Today's session on European stock exchanges started on a positive note. Futures contracts on most major indices were in the green, indicating moderate optimism among investors. The German DAX also opened in positive territory, suggesting that the market is trying to maintain positive momentum despite recent geopolitical turmoil and corrections in the USA. Contract valuations are rising by about 0.1-0.2%. The leader of growth today is Spain, whose IBEX35 index is rising by about 0.6% on the wave of good macroeconomic data.

On the global stage, investors are analyzing the latest decisions of Donald Trump's administration. The former US president announced the introduction of additional tariffs, this time mainly affecting the pharmaceutical sector.

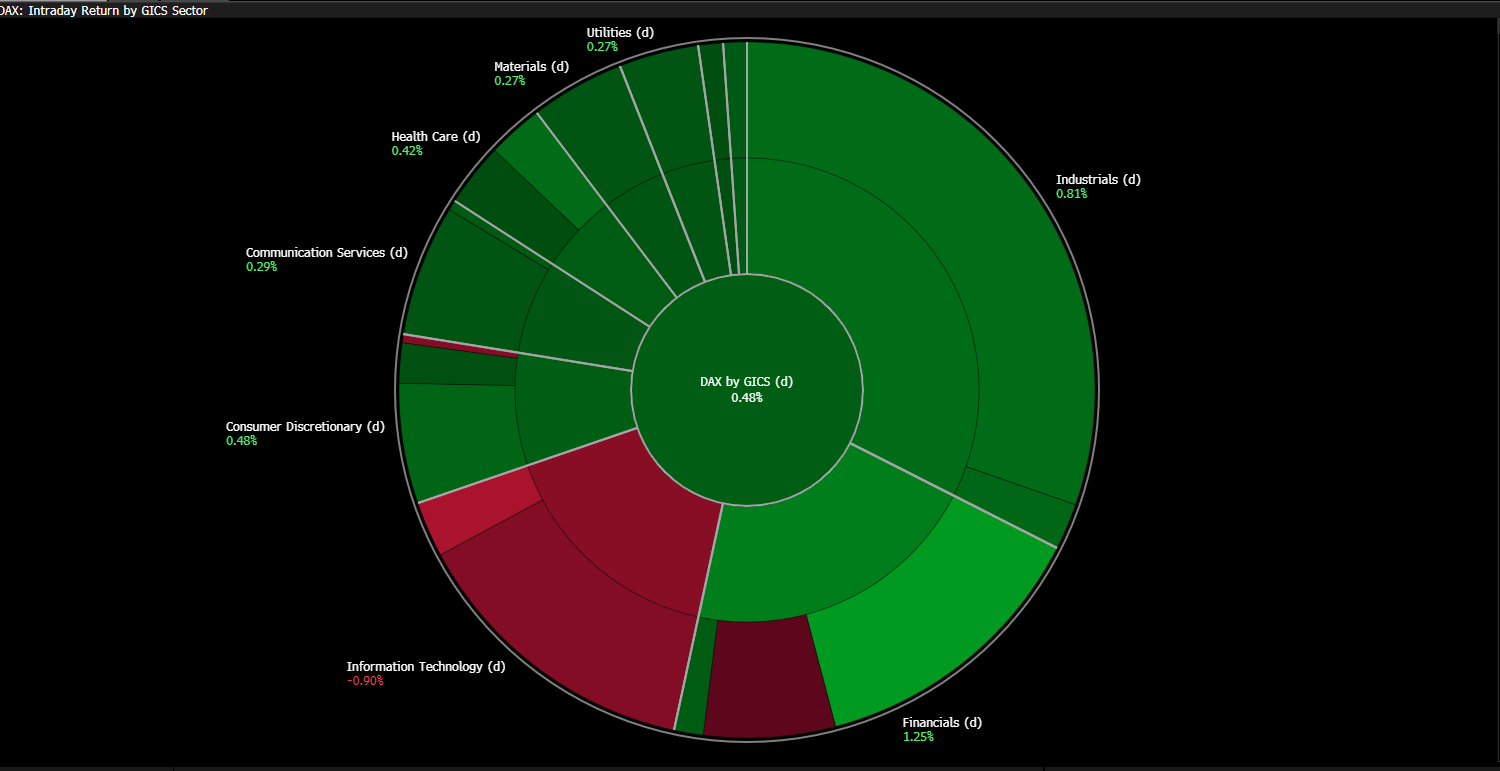

Source: Bloomberg Finance LP

In Germany itself, the DAX index is supported today primarily by the financial sector and industrial companies, which benefit from improved sentiment in the broader market. On the negative side, the technology sector stands out, weighing down the index and limiting its growth potential.

