-

Good sentiment in the stock market

-

Gas market tumbles

-

Cryptocurrencies try to make up for weekend losses

-

JPY and CHF are losing to USD

Today's equity market session was a successful one, with the vast majority of European indices closing the day in positive territory, and this despite disappointing German industrial orders data, as well as lingering concerns over a new variant of the coronavirus. The DAX gained 1.38% today, France's CAC40 added 1.48% and London's FTSE100 strengthened 1.57%.

The forex market, on the other hand, shows mixed moods. The dollar strengthened today against the Swiss franc and the Japanese yen, which can be explained by the increased appetite for riskier stocks such as equities. The USD loses visibly against AUD, which may be related to investors' positioning ahead of the RBA decision, which will be announced tonight at 4:30 a.m. However, it seems that the Reserve Bank of Australia will withhold its decision and wait for the Fed's announcement.

As for the commodities market, today investors' attention was focused on gas. NATGAS opened with a solid downward gap after the weekend due to meteorologists' forecasts, and then we saw a continuation of the discount. Oil, on the other hand, saw the opposite movement, with both Brent and WTI gaining on Monday (over 4%).

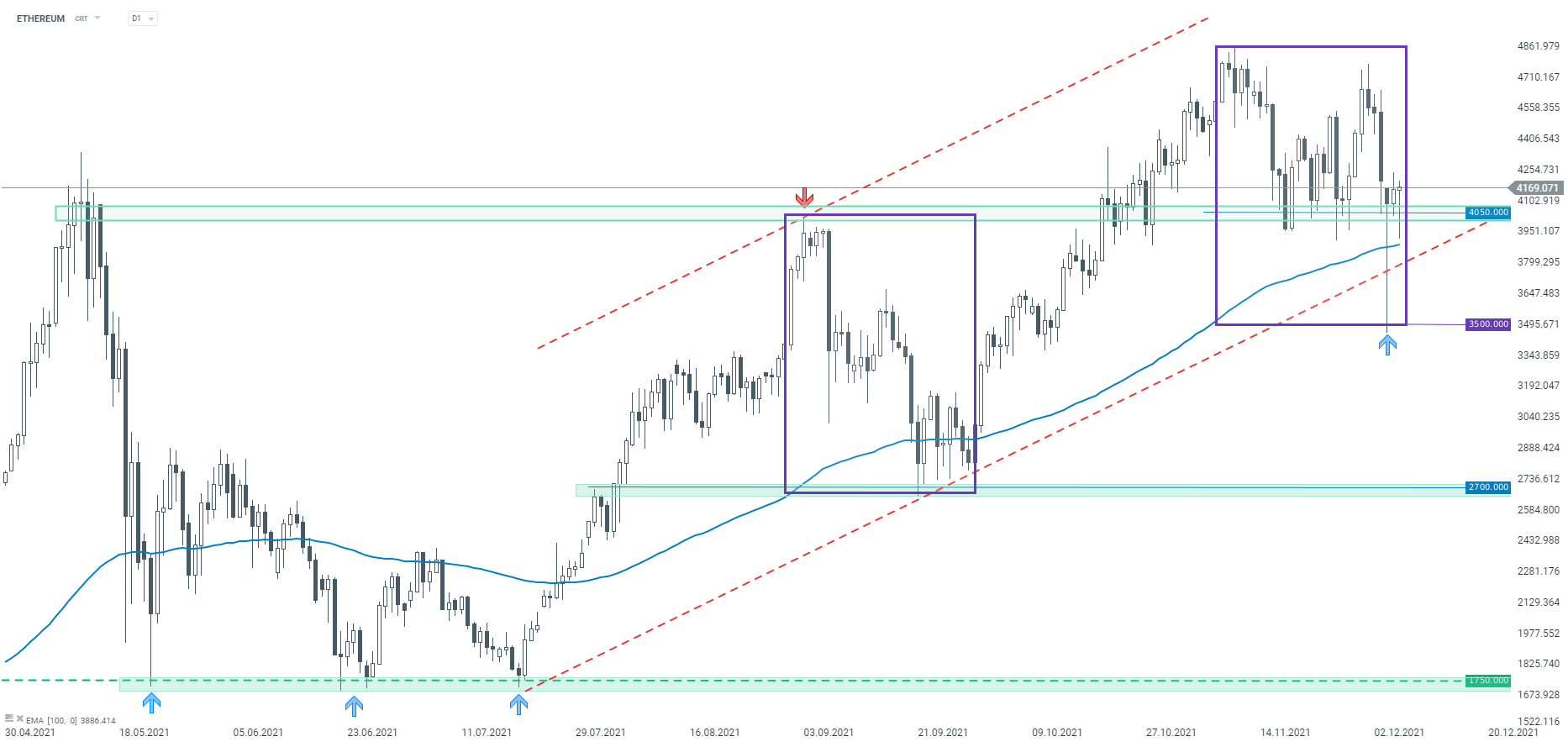

There was a lot of activity in the crypto market over the weekend. Bitcoin's price took a dive, which was also reflected in other digital currencies. The best of the entire top of the major cryptos were the quotes of Ethereum, where there was a strong rebound from the support at $ 3500 and then back above $ 4000, which according to the Overbalance methodology may indicate the continuation of the upward trend. Bitcoin, on the other hand, is lagging behind.

