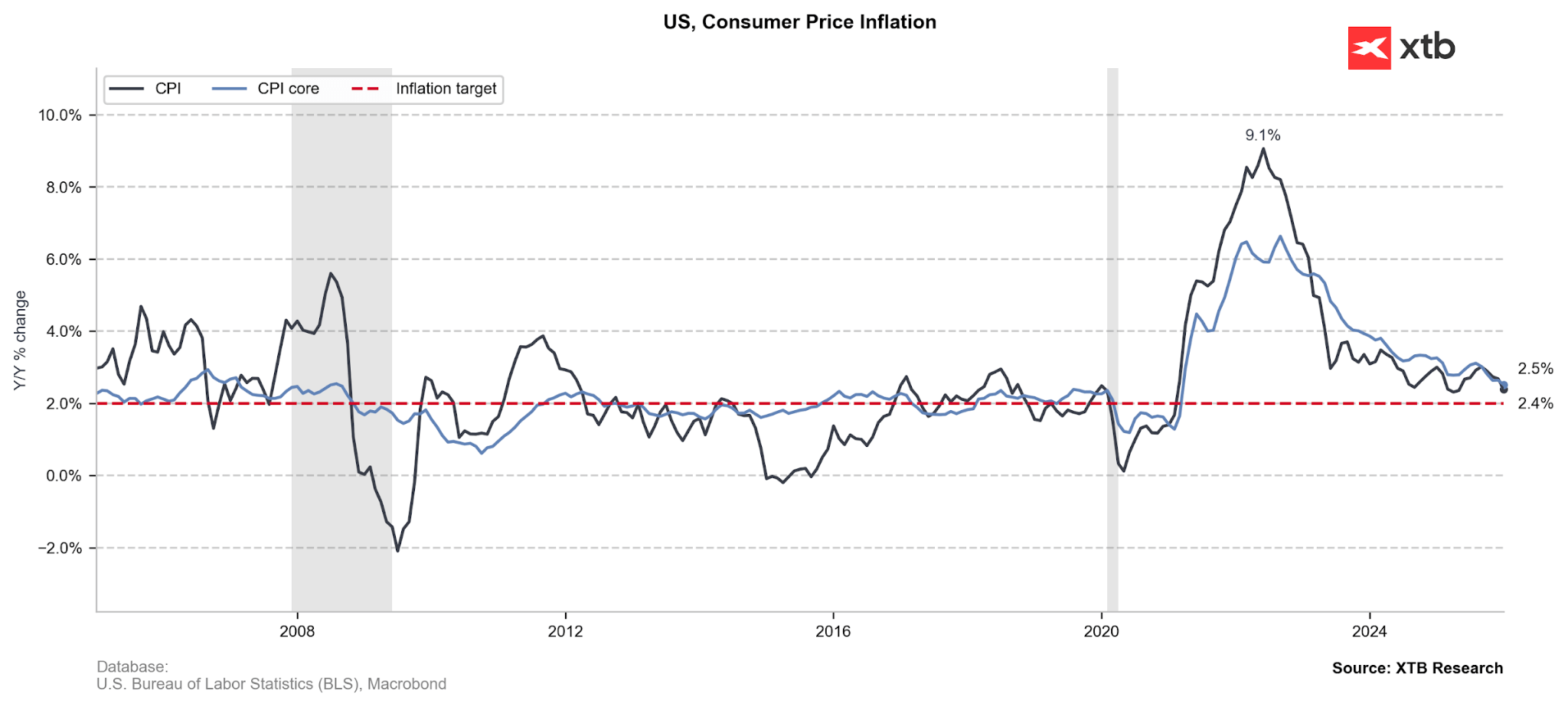

The January inflation report reveals a cooling headline rate — a dynamic that confirms a steady downward trend and places the Federal Reserve in an increasingly enviable position. However, there are still some persistent underlying pressures. While energy provided a significant disinflationary impulse to support this comfortable stance, the fact that service-sector costs and volatile categories like travel remained elevated ensures the Fed will likely remain patient and vigilant.

Disinflation has progressed over recent months, though post-shutdown data uncertainty and continued tariffs transmission raise questions about its sustainability. Source: XTB Research

Headline vs. Core Dynamics:

-

Headline Inflation: The "All items" index rose 0.2% MoM in January, a slight deceleration from the 0.3% recorded in December. This brings the annual (YoY) inflation rate to 2.4%.

-

Core Inflation: Excluding food and energy, prices accelerated slightly to 0.3% MoM (up from 0.2% in December), maintaining a yearly rate of 2.5%.