Macroeconomic data:

A positive highlight for European markets turned out to be the latest data from Spain. GDP for the last quarter grew more than economists had expected, supporting the narrative of the eurozone economy's resilience despite global trade tensions.

- GDP (q/q) (Q2): 0.8% (forecast 0.7%; previously 0.6%)

- GDP (y/y): 3.1% (forecast 2.8%; previously 2.8%)

However, investors remain cautious, waiting for afternoon publications from across the ocean. Key will be the PCE inflation data – the Federal Reserve's favorite measure. The reading may provide clues about the future path of interest rates. The market's attention will also be drawn to consumer sentiment readings and inflation expectations from the University of Michigan, which may confirm or undermine the strength of US domestic demand.

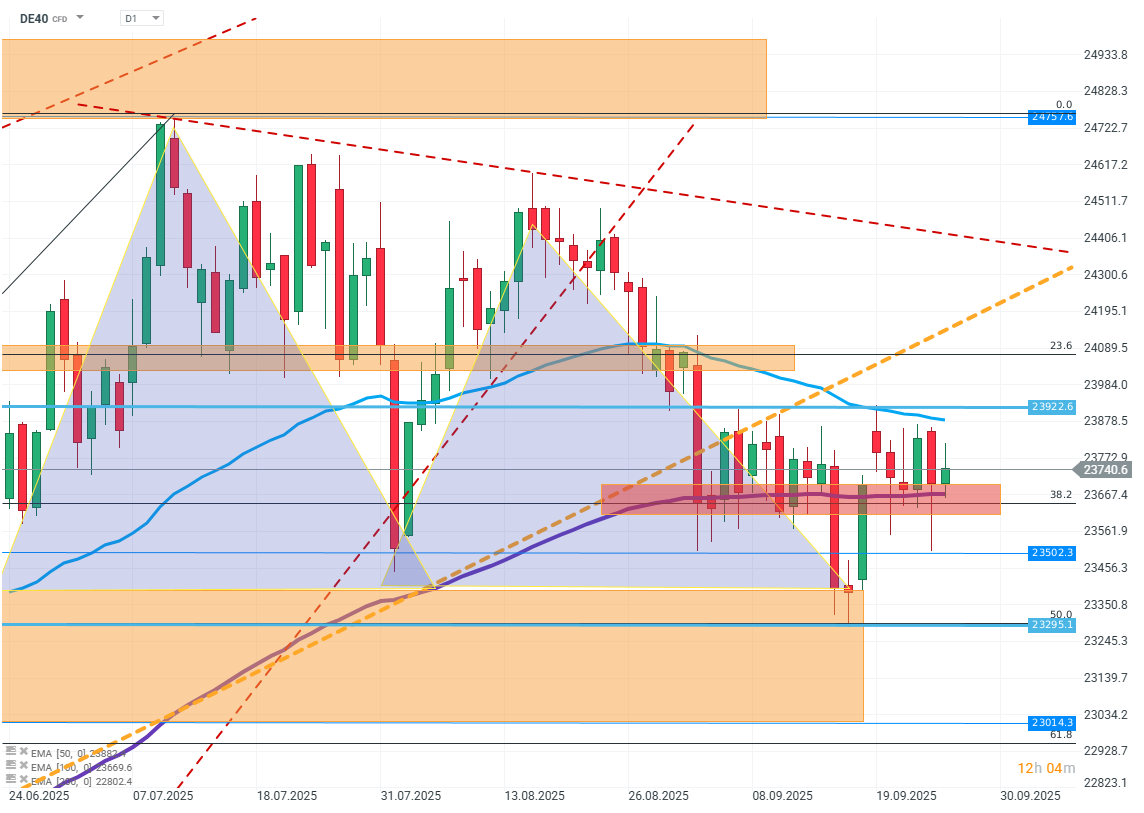

DE40(D1)

Source: xStation5

The chart shows that the realization of the RGR pattern is becoming increasingly unlikely. The price bounced off the neckline, which weakened the downward potential and halted further supply pressure. An additional technical support remains the EMA100 average, which stabilizes the quotations and strengthens the defensive barrier for buyers.

The baseline scenario for the next sessions seems to be entering a consolidation phase. Its probable range is determined by FIBO retracement levels from 23.6 to 50. Only breaking one of these limits may provide a stronger directional signal.

Company news:

Alten (ATE.FR) — The French company published results that exceeded expectations for operating profit. Shares are up 1.8% at the opening.

Volkswagen (VOW1.DE) — The German automotive giant is halting production at one of its electric car factories. The stock is down 2%.

Daimler (DTH.FE) — The truck manufacturer is down more than 5% following the announcement of new US tariffs affecting trucks.

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

Crypto up 4 % despite tension📈

US Open: Oil too expensive for Wall Street!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.