Ethereum defends the key support stemming from the 1:1 system, D1 interval. Source: xStation5

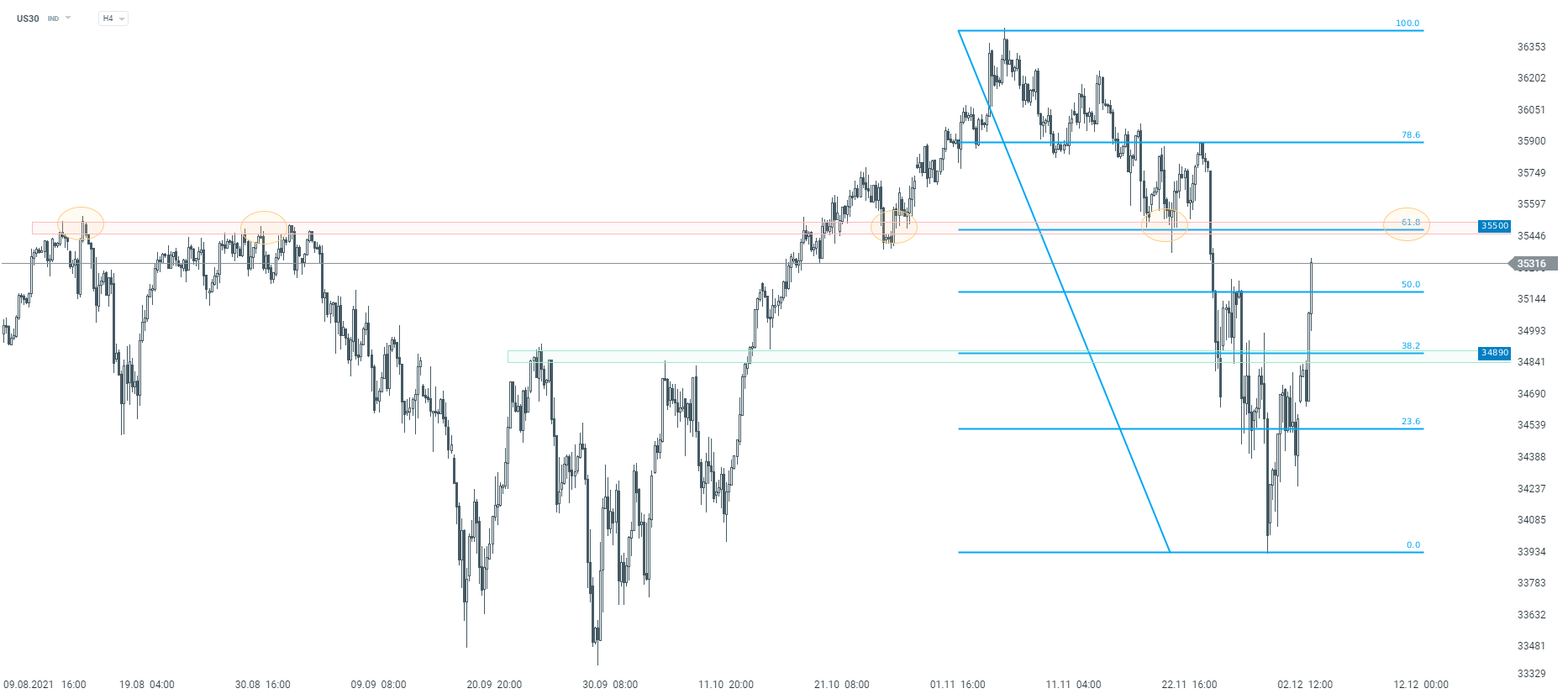

The US Dow Jones (US30) is doing really well today. If the current positive sentiment does not change, an attack on the resistance zone at 35500 points, which results from historical price reactions as well as measuring 61.8% of the last downward wave, is not excluded. In case of a breakout above, the way towards the historical maximums may be opened. On the other hand, a rebound of the price here could lead to a descent towards support at 34890 points.

US30 is heading towards the key short-term resistance at 35500 points, interval H4. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.