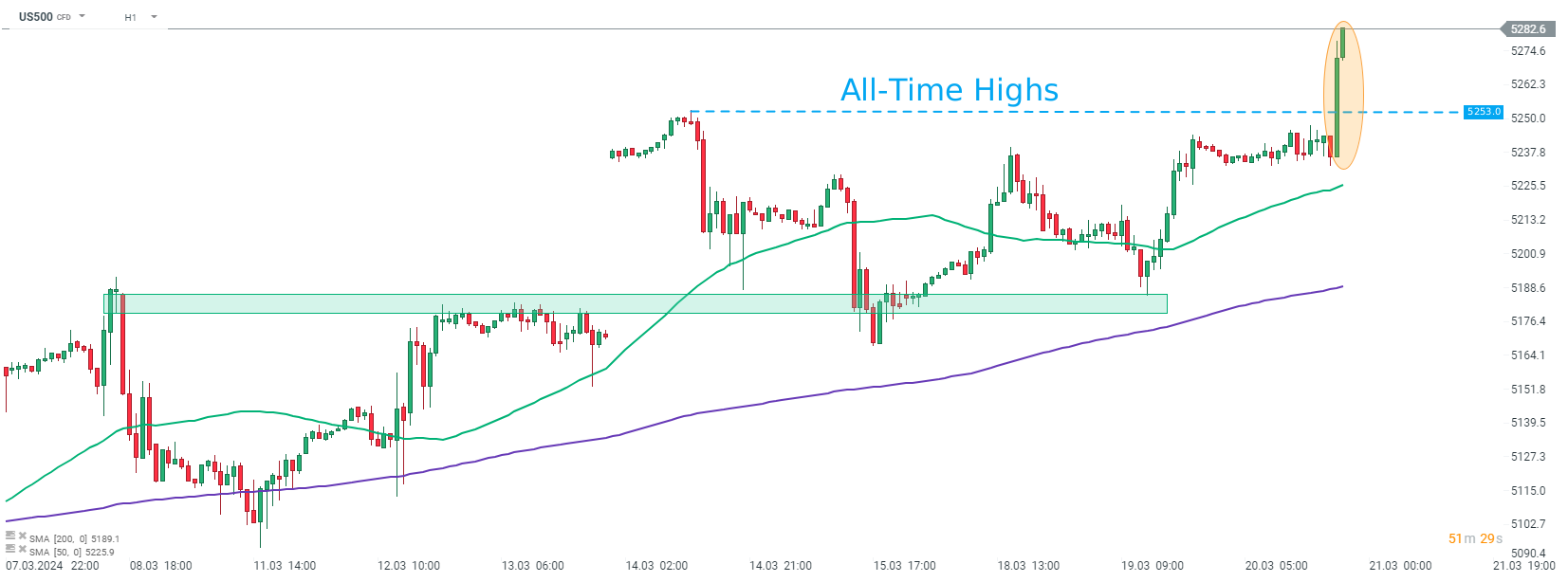

- Wall Street indices climbed to fresh record highs after FOMC decision and Powell's presser. S&P 500 trades 0.8% higher, Dow Jones gains 0.9%, Nasdaq jumps 1.1% and small-cap Russell 2000 rallies 1.4%

- FOMC left interest rates unchanged in the 5.25-5.50% range, in-line with market expectations. Policy statement contained no major changes compared to January

- New FOMC projections showed higher GDP growth in the coming years as well as high core inflation this year

- Median 2024 dot-plot remained unchanged at 4.60% (3 cuts), but only 1 FOMC member now expects 4 or more cuts this year, while 5 members expected it back in December

- In spite of new forecasts being rather hawkish, USD dropped following the decision while indices and gold gained

- Powell has been rather neutral during the press conference, sounding neither hawkish, nor dovish.

- European stock markets traded mixed today. German DAX gained 0.1%, UK FTSE 100 and Dutch AEX traded flat, French CAC 40, dropped 0.5% and Spanish IBEX jumped 0.5%

- Cryptocurrencies are trading higher, with Bitcoin climbing over 4% and breaking above $65,000 mark

- Energy commodities pull back - oil drops 1.5%, while US natural gas prices are down over 3%

- Precious metals rally amid USD weakening - gold trades 1% higher, silver surges 2.4%, platinum adds 1% and palladium jumps 1.9%

- AUD and CAD are the best performing major currencies, while USD and JPY lag the most

- People's Bank of China left 1- and 5-year loan prime rates unchanged at 3.45% and 3.95%, respectively, in-line with market expectations

- UK CPI inflation decelerated from 4.0 to 3.4% YoY in February (exp .3.5% YoY), while core measure dropped 5.1 to 4.5% YoY (exp. 4.6% YoY)

- German PPI inflation came in at -4.1% YoY in February (exp. -3.8% YoY), up from -4.4% YoY in January

- Czech National Bank cut the main interest rate by 50 basis points from 6.25% to 5.75%, in-line with expectations

- DOE report showed a 1.95 million barrel draw in oil inventories (exp. -2.5 mb), a 3.31 million barrel plunge in gasoline inventories (exp. -0.1 mb) and a 0.62 million barrel build in distillate inventories (exp. +0.1 mb)

S&P 500 futures (US500) rallied to fresh all-time highs above 5,250 pts after Fed decision. Source: xStation5

Market wrap: European stocks attempt to stabilize despite the surge in oil prices 🔍

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

Daily summary: Oil still pressures Wall Street despite favorable CPI data 🗽

Mixed sentiments on Wall Street amid Iran war🗽Oracle shares surge 10%

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.