-

Wall Street indices traded lower during the first trading session after a long weekend. Indices launched today's cash trading lower and continued to drop. However, declines started to be recovered later on

-

S&P 500 and small-cap Russell 2000 drop around 0.3%, Dow Jones trades 0.5% lower and Nasdaq declines 0.1%

-

European stock market indices traded lower today. German DAX dropped 0.5%, French CAC40 and UK FTSE100 traded over 0.2% down and Dutch AEX slumped almost 0.8%. Spanish IBEX was outperformer with a 0.1% gain

-

ECB's Villeroy said that inflation is already past peak in euro area and may move near 2% target by the end of 2024

-

People's Bank of China lowered the 1- and 5-year loan prime rate by 10 basis points to 3.55 and 4.20%, respectively. While a cut to 1-year LPR was in-line with market expectations, 5-year LPR was expected to be cut by 15 basis points to 4.15%

-

Minutes of Reserve Bank of Australia showed that recent unexpected rate hike was driven by inflation taking longer to reach its target. However, RBA noted that the decision on a hike was close and it led to a drop in market's pricing of future RBA rate hikes

-

US housing market data for May surprised positively. Building permits jumped 5.2% MoM to 1491k (exp. 1425k) while housing starts were 21.7% MoM higher at 1631k (exp. 1400k)

-

Cryptocurrencies gained today with Bitcoin jumping almost 4% to a fresh two-week high

-

Energy commodities traded lower today - oil drops 1% while US natural gas prices decline almost 5%

-

Precious metals pulled back after USD caught a bid following solid housing market data. Gold trades 0.7% lower, silver slumps 3% and platinum drops 1.2%

-

USD and JPY are the best performing major currencies while AUD and NZD lag the most

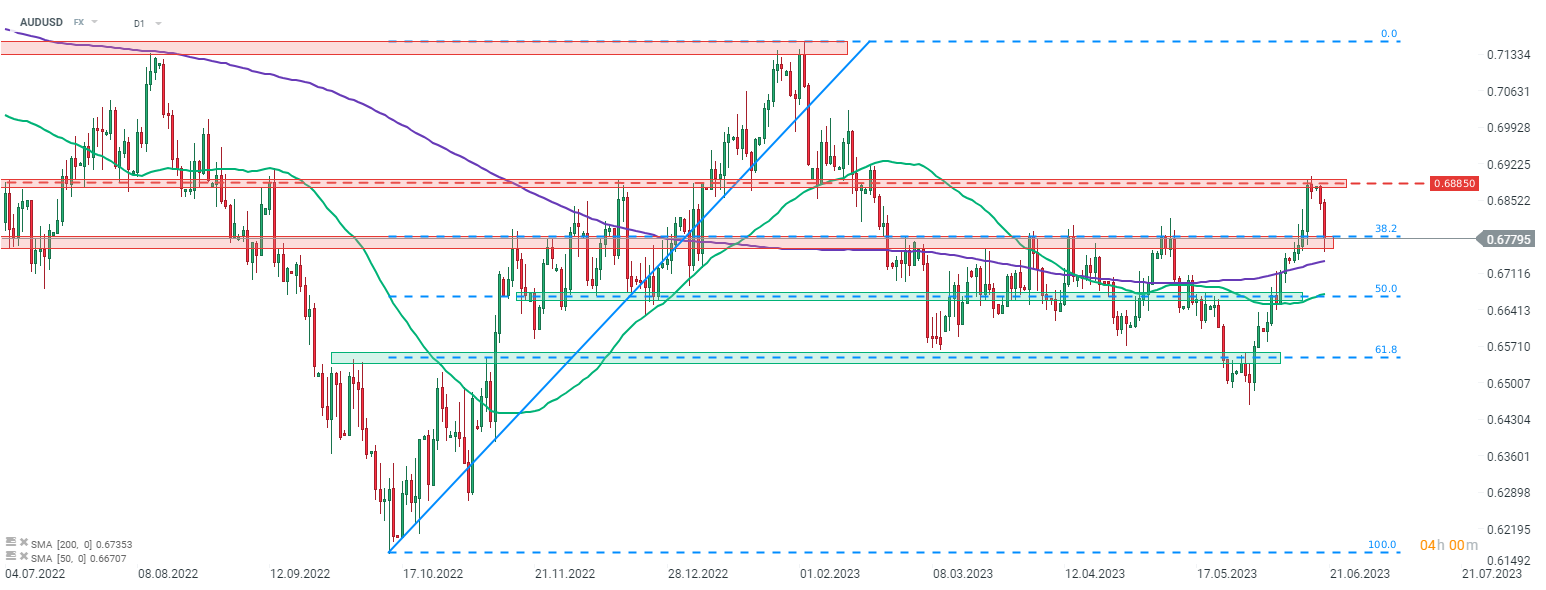

AUDUSD took a big hit today as RBA minutes turned out to be dovish and US housing market data beat expectations by a huge margin. The pair deepens pullback launched after a failed attempt at breaking above the 0.6885 resistance zone and tests 38.2% retracement today. Source: xStation5

AUDUSD took a big hit today as RBA minutes turned out to be dovish and US housing market data beat expectations by a huge margin. The pair deepens pullback launched after a failed attempt at breaking above the 0.6885 resistance zone and tests 38.2% retracement today. Source: xStation5

Daily summary: A historic day for precious metals; SILVER loses 30%; USD gains 💡

EURUSD down 0.5% amid US PPI inflation report🚨

US government shutdown averted, as Trump’s Fed pick boosts the dollar and weighs on gold

Daily Summary – Bessent Rescues the Dollar, Fed Delivers Hawkish Pivot

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.