- European indices extended losses into a second day, with DAX down 0.95% led by losses in auto stocks after carmaker BMW warned that higher interest rates and ongoing price pressure will have negative impact on sales

-

ECB's Kazaks believes that 50-75 bp hikes are possible in December

-

BoE delivered an interest rate hike of 75 bps to tame stubbornly high inflation, the largest rate increase since 1989, but suggested Bank Rate would peak at a lower-than-expected level by financial markets.

-

Later BOE's Bailey told Bloomberg that nobody should read a 75 basis points as a new normal

-

Dow Jones is trading 0.30% lower, while S&P500 and Nasdaq fell 0.80% and 1.20% respectively as fresh economic data did not help to ease concerns about the pace of the Federal Reserve's interest rate rises.

-

US service providers expanded in October at the slowest pace since May 2020 as orders growth and production slowed.

-

US jobless fell to 217k, below analysts’ estimates of 220k, which points out that the labor market remains tight, backing the hawkish policy signaled by the Federal Reserve at its November meeting. Tomorrow traders attention will focus on October's NFP report .

-

Amazon are to pause on its new incremental hires in the corporate workforce, however it still intends to hire a meaningful number of people in 2023.

-

Donald Trump is considering launching a new presidential campaign after the midterm elections in the US, which will be held next week.

-

NATGAS price dropped below $6.0/MMBtu on Thursday, after the EIA report showed a bigger-than-expected storage build. US utilities added 107 bcf of gas to storage during the week ended October 28th, more than market expectations of a 97 bcf build.

-

Oil price retreated from three-week high as disappointing data from China raised demand concerns. Caixin services purchasing managers' index falling to the lowest level since May. Meanwhile Chinese health regulators dismissed speculations regarding easing the country’s Zero-Covid policy.

-

Mixed moods prevail on the precious metals market amid a stronger dollar. Gold tested major support at $1615.00, while silver erased early losses and approaches $19.50 level.

-

The dollar index hovers near 113.00 as investors turned to the US dollar following a more hawkish than expected message from the Federal Reserve.

-

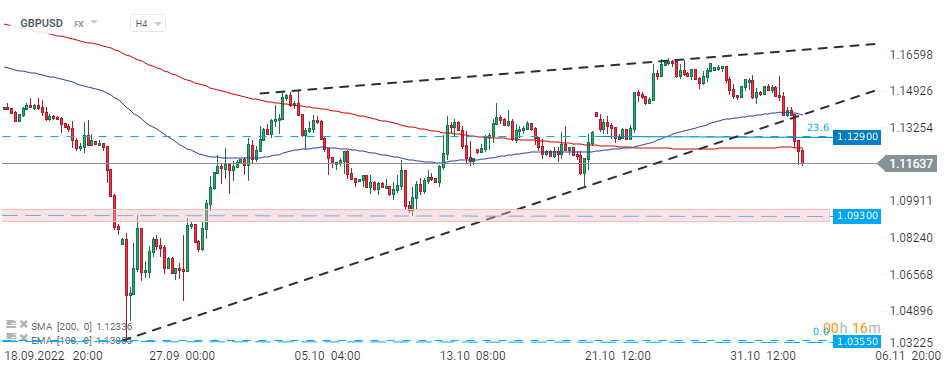

GBPUSD pair fell nearly 2.0% as markets now expect that the UK’s benchmark interest rate will peak just above 4.6% in September 2023, compared with 4.75% before today's BoE announcement.

-

Currently USD and CAD are the best performing major currencies while GBP and CHF lag the most.

GBPUSD pair broke below the major support zone around 1.1290 in the morning and the downward move gained steam following the BoE meeting. If current sentiment prevails, support at 1.0930 may be at risk. Source: xStation5

NFP preview

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.