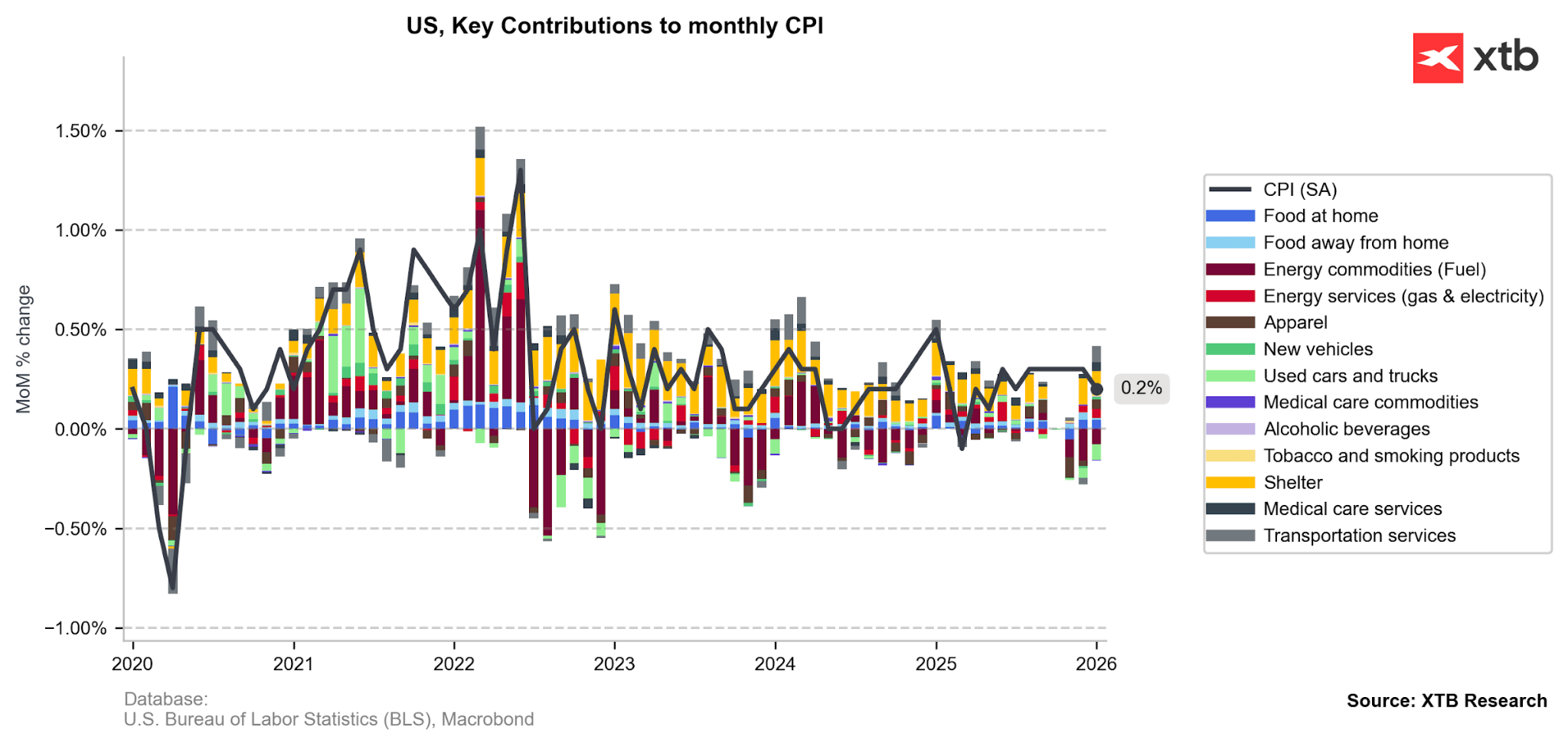

Significant MoM Changes (Dec 2025 to Jan 2026):

-

Energy Drag: Energy prices saw a sharp reversal, falling 1.5% MoM in January after a 0.3% increase in December. This was primarily driven by Gasoline, which plunged 3.2% during the month.

-

Service Stickiness: The services sector remains a primary driver of inflation, rising 0.4% MoM. Notably, Airline Fares surged by 6.5%, significantly accelerating from December's 3.8% increase.

-

Housing & Shelter: There was a notable deceleration in the housing sector price; Shelter grew by 0.2% MoM, down from the 0.4% pace seen in December.

-

Overall Goods Deflation: Used Cars & Trucks continued to decline, dropping 1.8% MoM. Conversely, Apparel saw a modest uptick of 0.3% following a flat reading previously.

-

Tariffs Are Still Creeping In: Conversely, tariff-sensitive categories showed marked price increases during this period. Costs for furnishings rose by 0.7%, while appliances—such as washing machines—increased by 1.3%. Even sharper growth was recorded in video and audio equipment (+2.2%) and the computers and software segment, which surged by 3.1%.

