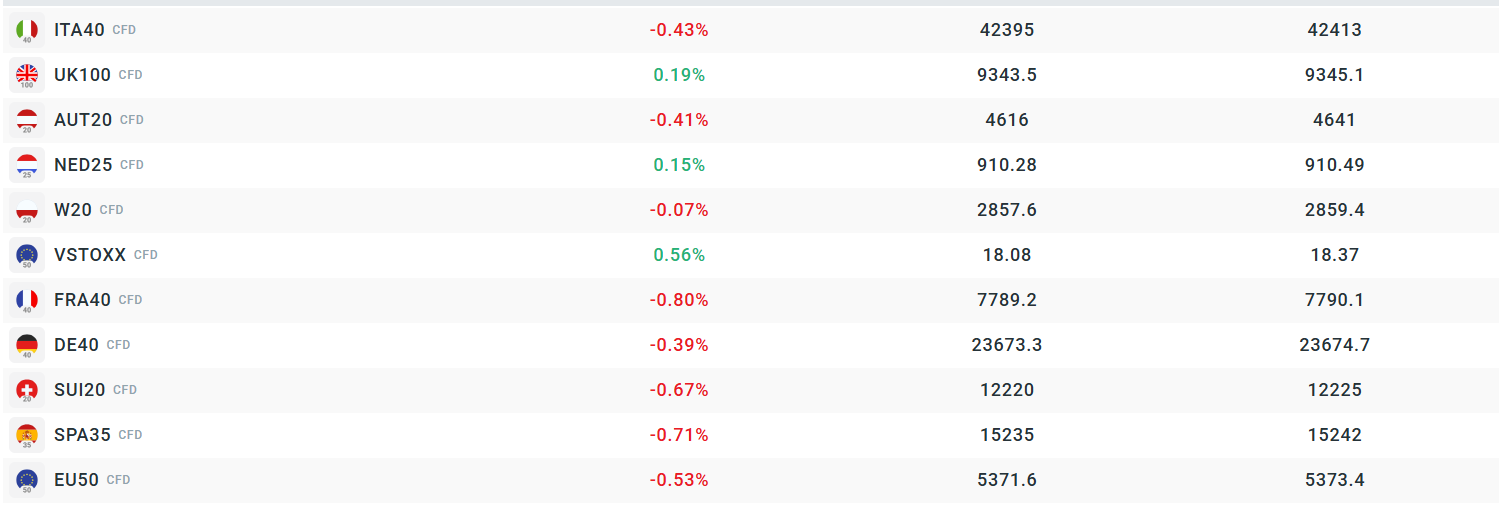

European financial markets are experiencing a wave of pessimism today. Futures on the DE40 index are down more than 0.4%, while the EU50 is declining by over 0.8%. FRA40 and ITA40 futures are also underperforming, with losses of approximately 0.9% and 0.8%, respectively. The market is reacting to today’s inflation reading from Germany and anticipation ahead of the U.S. Federal Reserve's interest rate decision.

German data show consumer inflation (CPI) rose by 2.2% year-over-year, in line with forecasts, and by 0.1% month-over-month, also matching expectations. The harmonized index of consumer prices (HICP) increased by 2.1% y/y and 0.1% m/m. Although inflation remains stable, investors may fear that further price increases could influence the European Central Bank’s monetary policy decisions.

In the context of monetary policy expectations, investors are eagerly awaiting the U.S. Federal Reserve’s decision regarding interest rates. The Fed is expected to move towards further monetary easing, which could impact global financial markets.

Source: xStation5

Volatility Observed Across the Broader European Market

Source: xStation

The German DE40 index is down 0.4% during today’s session and is trading very close to a support level defined by the 100-day exponential moving average (orange curve on the chart). This area acts as a technical support, helping to limit further downside. However, market sentiment remains cautious, as the upcoming Federal Reserve decision next week may significantly impact global market sentiment, including European indices.

Source: xStation

Company News:

-

Hannover Re (HNR.DE) is up nearly 3% today after UBS upgraded the stock from “neutral” to “buy,” highlighting the company’s strong financial resilience. Analysts note that the firm is trading at a 6% discount relative to the sector despite stable earnings growth and solid performance. The company may benefit from investor expectations of a potential market slowdown, as its defensive profile makes it a relatively safe pick in the sector. UBS set a new price target of €280, implying around 16% upside from current levels.

-

Stellantis (STLAM.IT) is down around 1.7% after UBS lowered its forecasts for the company, pointing to a delayed recovery in financial performance. Analysts highlight ongoing challenges such as high costs, weak demand, and strong competition from Chinese manufacturers.

-

BAE Systems (BSP.DE) is up about 1% amid rising demand for weapons and military equipment. Increased defense spending in Europe and ongoing geopolitical tensions are contributing to positive expectations for the company, which is one of the world’s largest defense technology providers.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.