Global markets open Monday’s session in mixed moods. Wall Street futures are edging lower, while the CBOE Volatility Index (VIX) rises more than 1.5% after last week’s steep declines. The U.S. dollar is strengthening as investors once again digest the implications of Jackson Hole for the Federal Reserve’s monetary policy.

Profit-taking after Friday’s euphoric rally is dragging cryptocurrencies lower:

-

Bitcoin has fallen from around $118,000 before the weekend to just under $112,000 in Monday trading.

-

Ethereum is down more than 5%, slipping below $4,600 despite positive ETF inflows. The drop follows fresh all-time highs reached last week.

-

This week will bring several key U.S. economic releases, to which cryptocurrencies may prove sensitive.

-

According to Trump advisor Bailey, the “crypto bear market” is still “years ahead.” Despite positive commentary surrounding the sector, markets remain uncertain about future momentum. Periodic reports of Bitcoin sales by so-called “whales” add both direct selling pressure and uncertainty around the continuation of the broader crypto rally.

Bitcoin & Ethereum Charts (D1)

Bitcoin continues its medium-term uptrend but faces fresh obstacles. The price failed to break above the 50-day exponential moving average (EMA50, orange line), which now acts as key resistance. As a result, BTC is trading near the average purchase price of short-term holders (STH Realized Price), currently around $109,000. Thus, the $110,000 zone is the critical support level for today.

Source: xStation5

Ethereum is trading within a rising price channel, with the lower boundary near $4,100. A break below this level could trigger a deeper correction. For now, despite profit-taking after recent gains, the trend remains upward. Paradoxically, Bitcoin’s consolidation could support interest in Ethereum — but today, declines are visible across the entire risky-assets market.