Shelter component has been persistently the key driver of consumer inflation, so its falling share in the newest CPI print should encourage the discussion around the interest rate cuts. The expected further drop in oil prices should also sustain a disinflationary effect of energy commodities and possibly limit the volatility of airfares. Source: XTB Research

Implications for Fed

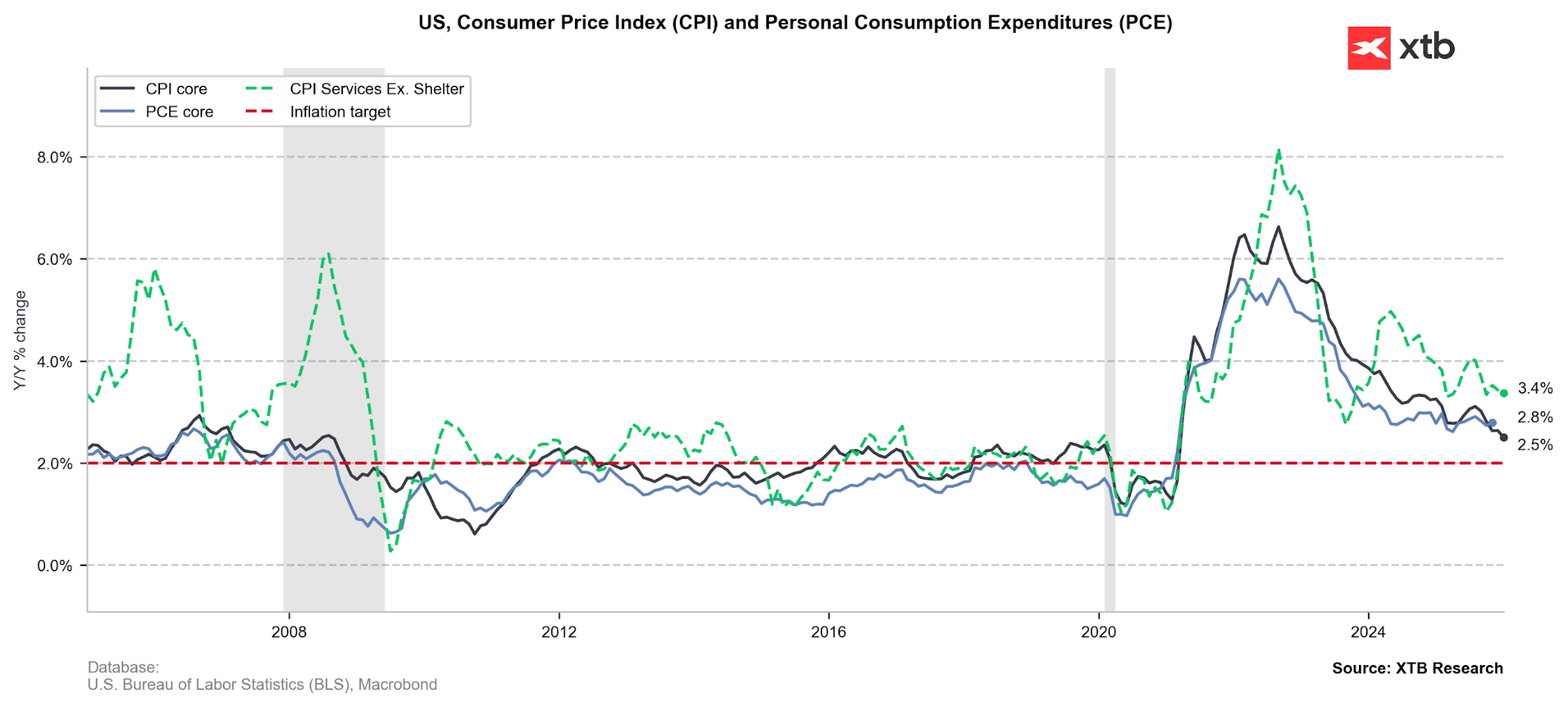

The latest inflation data provides the FOMC with significant breathing room to discuss the potential return of monetary easing rather than feeling pressured to rush into it. The cooling of the headline rate is largely supported by a sharp drop in gasoline prices and subdued food inflation, which should help keep consumer inflation expectations firmly anchored. Furthermore, the deceleration in shelter costs to a 0.2% monthly pace offers the most robust relief yet for the core services sector.

Nevertheless, more hawkish committee members are likely to keep their guard up due to "sticky" core dynamics and clear inflationary pressures in tariff-sensitive goods. Ultimately, the combo of progressing disinflation and a comfortable labour market data grants the Federal Reserve the space to adjust freely to risks on both sides of their mandate, which currently appear relatively low

Overall lower services inflation should encourage the discussion around further rate cuts. Source: XTB Research

Market Reaction

U.S. Treasuries experienced a significant rally, with 10-year yields falling to their lowest in 3 months (currently around 4.06%).

The futures on 10Y Treasury Notes are at their highest since early December 2025. Source: xStation5

According to the Federal Funds Futures, the short-term rate cut expectations remain well-anchored, with implied probabilities for the first half of 2026 remaining broadly unchanged (approx. 10% for March, 35% for April and 90% for June). The longer end, however, turned more dovish, with markets currently pricing 2.56 rate cuts before the end of 2026, compared to 2.3 a week ago.

Source: Bloomberg Finance LP

CPI report capped today’s strength in the dollar, clearing all the gains in the USDIDX, although the overall volatility in the FX caused by the print was limited.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.