Source: xStation

- We are approaching the end of Friday's trading session.

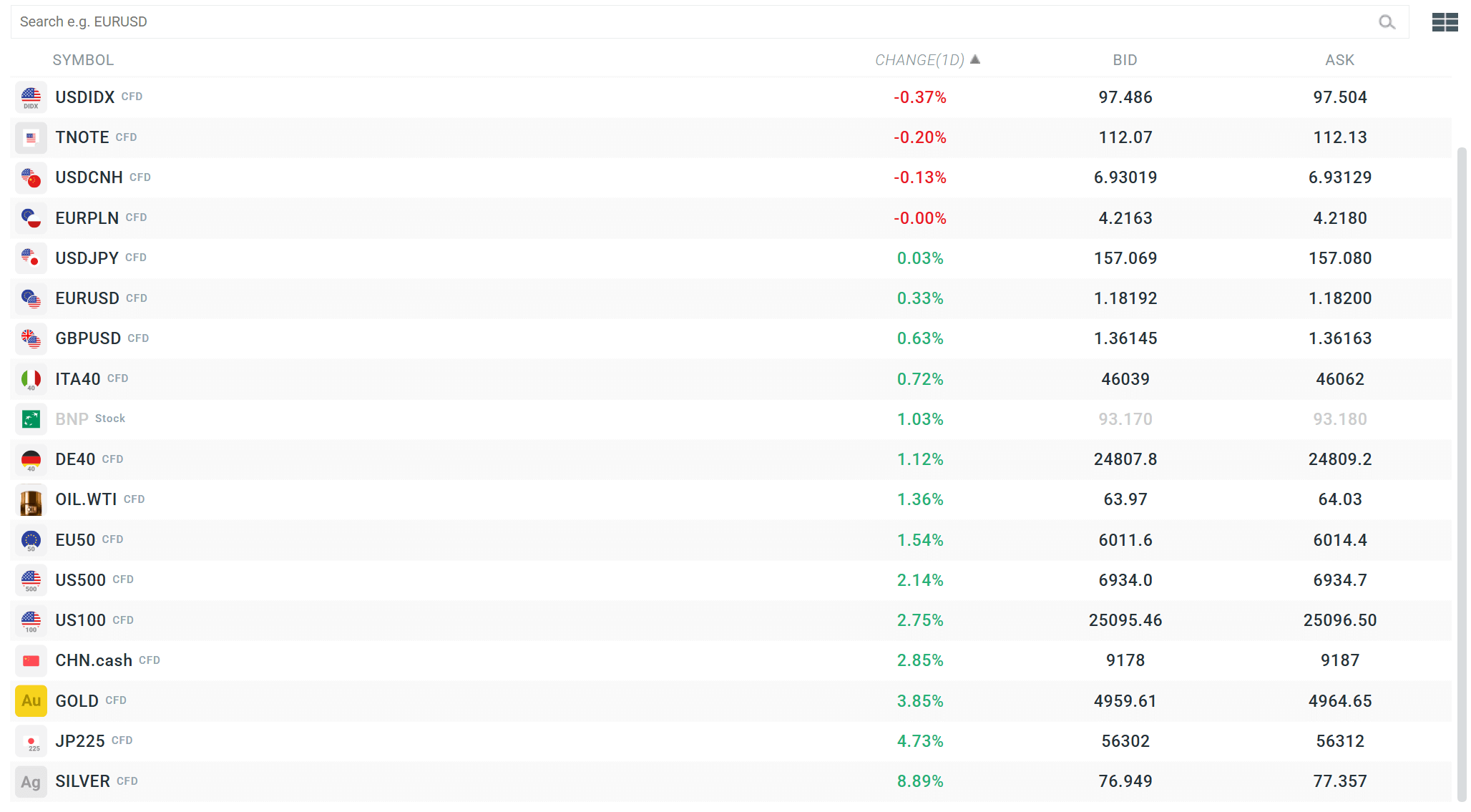

- The mood on Wall Street is very positive, driven by gains in technology companies. The Nasdaq is up 1.93%, while the S&P 500 is up 1.72%.

- The Russell 2000 recorded the largest intraday gains, reaching 3.42%.

- NVIDIA (NVDA.US) shares are up 7.3% today following comments from CEO Jensen Huang, who called the expansion of AI infrastructure a "once-in-a-generation opportunity."

- Strategy (MSTR.US) shares rebounded spectacularly today by 24%, returning to around £132 and erasing yesterday's 18 per cent decline. The current movements are primarily driven by synchronisation with Bitcoin, which jumped 10% to £70,000 after Thursday's lows of £60,000.

- According to a survey conducted by the University of Michigan in the US in February, sentiment in the US stands at 57.3, compared to 55 in the forecast and 56.4 in January (the assessment of current conditions rose sharply to 58.3 from 53.7 previously, while the expectations index rose slightly less). Annual inflation expectations fell to 3.5% against 4% expectations and 4% in January, while 5-year expectations were slightly higher than expected (3.4% vs. 3.3% expectations and 3.3% in January).

- Amazon shares fell 9% after Q4 results, where EPS was $1.95, slightly below the consensus of $1.97, even though revenues exceeded expectations. The main reason for the sell-off was the raising of the capex forecast for 2026 to $200 billion, mainly for investments in AWS and AI, which raised concerns about short-term ROIC.

- The situation surrounding the Islamic Republic of Iran remains serious and unstable. Increased military activity by the US and its allies points to a possible scenario of significant escalation of the conflict in the region. The market seems to be underestimating the scenario of escalation.

- Stellantis (STLAM.IT) saw its shares plummet by more than 24% on the Milan stock exchange today in response to the announcement of massive write-downs of €22.2 billion related to the revision of its EV strategy.

- Silver (SILVER) is up more than 9% today, and gold (GOLD) is up 4% to nearly $4,970 per ounce, riding a wave of improved sentiment in global markets.

- Antipodean currencies, the New Zealand dollar and the Australian dollar, are performing best on the Forex market. On the other hand, we are seeing relatively large declines in the Japanese yen and the US dollar today.

- Energy commodities are not moving in one direction. WTI crude oil prices are up 1.5%, while NATGAS is down nearly 3%. The improved sentiment surrounding OIL may indicate slightly defensive positioning following Iran's refusal to end its nuclear programme.

US stocks sell off on Nvidia’s good news, as traders wait for results of key UK election

US dollar strengthens, pressuring EUR/USD, silver and Bitcoin 📉

Oil surges almost 2% amid US - Iran tensions 📈

📉US100 loses 2%

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.