- Risk-off moods could be spotted on the global markets on Friday as investors seems to be reducing bets on riskier assets amid concern that conflict in the Middle East may escalate over the weekend

- Part of those moves was retraced after Bloomberg reported that United States and European countries are pressing Israel to delay ground invasion of Gaza Strip in a bid to win hostage release

- Wall Street indices are trading lower but off the daily lows. S&P 500 drops 0.5%, Dow Jones trades 0.4% lower and Nasdaq declines 0.6%

- European stock market indices finished today's trading with big drops. German DAX was down 1.6%, UK FTSE 100 dropped 1.3% while French CAC40 and Italian FTSE MIB pulled back 1.4%

- Fed Bostic said that it is possible that Fed would cut rates in late-2024. Bostic does not expect US recession

- Fed Mester said that her outlook aligns with Fed forecast and she expects one more rate hike

- Fed Harker said that now is time to hold rates steady. He also said that inflation is easing faster than expected but also that the economy is softening faster than expected

- 30-year US Treasury yields climbed above 5.10% today and reached the highest level since 2007

- People's Bank of China left 1- and 5-year lending rates unchanged at 3.45% and 4.20%, respectively

- Canadian retail sales dropped 0.1% MoM in August (exp. -0.3% MoM) while retail sales excluding autos were 0.1% MoM higher (exp. -0.1% MoM)

- UK retail sales dropped 0.9% MoM in September (exp. -.02% MoM)

- Japanese CPI inflation slowed from 3.2% to 3.0% YoY in September while core CPI slowed from 3.1% to 2.8% YoY (exp. 2.7% YoY)

- Cryptocurrencies gained today with Bitcoin testing $30,000 area for the first time since the first half of August

- Energy commodities trade lower on the day with Brent and WTI dropping 0.6% and US natural gas prices being 1.8% down

- Gold has almost touched the $2,000 per ounce level today but bulls run out of steam and daily gain was trimmed to 0.5%

- GBP and CAD are the best performing major currencies while NZD and CHF lag the most

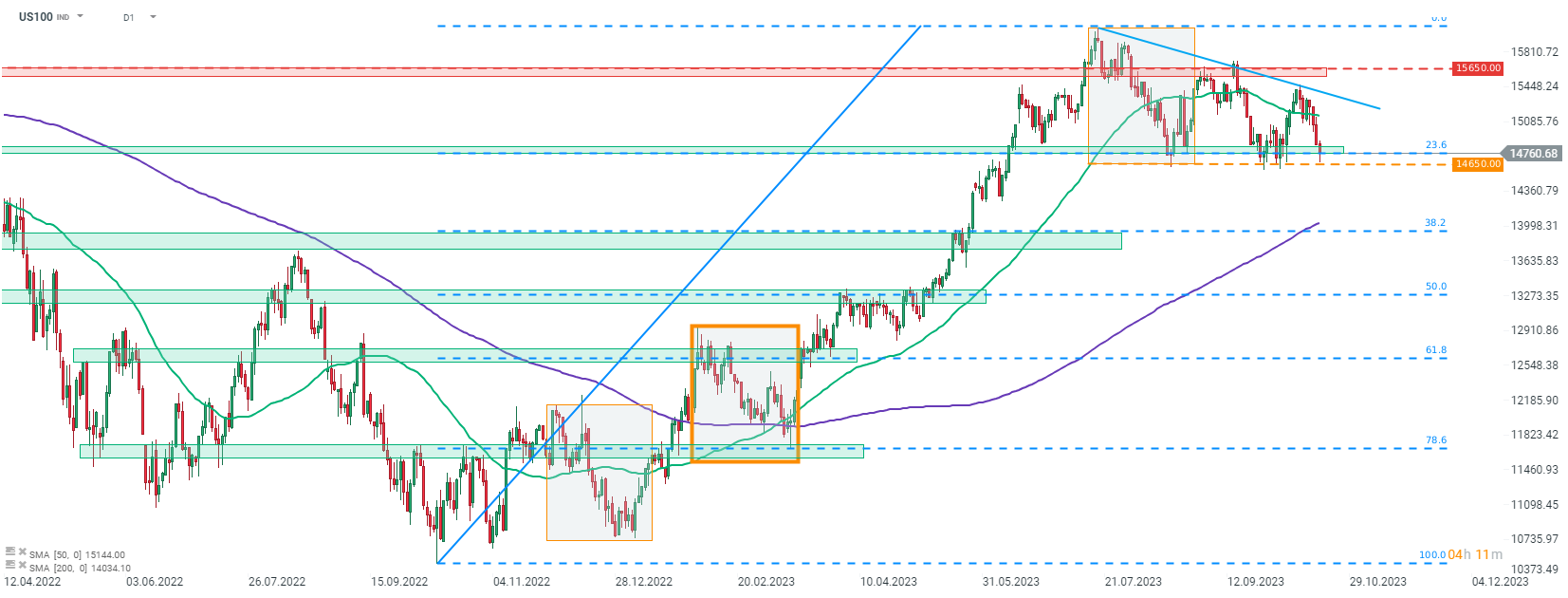

US100 is testing the support zone at 23.6% retracement that has halted downward moves a few times recently. An attempt to break lower today has not succeeded so far. Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.