-

Fed delivers first 50 basis point rate hike in 22 years

-

QT to begin in June at pace of $47.5 billion per month

-

Fed is not actively considering 75 basis point rate hikes

-

USD drops, gold gains after Powell's presser

-

EU inching closer to embargo on Russian oil, crude jumps 5%

-

European indices finish trading lower

-

ADP employment report shows 247k jobs gain in April (exp. 395k)

-

ISM services employment subindex drops into recession territory in April

-

Lyft and Uber Technologies drop after Q1 earnings disappoint

-

AMD gains as management remains bullish on PC demand

FOMC meeting was a key point in today's and this week's economic calendar. As expected, the US central bank delivered the first 50 basis point rate hike in 22 years and announced the beginning of quantitative tightening. Balance sheet run-off will begin in June at a monthly pace of $47.5 billion and increase to $95 billion after 3 months. Fed Chair Powell explained during the press conference that US central bankers are not actively considering a possibility of a 75 basis point rate hike but 50 basis point rate hikes are on table for the next couple of meetings.

The EU embargo on Russian oil was a big story of the day as well. While European Union members failed to agree on the definite shape of oil sanctions, decision may come this or next week. Embargo is expected to be gradual with some countries exempted from it. However, what looks massive is that it will target not only oil imports but also provide services to the Russian oil shipping sector, like for example maintenance or insurance. As Russia relies on foreing tanker fleet to ship its oil overseas, such measures may have a negative impact on Russian oil exports even beyond those to the EU. Both Brent and WTI gained more than 5% today.

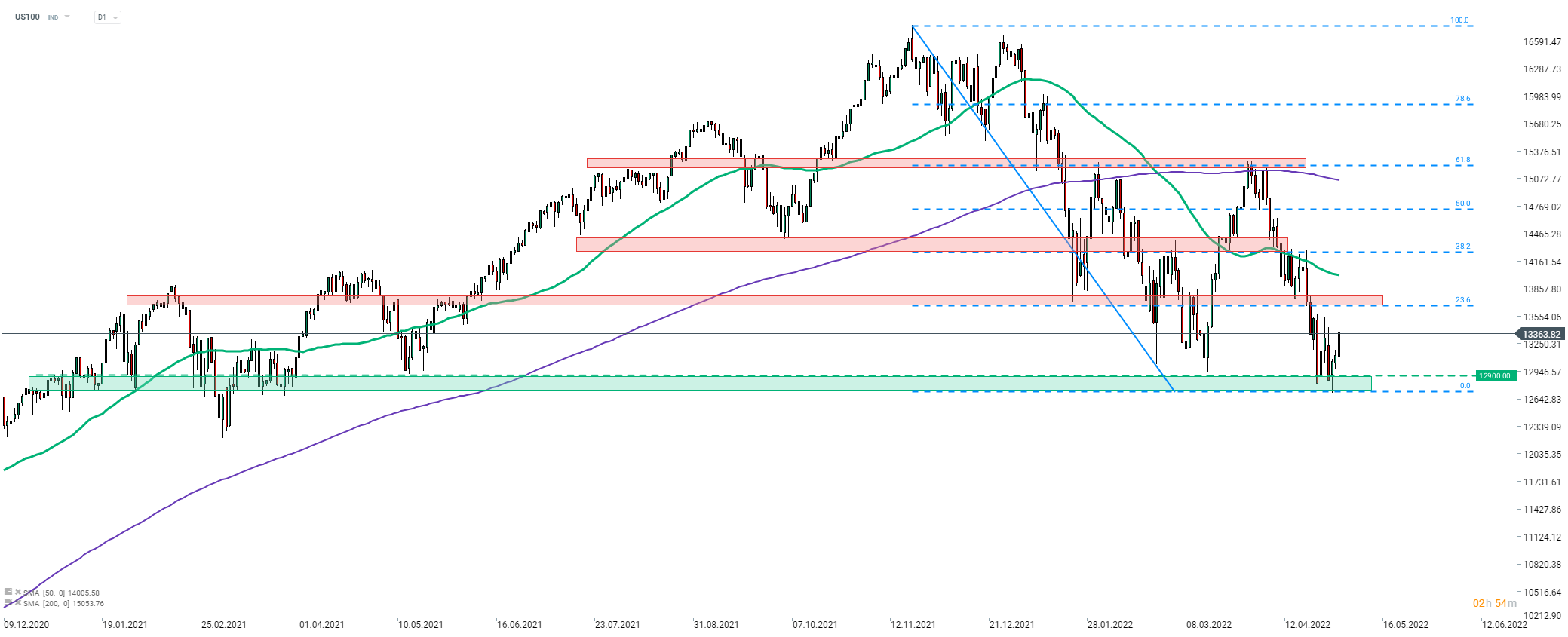

Nasdaq-100 (US100) continues recovery with help from Fed. Both a policy decision and Powell's presser were seen as less hawkish than expected. Source: xStation5

Nasdaq-100 (US100) continues recovery with help from Fed. Both a policy decision and Powell's presser were seen as less hawkish than expected. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.