-

European stock markets trade flat

-

DE30 trades sideways in the 15,850 pts area

-

BMW plans to boost employment by 6,000 thousand jobs next year

European stock markets indices trade mixed during, what is for many markets, a final trading session of the year. German DAX, UK FTSE 100 (UK100, Spanish IBEX (SPA35) and Italian FTSE MIB (ITA40) trade flat. French CAC (FRA40) and Dutch AEX (NED25) gain slightly while Polish WIG20 (W20) and Russian RTS (RUS50) drop.

Source: xStation5

Source: xStation5

DE30 halted yesterday's pullback slightly above a key near-term support zone. The zone ranging around 61.8% retracement of the downward move started in late-November 2021, is additionally strengthened by previous price reactions as well as the lower limit of a local market geometry. Stock recovered from a brief drop below 15,800 pts and started to trade sideways in a narrow 15,820-15,870 pts range. Today is the final trading session for DAX index in 2021 and the last chance for investors to make tax-related portfolio rebalancing. However, it is expected to trigger big moves today as most investors have already rebalanced their portfolios.

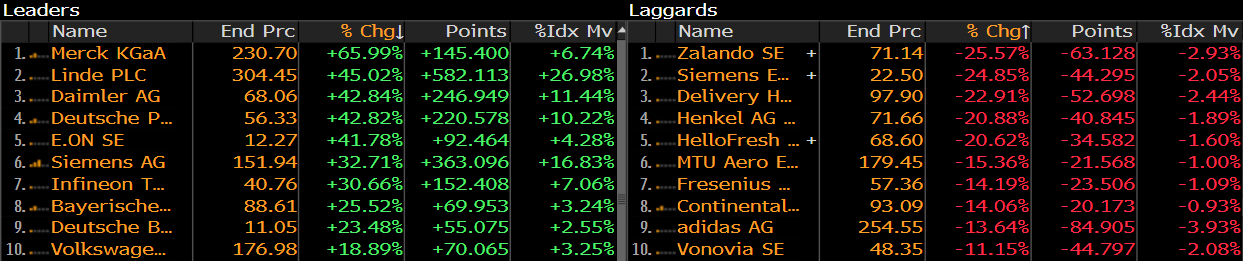

DAX leaders and laggards in 2021. Source: Bloomberg

DAX leaders and laggards in 2021. Source: Bloomberg

German DAX has gained 15.7% so far this year. However, majority of those gains was made at the beginning of the year as the German index traded sideways in a 1,000-point trading range from April (15,000-16,000 pts). A look at how individual companies from the index performed shows no clear sector theme. Top performers - Merck, Linde, Daimler, Deutsche Post and E.ON - came from different sectors. On the other hand, similarities can be found among top laggards. Improvement in pandemic situation can be named as a reason as 3 out of 5 DAX top laggards in 2021 - Zalando, Delivery Hero and HelloFresh - were companies that benefited from "stay-at-home" environment.

Company News

Olivier Zipse, CEO of BMW (BMW.DE), said that the company plans to add around 6,000 jobs in 2022, mostly in areas related to production and IT. Zipse also said that he expects semiconductor shortages to start easing gradually in the second quarter of 2022 and supply to return to normal levels by the end of 2022.

According to a Financial Times report, Hugo Boss (BOSS.DE) plans to increase output at its Turkish factory in Izmir in order to shorten the supply chain. Daniel Grieder, CEO of Hugo Boss, said that the goal is to bring production as close as possible to markets where it will be sold. Company also plans to hire 1,000 additional workers for a plant in Izmir, Turkey (an over 30% increase to current workforce).

Siemens Healthineers (SHL.DE) announced that its rapid at-home Covid-19 test kit received an emergency authorization from the US Food and Drug Administration. Marketing of test kits is expected to begin in January 2022 and monthly production capacity for the US markets is said to be in the tens of millions of tests.

Siemens Healthineers (SHL.DE) trades a touch higher today following emergency approval for its at-home Covid test kit issued by US FDA. A near-term resistance can be found at recent local highs in the €66.70 area. However, the major resistance zone ahead is marked with all-time highs in the €67.50 area. Source: xStation5

Siemens Healthineers (SHL.DE) trades a touch higher today following emergency approval for its at-home Covid test kit issued by US FDA. A near-term resistance can be found at recent local highs in the €66.70 area. However, the major resistance zone ahead is marked with all-time highs in the €67.50 area. Source: xStation5

3 markets to watch next week - (17.10.2025)

US100 tries to recover🗽Sell-off hits uranium stocks

DE40: European markets decline due to concerns about the U.S. banking sector

Cockroach fears cause stock market sell off, as we wait for clearer details

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.