Sentiment in the cryptocurrency market improved with a rally on the Nasdaq index, where bulls took control after US inflation data. Another lower inflation reading at least in the realm of expectations supported market expectations around a softer Fed policy. Smaller cryptocurrencies like Graph, Stepn, Filecoin are gaining the most, but it's still also today's bouncing Bitcoin and Ethereum that are attracting the most attention from crypto market investors.

- Since the last update to the Ethereum network known as Shanghai, a significant amount of 'staked' ETH has been withdrawn by investors;

- In addition to the one-time withdrawal of accumulated rewards, a total of more than 48,000 validators have exited the staking pools and withdrawn more than 1.55 million ETH, most of which went to exchanges from where they could be sold.

Data from Glassnode shows that a total of 48,341 validators left the network, withdrawing 1.55 million ETH (more than $2.9 billion). On the day after the Shanghai update, a total of 14,249 validators left the staking pools, which remains the highest daily number. Investors had been waiting for such an opportunity even since December 2020. After the peak breakout, however, the number of exits declined sharply, stabilizing between 300 and 700 per day. Source: Glassnode

Data from Glassnode shows that a total of 48,341 validators left the network, withdrawing 1.55 million ETH (more than $2.9 billion). On the day after the Shanghai update, a total of 14,249 validators left the staking pools, which remains the highest daily number. Investors had been waiting for such an opportunity even since December 2020. After the peak breakout, however, the number of exits declined sharply, stabilizing between 300 and 700 per day. Source: Glassnode Glassnode shows that the estimated annual return of validators is negatively correlated with the number of active validators. In short, this means that as the number of ETH stakers increases, the rewards and ultimate return for staking decrease because the rewards must be distributed among more validators. Source: Glassnode

Glassnode shows that the estimated annual return of validators is negatively correlated with the number of active validators. In short, this means that as the number of ETH stakers increases, the rewards and ultimate return for staking decrease because the rewards must be distributed among more validators. Source: Glassnode

- About 561,000 validators are staking ETH, which, according to Glassnode's calculations, yields a 4.27% annual return.Although the Ethereum blockchain is still developing quite rapidly, a 4.3% yield does not seem attractive in a high interest rate environment;

- With the change in central banks' monetary policies, investors have gained access to a number of liquid, more attractive and potentially also less risky instruments offering 'fixed income' (fixed income). Back in 2021, a passive income above 4% was something that, investors would have definitely paid attention to;

- Apart from the fact that many investors opted for withdrawals in the face of increasingly unattractive staking returns, the important fact is that Ethereum's blockchain rose to the occasion - the upgrade ultimately went well, and the Proof of Stake mechanism passed the test, showing that Ethereum's key and most challenging technical upgrades may be behind it. This could be a competitive advantage in the long term, speaking in ETH's favor,

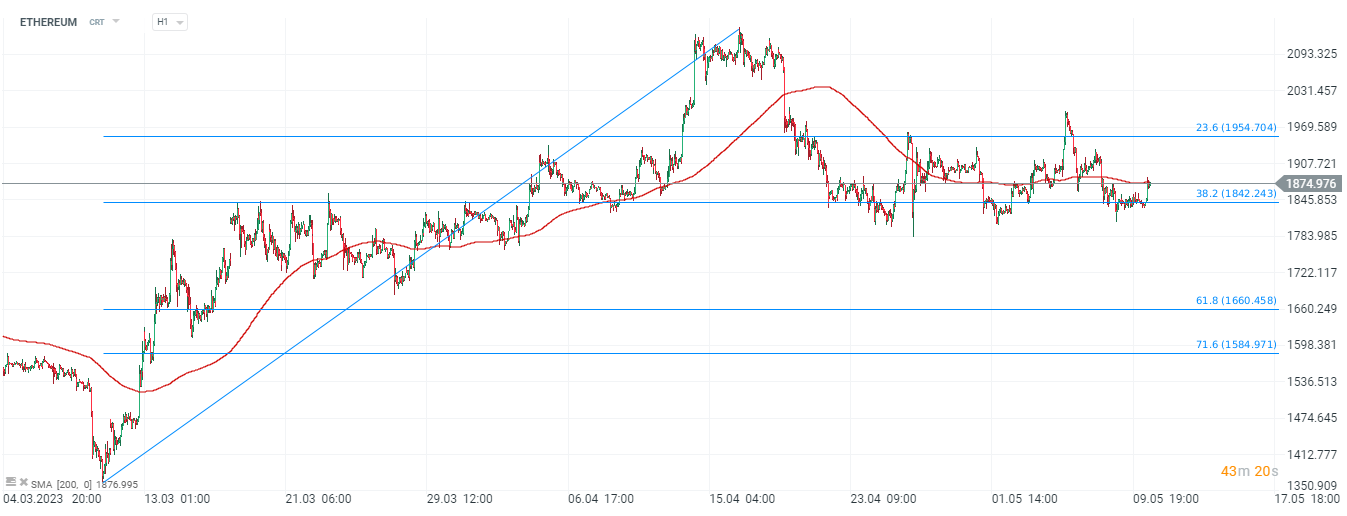

ETHEREUM faces a key resistance zone at $1876, which is marked by the SMA200 (red line). The key support level appears to be $18540 where we have seen significant price reactions. If the bulls maintain the momentum, a retest of resistance at $1950, where the 23.6 Fibonacci retracement of the March 10 upward wave is located, remains possible. Source: xStation5

ETHEREUM faces a key resistance zone at $1876, which is marked by the SMA200 (red line). The key support level appears to be $18540 where we have seen significant price reactions. If the bulls maintain the momentum, a retest of resistance at $1950, where the 23.6 Fibonacci retracement of the March 10 upward wave is located, remains possible. Source: xStation5

Jane Street: Legendary market maker in the court

Morning Wrap: Nvidia's brilliant results drag the market down (27.022026)

US dollar strengthens, pressuring EUR/USD, silver and Bitcoin 📉

Daily summary: Technology Drives Wall Street as Tehran Seeks Truce

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.