Source: xStation5

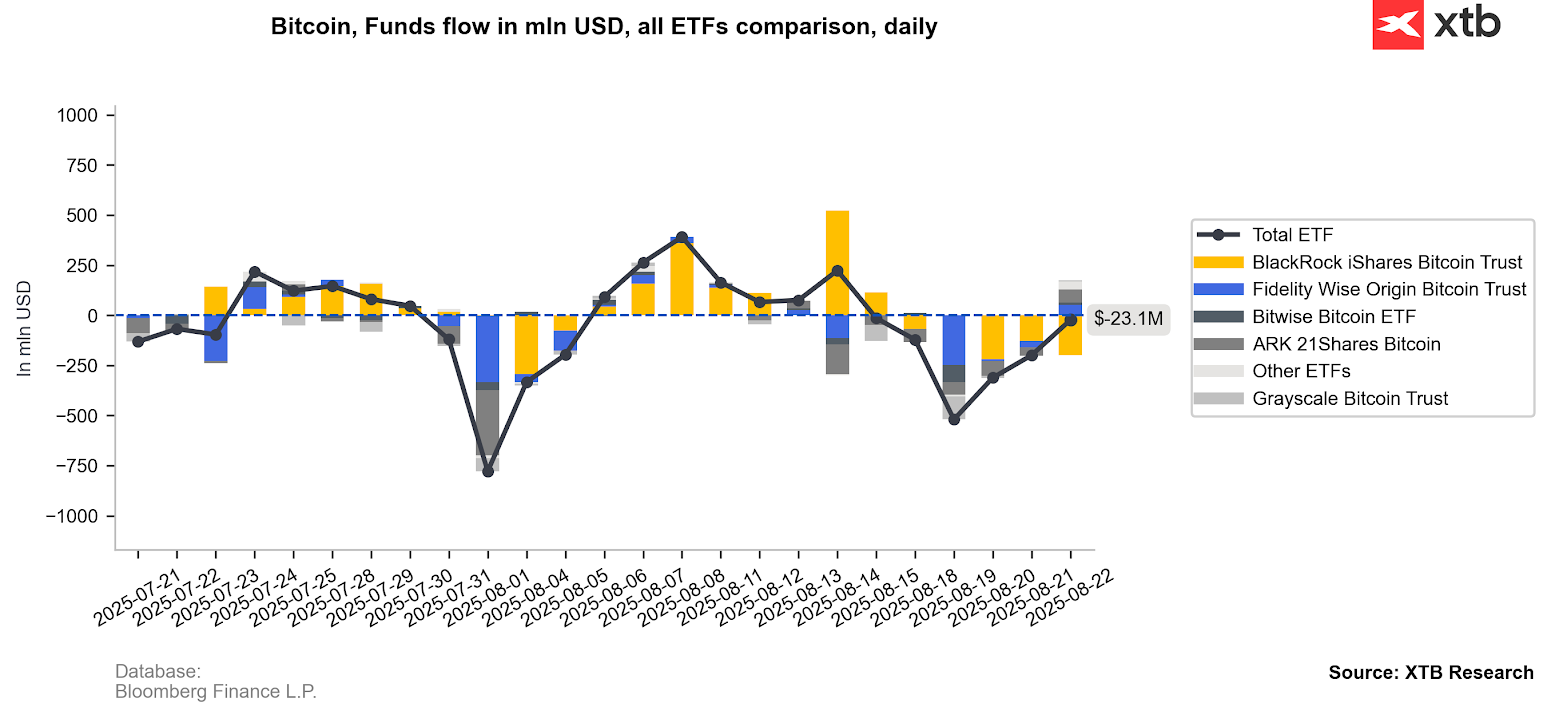

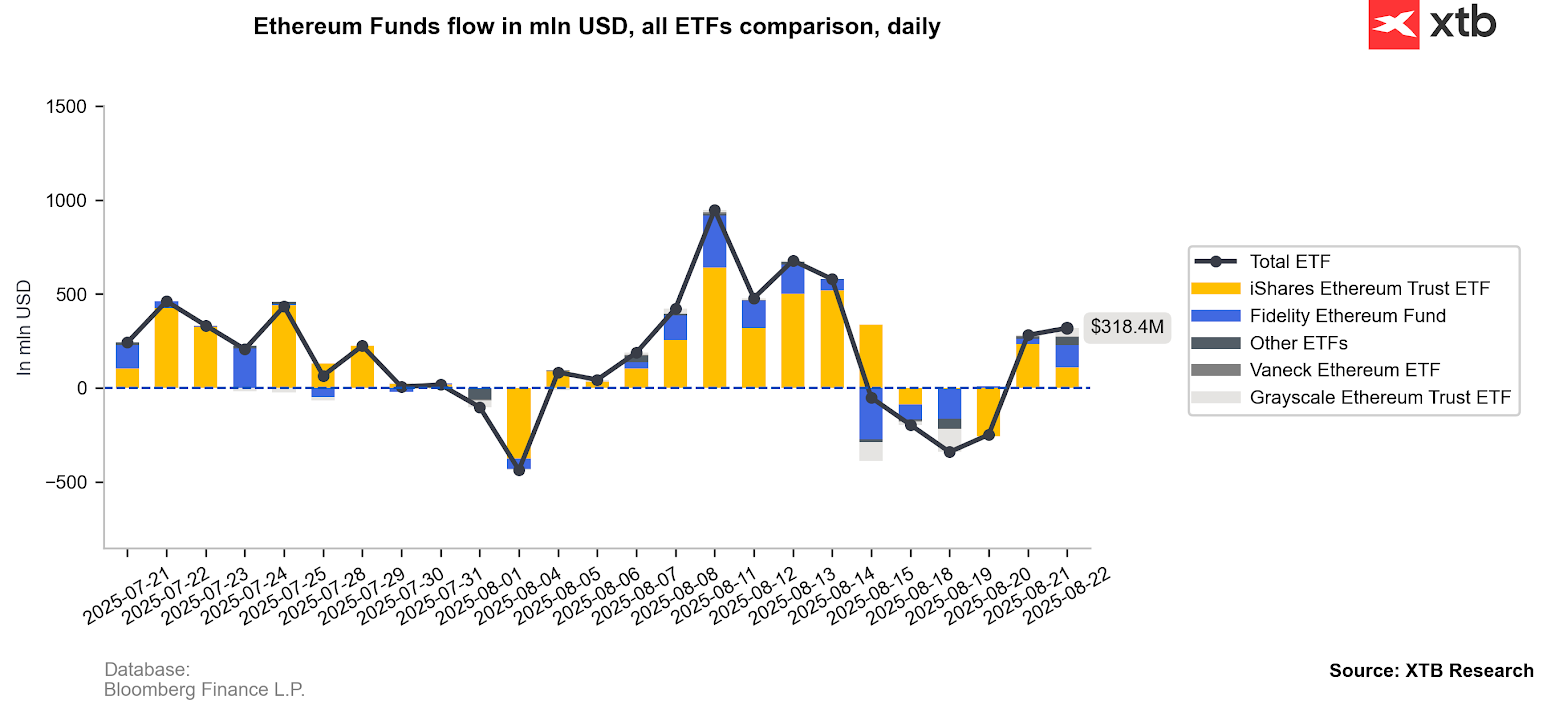

ETF Inflows into Bitcoin and Ethereum

ETF activity in Bitcoin accumulation has slowed markedly. Last Friday recorded net outflows of more than $20 million, with BlackRock emerging as the main seller in recent sessions. By contrast, Ethereum attracted over $300 million in net inflows during the last trading day of the week. At this stage of the market, investors appear more willing to take bolder positions in Ethereum, hoping for higher short-term returns. Bitcoin, meanwhile, continues to struggle with breaking sustainably above the $120,000 mark.

Source: Bloomberg Finance L.P, XTB Research

BREAKING: US100 reacts to weaker ADP report

BREAKING: EURUSD ticks higher after ADP data huge miss💡

AI disruption dominates markets, as gold and silver continue to recover

Gold surges 2.5% after beating record from 2008 📈

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.