Shares of Credit Suisse Bank (CSGN.US), which caused a flurry of stock market speculation around the bank's potential bankruptcy and insolvency in early October, are still under bearish pressure. Credit Difault Swap (CDS) levels have climbed to new peaks:

- Credit Suisse's dollar-denominated bonds have fallen recently, and CDS spreads have jumped to record highs near 444 basis points. Reuters pointed out that CDS levels are now comparable to Italy's Banca Monte dei Paschi at 466 basis points, with it already a bailed-out bank;

- By comparison, Commerzbank, Santander and UBS named among potentially troubled banks are keeping their CDS spreads much lower, in the 70-80 bps range. Bank analysts at ABN Amro commented on the situation, stressing that "investor confidence has not yet been restored." Credit Suisse's Q3 financial report negatively surprised the market;

- Credit Suisse is currently in the process of issuing new shares in connection with a planned CHF 2.24 billion capital raise as part of a broader CHF 4 billion 'rescue' capital action;

- Concerns around a potential deep recession in Europe and the ECB's tightening of monetary policy are increasing risks for the financial industry. Energy prices are also a problem, and although they have stabilized recently, they still remain uncertain which could translate into increased credit risk.

CDS spreads widened at the end of November and are again reaching record levels near 450 points. Source: Bloomberg, BondEvalue

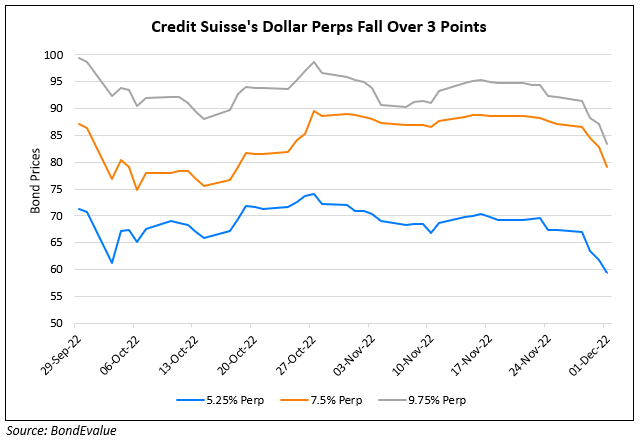

Priced in U.S. dollars, Credit Suisse bonds continue to fall, indicating rising expected financial stability. Source: BondEvalue

Priced in U.S. dollars, Credit Suisse bonds continue to fall, indicating rising expected financial stability. Source: BondEvalue

What are CDSs?

- A Credit Default Swap is a hedge against default and a type of contract between parties that is part of the pricing of the risk of potential default or the occurrence of other negative events. An important factor affecting the CDS spread is the measure of the risk of the transaction as estimated by rating institutions like Fitch, Standard&Poor's and Moody's;

- A widening CDS spread of an institution means increasing certainty among speculators about its future problems. At the present time, the vast majority of CDSs are so-called 'naked CDSs', traded by institutions that do not simultaneously own the debt (bonds) of the entity whose CDS contracts they trade;

- In the past, the CDS tool was often criticized, however, according to regulators, it accelerated the bankruptcy processes of entities that would inevitably have to go through it anyway. So we can take a chance and consider the CDS spread as the market's ability to price the probability of a possible threat of financial instability.

Credit Suisse (CSGN.CH) shares, H4 interval. Credit Suisse shares are near all-time low levels with Price to Book ratio at 0,20 level. Those 80% discount book value levels might be readen as a potentiall bankruptcy risk sign. Source: xStation5

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.