- European indices finished today's session sharply lower, with Germany’s DAX down 1.54% which is the lowest since mid-March as concerns regarding slowing economic growth, a looming tightening cycle of monetary policy, and worsening pandemic situation in China overshadowed Macron's strong victory in the French presidential elections,

- German business morale unexpectedly rose to 91.8 pts in April from 88.3 in March,

- Chinese authorities suspect that the virus has spread undetected for a week in the capital Beijing. Officials revealed that Beijing will expand mass testing to the entire city from now through April 30,

- US indices launched today’s session sharply lower, however Nasdaq manage to erase early losses and is trading slightly above the flat line, while Dow Jones and S&P 500 fell 0.555 and 0.70% respectively,

- Twitter stock rose 5% on reports the company is in advanced talks to sell itself to Elon Musk. Coca-Cola stock also gained after it reported better-than-expected Q1 results,

- Oil prices extended last week’s losses amid worsening demand prospects from China and reports that the EU is preparing “smart sanctions” for its sixth package against Russian oil imports that may be unveiled later this week, aimed at maximizing pressure on Russia with minimal collateral damage. Brent fell below psychological support of $100 per barrel, while WTI tested $96.00 level,

- Gold declined more than 1.5% to below $1,900 an ounce, while silver fell at one point 3.0% to $23.41 as stronger dollar and elevated US Treasury yields dented demand for precious metals,

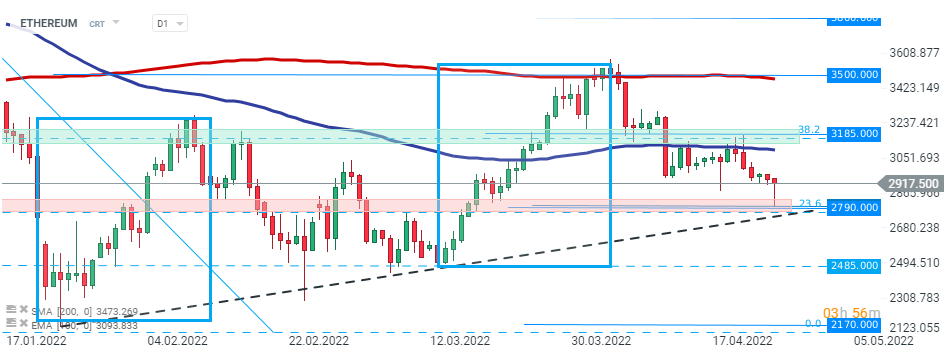

- Cryptocurrencies also took a hit early in the session, however buyers managed to halt declines and erase most of the losses. Currently Bitcoin trades around $39340 while Ethereum bounced off support at $2790,

Market bears have taken control during today's session after positive election results in France have been overshadowed by negative news from China as it grapples with a worsening pandemic situation. As a result stocks, oil and industrial metals took a hit today and taking into consideration rising inflation and more hawkish approach of major central banks, market moods may deteriorate further. A lot will depend on the quarterly performance of major US tech companies. Tomorrow Microsoft, Alphabet, and Visa will release their quarterly figures.

Ethereum fell sharply at the beginning of today's session, however buyers managed to defend support at $2790 which coincides with the upward trendline and 23.6% Fibonacci retracement of the last downward wave. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.