Major cryptocurrencies as well as alt coins have been traded lower as of late. Sell-off intensified yesterday's, pushing Bitcoin 7% lower and Ethereum down 8%. Investors have lowered exposure to risky assets ahead of this week's Fed meeting and cryptocurrencies seem to be no exception. Fed is expected to accelerate the pace of QE tapering, which may withdraw part of excess liquidity from the markets and is generally viewed as negative for high-risk asset prices, like equities and cryptos. In more crypto-related news, it was reported yesterday that inflows into digital asset investment funds dropped to below $100 million in the previous week. Second straight week of lower inflows highlights lower interest from investors during the ongoing correction.

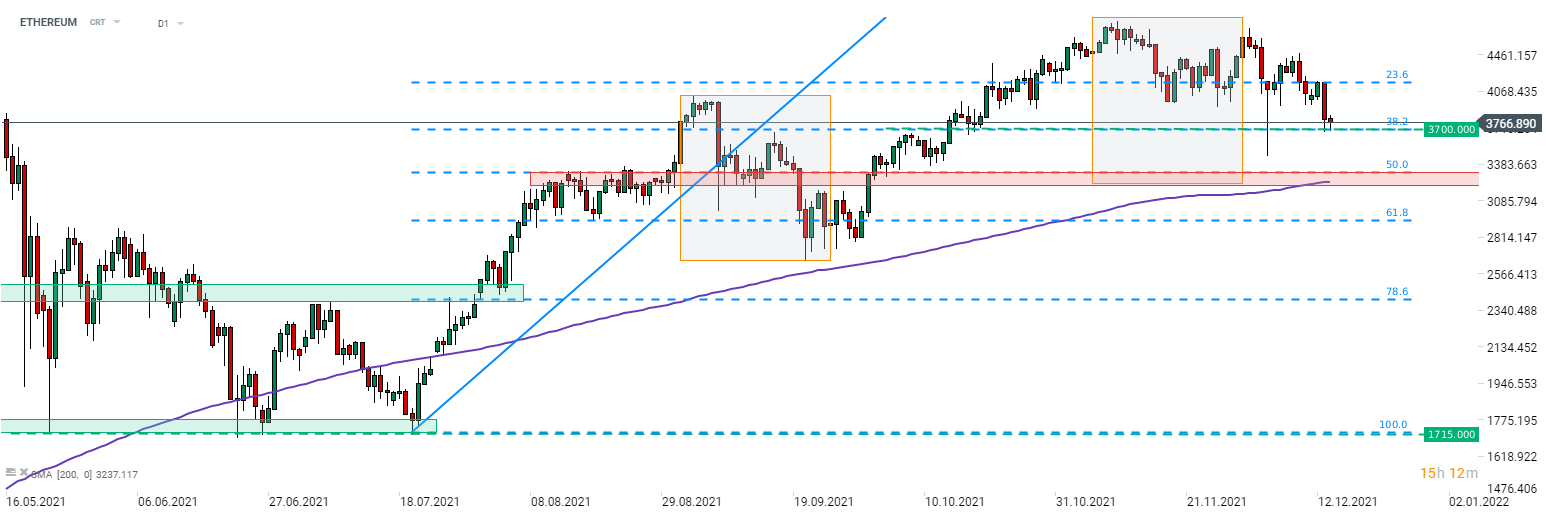

Cryptocurrencies trade off yesterday's lows but remain under pressure. Taking a look at the Ethereum chart, we can see that this coin dropped around 23% off its highs from the beginning of November. Price tested support at $3,700, marked with 38.2% retracement of the upward move started in July, and the area has managed to hold sellers for now. Should declines resume and Ethereum drops below $3,700 area, the next major support to watch can be found in the $3,200-3,300 zone, where 200-session moving average, 50% retracement and lower limit of the Overbalance structure can be found.

Source: xStation5

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.