The European session at the end of the week is taking place in a positive mood. Most indices of the old continent are recording moderate gains. Leading the way today is the German DAX, with DE40 contracts rising by over 0.6%. Other Western European indices are limiting gains to around 0.4%.

A series of positive macroeconomic data allows investors from Europe to discount a better growth trajectory for the community.

Macroeconomic Data:

- Today, the GDP reading for the Eurozone was published. The annual growth rate remained stable at 1.4%. Quarterly growth accelerated to 0.3% compared to expectations of 0.2%.

- Orders for German factories are significantly increasing, by 1.5% compared to the expected 0.3%. The boost is also visible on an annual basis.

- In France, the trade deficit is decreasing, and industrial production increased by 0.2% against the expected contraction of 0.2%.

- Towards the end of the European session, investors will learn about the PCE inflation data from the USA. This is one of the most important measures for the FED, and any surprises could seriously impact the forecasted path of policy easing by the FOMC.

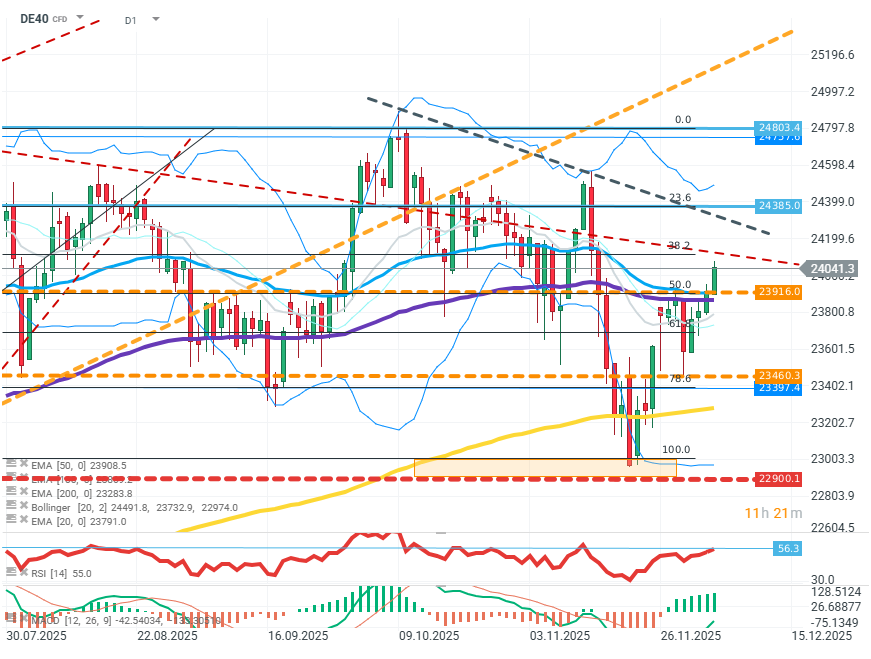

DE40 (D1)

Source: xStation5

The price on the chart continues its upward trend, with buyers managing to overcome another resistance zone, FIBO 50, and heading towards FIBO 38.2, where a downward trend line additionally runs. Overcoming the next level may open the way to test recent highs. Losing initiative by buyers at current levels may, however, trigger a correction around FIBO 78.6. Investors must closely monitor the EMA50 and EMA100 averages and the rising RSI indicator.

Company News:

- Alstom (ALO.FR) - The French railway company received a positive recommendation from an investment bank. The stock price is rising by over 2%.

- Renk (R3NK.DE) - The German manufacturer of drive systems, focused around military vehicles, received a positive recommendation from an investment bank. The company gains over 3%.

- Hensoldt (HAG.DE) - The German defense company is losing over 2%, with investor and analyst concerns about the company's valuation indicators.

- UCB (UCB.DE) - The biotechnology company publishes forecasts for EBITDA growth of over 30%, with the stock price gaining over 5%.

- Swiss Re (SREN.CH) - The Swiss insurer is losing over 4% after publishing disappointing forecasts for the next year.

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

BREAKING: US Manufacturing data above expectations! 📈🏭

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.