Today's session on the European stock market was one of success. The main indices from the Old Continent surged upwards shortly after the start of trading and ended the day on a positive note despite a pullback in the second half of the day. The DAX set new local peaks and gained more than 0.7 per cent.

Sentiment deteriorated in the second half of the day and although European indices closed the cash session higher, in the futures market we are seeing a significant pullback and an erasure of today's rally.

A similar situation is taking place on Wall Street, where the major indices started trading higher, but at this point have erased all upward movement and are trading under the dash.

Adidas shares lose almost 5% in after-hours trading following the release of quarterly data .

Yahoo will reduce more than 20% of workforce as it shrinks ad biz.

Investors today continued the intense sell-off of Alphabet (GOOGL.US) shares following yesterday's mistake of AI chatbot, Bard, a competitor to ChatGPT.

ECB's Nagel said that stopping rate rises in the near term is a cardinal mistake.

The dollar came under pressure again today, thus there is a risk of breaking the correction we experienced last week. On Thursday, the USD depreciated 0.3% against the euro, and more than 0.5% against the pound and the New Zealand dollar.

The EURUSD bounced off the key support zone of 1.0660 - 1.0700 yesterday and today the upward movement continued and the pair approached almost 1.0800, but in the second half of the day we see a slight retracement around 1.0745.

The deterioration of sentiment in the stock market in the second half of the day is negatively affecting the cryptocurrency market. Bitcoin retreated below $22500 and the Ethereum exchange rate fell below $1630.

Precious metals have not benefited from the weaker well and are trading slightly below the bar. Gold is trying to recover from last week's strong discount and is losing around 0.3% today, while silver is down 0.7%. However, industrial metals such as nickel, copper and aluminum are doing well.

