-

Stocks trade higher fuelled by trade optimism and PBOC’s easing

-

DE30 climbs back above the 13300 pts handle

-

Deutsche Bank (DBK.DE) and Commerzbank (CBK.DE) surge on PBOC’s move

European stocks echo performance of Asian peers on the first trading session of the 2020 and trade higher. Upbeat performance can be ascribed to PBOC’s easing and trade optimism. The latter comes from Trump’s announcement that “Phase One” trade deal will be signed in mid-January.

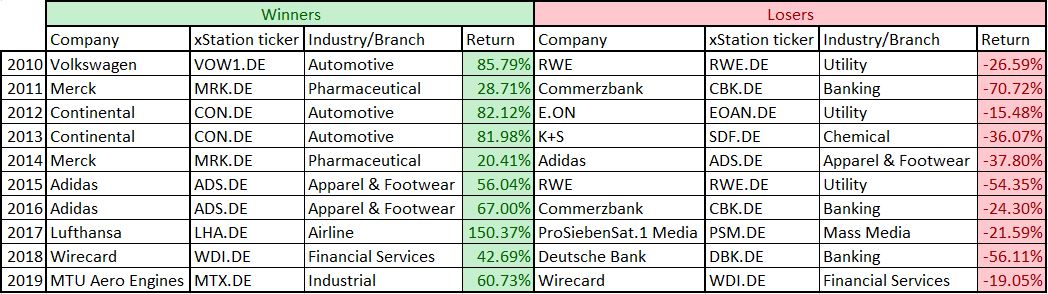

DAX winners and losers of the decade

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app DAX winners and losers over the past decade. Only stocks that were included in the index at year’s end were taken into account. Source: Bloomberg, XTB Research

DAX winners and losers over the past decade. Only stocks that were included in the index at year’s end were taken into account. Source: Bloomberg, XTB Research

The decade ended and now we are heading into 20s. However, was there a common pattern when it comes to the DAX winners and losers over the previous 10 years? We have created a table with top gainers and top losers for each year. When it comes to leaders, there is no clear pattern in regards to the industry or a branch but three stocks - Continental, Merck and Adidas - stood out among the rest. Situation looks different when it comes to top losers. Utility and financial stocks underperform most often. However, this should not come as a surprise as utility stocks are considered defensive and tend to underperform during a bull market. Meanwhile, banks were hit by an introduction of negative interest rates.

Source: xStation5

Source: xStation5

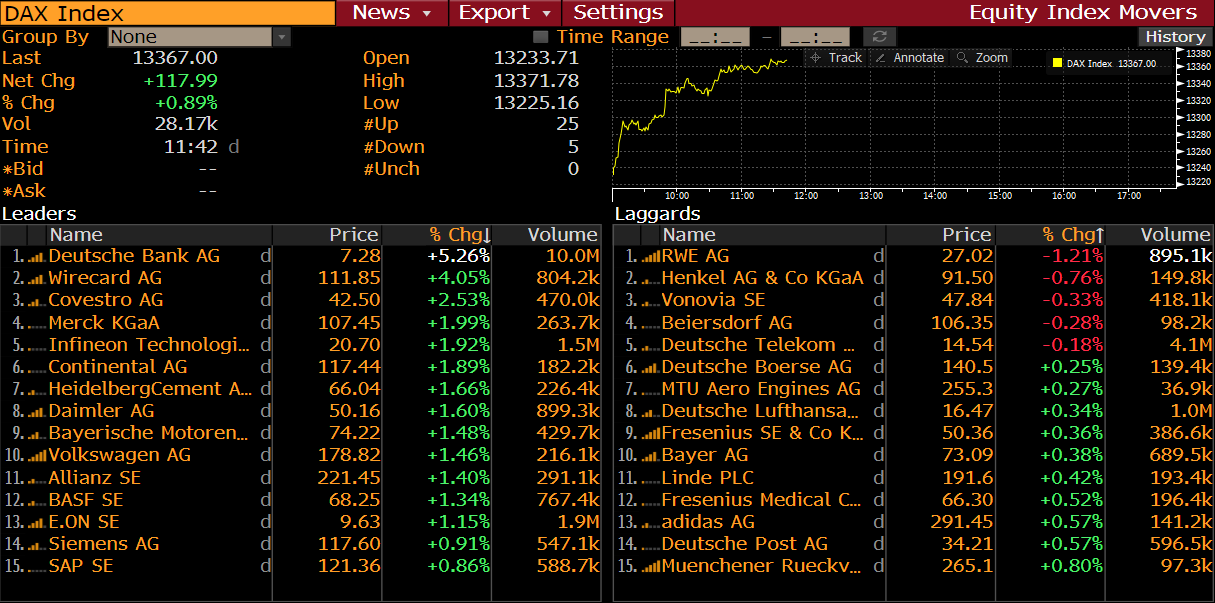

DAX rallied 25% in 2019, marking the best year for the German blue-chips since 2013. New year - 2020 - started on a high note as well with the index gaining over 100 points already. Ongoing surge brought DE30 above 50-, 100- and 200-hour moving average and saw the index break above the resistance zone ranging around the 13300 pts handle. The attention shifts to the short-term trendline that currently runs in the 13365 pts area. However, given the upward momentum the index is enjoying right now, a break above this hurdle may be just a matter of time. In such a scenario, the first resistance to watch would be the 13430 pts area, where 2019 highs can be found.

DAX members at 10:42 am GMT. Source: Bloomberg

DAX members at 10:42 am GMT. Source: Bloomberg

The People's Bank of China decided to lower the reserve requirement ratio by 50 basis points in order to release over $100 billion in liquidity and support the economy. The move triggered a rally in the European banking sector. Commerzbank (CBK.DE) and Deutsche Bank (DBK.DE) can be found among the best performing stocks on the German stock exchange.

Airbus (AIR.DE) can be found among MDAX top gainers today. Reuters reported that the European plane maker delivered a record 863 aircrafts in 2019, up from 800 in 2018. It also means that Airbus most likely dethroned Boeing (BA.US) as world’s top planemaker for the first time since 2011. Nevertheless, it should be noted that the figures come from industry sources and were not confirmed by the company yet.

The union representing cabin crews at Germanwings, subsidiary of Lufthansa (LHA.DE), decided to suspend a strike after 3 days of stoppages. Discussions over how to proceed with the dispute will be held on Sunday.

Analyst actions

-

Ceconomy (CEC.DE) was raised to “buy” from “hold” at Baader Helvea. Price target was set at €5.20

-

Lufthansa (LHA.DE) was cut to “sell” from “neutral” at Citi.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.