-

European markets trade lower

-

Markets wait for response to Putin's actions

-

DE30 tries to bounce off the 38.2% retracement

European stock markets are trading lower on Tuesday amid escalation in tension in the eastern Ukraine. Russia recognized the independence of two separatist-controlled republics and moved its military there. World awaits a response from the West. Sanctions were already promised and now we are waiting for world leaders to deliver on those promises. The Ukraine President said that no matter what Russia says or announces, Ukraine's borders remain unchanged. It means that the Russian army has violated Ukrainian borders and the risk of outright conflict remains high.

Indices from Western Europe trade 0.5-1.0% lower while Russian RTS (RUS50) is taking a 6% hit, following a 13% plunge yesterday. Brent broke above $99 per barrel as amid concerns over supply in case of Russia-Ukraine military conflict

Source: xStation5

Source: xStation5

DE30 slumped yesterday and closed below the lower limit of a year-long trading range. Index reached the 38.2% retracement of the upward move started after 2020 US Presidential Elections and trades at the lowest level since late-March 2021. An attempt to launch a recovery move can be observed today with index breaking back above 14,500 pts. If the recovery fails and DE30 starts to move lower once again, the 14,180 pts area will be on watch. It is marked with the lower limit of the Overbalance structure and breaking below could hint large trend reversal.

German IFO indices for February were released at 9:00 am GMT today. Headline business climate index jumped from 96.0 to 98.9 (exp. 96.5). Expectations subindex moved from 95.8 to 99.2 while current conditions index jumped from 96.2 to 98.6. All three indices for January were revised slightly higher. Release showed strong beats but IFO Institute noted that results are not yet impact by recent developments in eastern Ukraine.

Company News

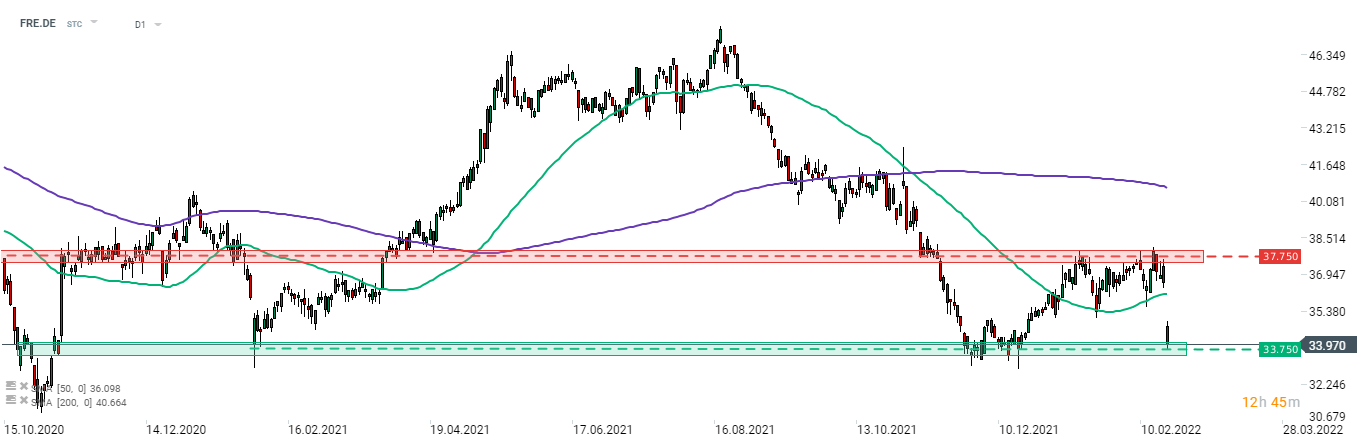

Fresenius (FRE.DE) reported Q4 2021 results today. Company said that its EBIT drop 7% YoY, to €1.17 billion. Sales increased 9% YoY to €9.97 billion while net income was 21.7% YoY higher, at €499 billion. Full-2021 sales were 3% YoY higher at €37.52 billion while EBIT dropped 8% YoY to €4.25 billion. Fresenius said that weaker profits were the result of Covid-related headwinds at its subsidiary, Fresenius Medical Care (FME.DE). Company expects sales to grow in the mid-single digits range in 2022 .

Airbus (AIR.DE) plans to demonstrate its hydrogen plane by mid-decade

According to a Reuters report, Volkswagen (VOW.DE) is in advanced talks about an IPO of the Porsche brand. Volkswagen is in talks with holding company, Porsche Automobil Holding and a framework agreement on how to prepare such a move has been reached already.

Fresenius (FRE.DE) is taking a hit following the release of Q4 2021 and full-2021 results. Markets saw the company's 2022 forecasts as disappointing. Stock plunged and is currently testing a mid-term support zone ranging around €33.75 mark. Source: xStation5

Fresenius (FRE.DE) is taking a hit following the release of Q4 2021 and full-2021 results. Markets saw the company's 2022 forecasts as disappointing. Stock plunged and is currently testing a mid-term support zone ranging around €33.75 mark. Source: xStation5

US Earnings Season Summary 🗽What the Latest FactSet Data Shows

3 markets to watch next week (14.11.2025)

US Open: US100 initiates rebound attempt 🗽Micron shares near ATH📈

DE40: European markets extend decline

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.