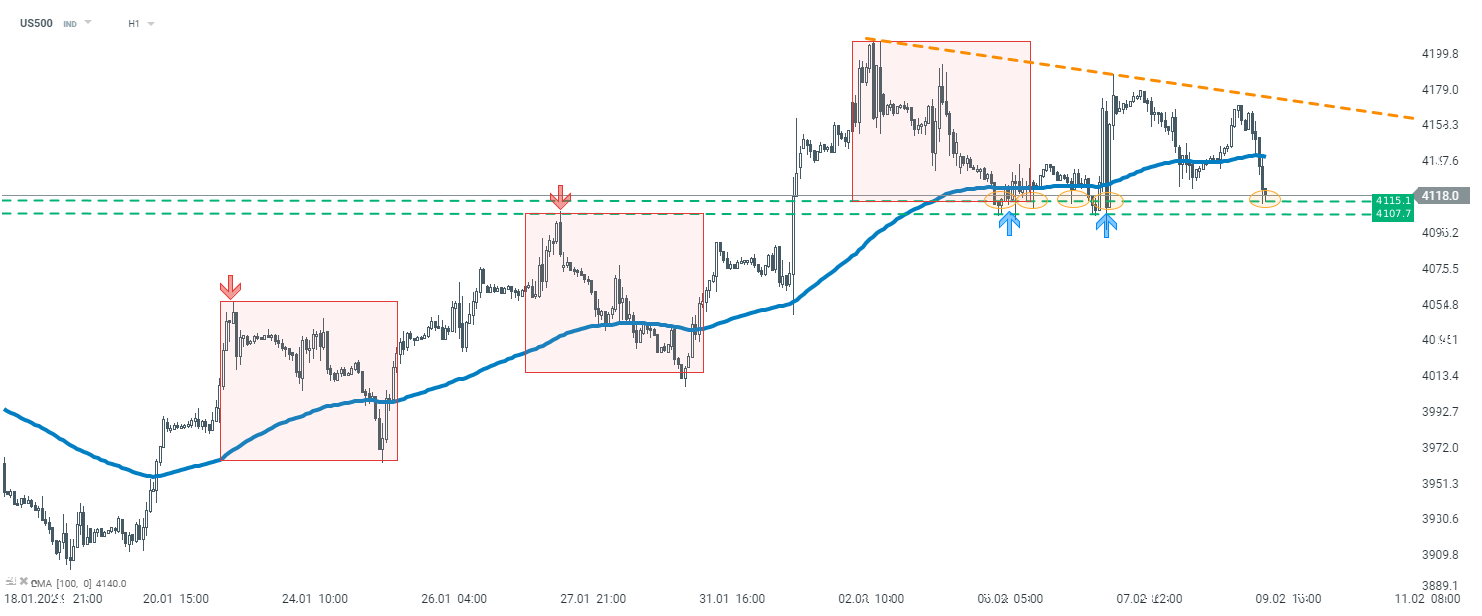

The US500 failed to break above the line drawn from the recent peaks. We are currently seeing a pullback and a retest of the key short-term support zone at 4107-4115 points.

Source: xStation5

Source: xStation5

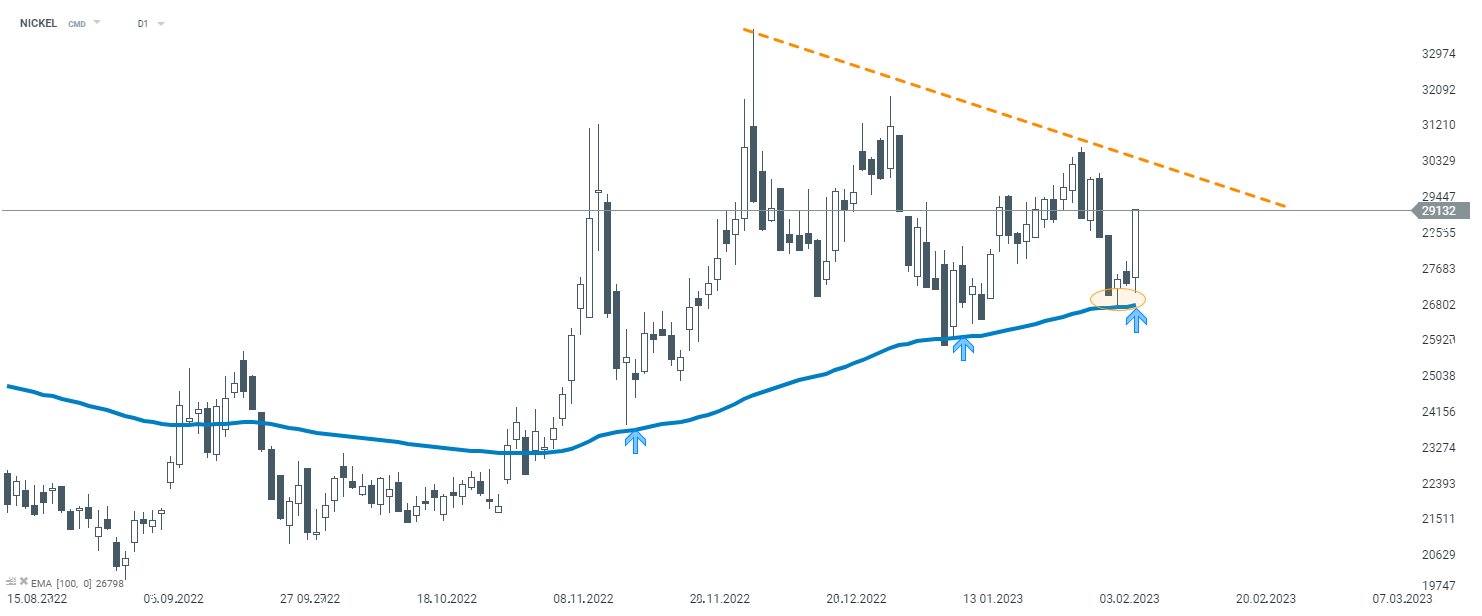

Nickel quotes have bounced in recent days from the support stemming from the average EMA 100 and are heading towards the line drawn after the recent tops.

Source: xStation5

Source: xStation5

Gold and silver rebound after the sell-off 📈

VIX struggle to rise higher despite uncertainty on Wall Street 🔎

OIL: prices continue to rise despite the US Navy escort proposal for ships📌

Trump’s plan for Strait of Hormuz fails to stop gains in oil price, as investors pause European sell off

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.