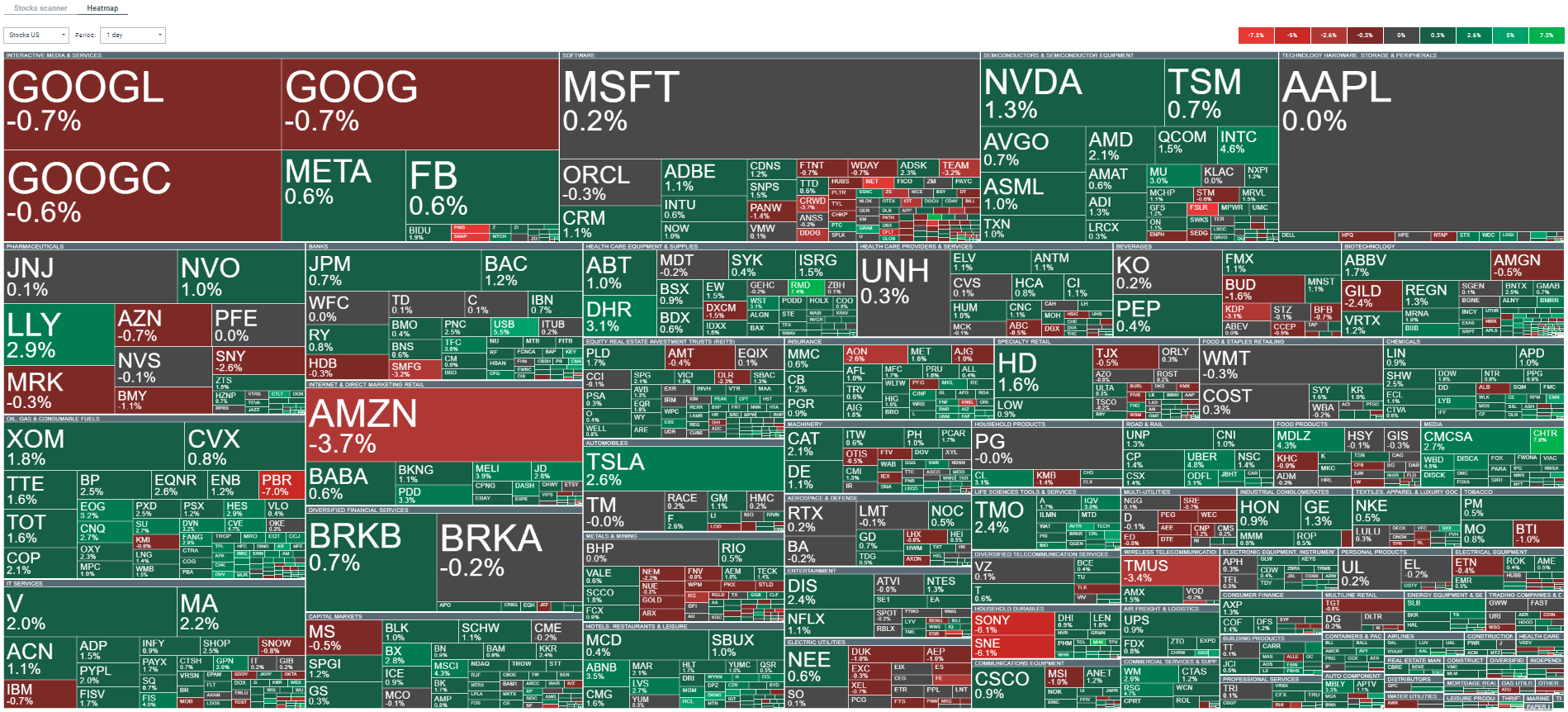

The last session of the month on Wall Street brings improvement in sentiment, as investors eagerly buy American bluechips despite uncertainties related to the potential insolvency of First Republic Bank.

The better mood is primarily due to much better than expected quarterly results published by companies such as Alphabet, Microsoft, and Meta Platforms. However, on the other hand, other upcoming financial results are uncertain due to the relatively mixed results of Amazon and Intel. Next week, investors will focus mainly on the bluechips such as Apple and AMD.

The optimism caused by earlier reports of the largest tech companies was somewhat subdued after the publication of Amazon's results. While the results were relatively good - the company exceeded revenue and earnings per share expectations - investors focused on the worse cloud computing projections. Currently, the company's shares are down over 3%.

First Republic Bank's shares are down nearly 45%, which is directly related to the reported possibility of insolvency, which contradicts morning statements about possible mediations.

The key macro readings for today were the US PCE inflation and data regarding GDP and inflation in eurozone countries. Inflation in Germany was lower than expected, rising 7.6% YoY compared to expected 7.8%. At the same time, the GDP surprised to the downside, showing no change QoQ compared to an expected 0.2% increase. Overall, the data was mixed from the perspective of the ECB's decision, which the market will watch closely next week.

On the FX market, attention was mainly focused on the Japanese yen. The Bank of Japan decided to keep rates and the yield curve control (YCC) unchanged at its first meeting under new Governor Ueda. The paragraph about keeping rates at their current or lower levels was removed from the statement. While this may be perceived as a hawkish move, the Bank of Japan also said that it will conduct a review of its monetary policy, which will last from 1 to 1.5 years. The JPY weakened as investors took this as a suggestion that no change in BoJ policy will occur until the review is completed. Market sentiment towards the yen has not changed even after Ueda assured during the press conference that it does not mean no change in policy for the next 1.5 years.

Gold is gaining today, however, the price has not been able to return above the $2000 per ounce barrier.

The crypto market is under selling pressure today. At the time of publication, Bitcoin is losing more than 1.3% and is trading around $29300.

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.