- The end of today's session brought a lot of turmoil to the markets after reports of possible changes to Japan's yield control program.

- In the wake of these announcements, the USDJPY pair fell sharply below the psychological barrier of 140.00. Moreover, the announcement almost significantly negated the day's rallies on US Wall Street.

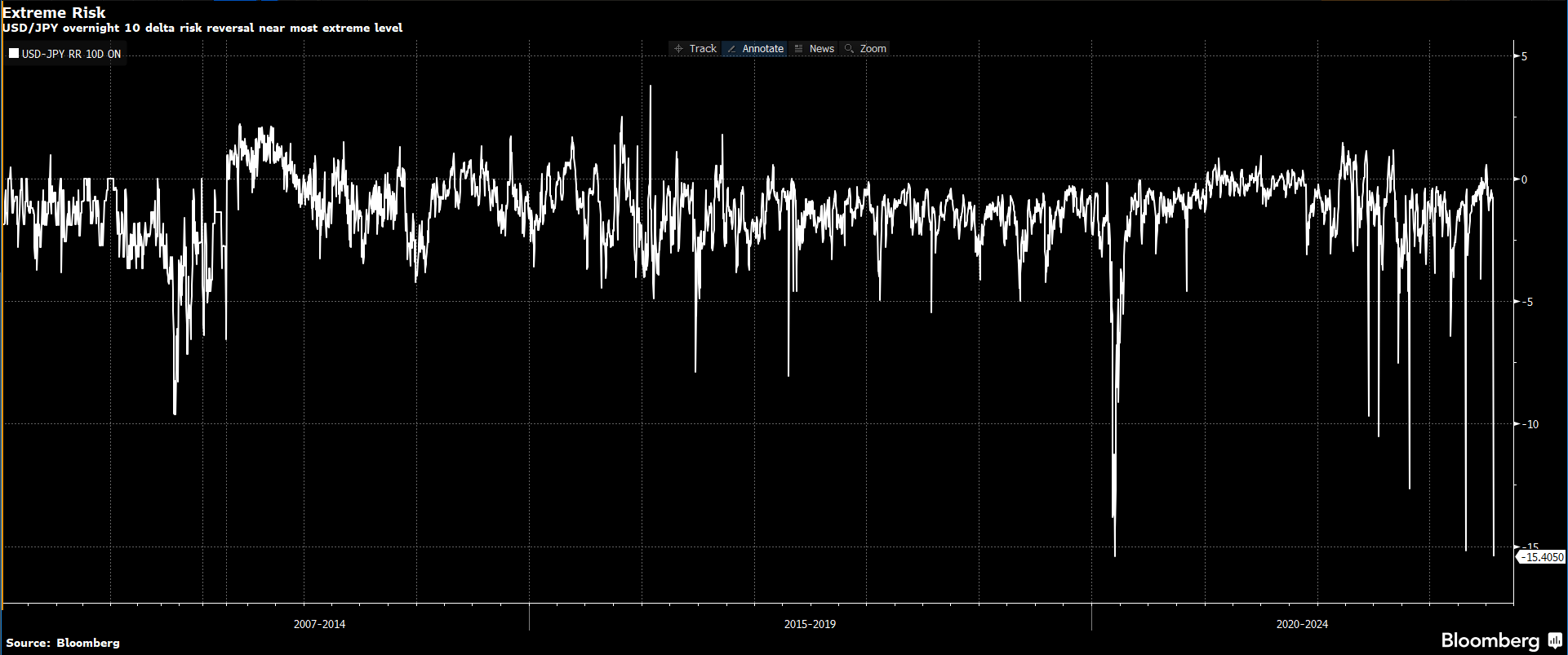

- Quite a lot of confusion is also observed in the options market, where positioning to hedge against a sharp decline in the USDJPY pair reached almost the highest values in 15 years.

- Tomorrow's BoJ meeting is expected to discuss programmatically allowing yields to rise above the 0.50% limit by a certain degree.

- At the moment, the best performing currency in the FX market is the Japanese yen, and the worst performing is the British pound.

- Indexes in Europe were euphoric today, with the DAX up 1.7% with the CAC40 rallying more than 2%.

- After the session, luxury goods giant Kering delivered a weaker-than-forecast Q2 report. After yesterday's surprise results from LVMH, investors are beginning to see opportunities for longer-term weakness in the fashion industry

- The ECB raised rates by 25 bps to 3,75% as expected, but during the press conference, President Christine Lagarde, despite her hawkish narrative, did not rule out a pause in the cycle and indicated that the bank would respond to data. This supported market sentiments and EURUSD weakened;

- The money market now assumes (after Lagarde's initial comments) that the ECB will raise rates by 25 bps at its September meeting with a probability of just under 40%.

- The strength of the US dollar resulting from Lagarde's dovish comments and strong macro data lifted gold prices below the psychological barrier of $1,950

- The macro data package from the US turned out to be much better than expected, which ultimately supported sentiment on the indices. S&P500 gains 0.2% at 0.8% - some of the gains were erased by reports from the Bank of Japan

- U.S. unemployment claims indicated 221,000 with 235,000 forecast and 228,000 previously. Continuing claims unexpectedly fell from 1.75 million to 1.69 million

- Durable Goods Orders surprised sharply upward, rising 4.7% m/m with an expected increase of 0.6% and 1.8% previously. Orders excluding transportation equipment also beat expectations by 0.5% m/m

- Annualized GDP reading indicated 2.4% vs. 1.7% forecast and 2% previously with core PCE inflation 0.2% lower than forecast - reading indicated 3.8% vs. 4.9% k/k previously

- US natural gas inventories data came in above expectations. Current: +16 bcf. Expected change: +14 bcf. Previous: +41 bcf

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.