Financial markets are clearly in a wait-and-see mode today, awaiting the outcome of talks between US Special Envoy Steven Witkoff and Vladimir Putin, with any rumours of progress in the negotiations quickly translating into movements in the euro, European indices and the industrial and defence sector. Investors are discounting the growing likelihood of even a framework agreement or a lasting ceasefire, treating it as a potential game-changer for risk premiums in Europe.

At the same time, the very fact that the market is increasingly pricing in a more optimistic resolution to the conflict is acting as a brake on the share prices of European defence companies. After months in which the defence sector benefited from record orders and increased security spending, the recent wave of headlines about peace plans has triggered profit-taking and a correction in industry indices, even though there is still no sign of a lasting breakthrough on the battlefield.

What can we expect from today's talks?

Two possible paths can be considered. Firstly, Putin may take a stand against President Donald Trump's peace plan. The immediate market reaction would be the opposite of what we saw last week, i.e. a rebound in the euro, frontline currencies, including the Polish zloty, and growth in the broader European market, with the exception of raw materials, industrial and defence companies. Alternatively, Putin could signal his willingness to negotiate. At first glance, this is positive news, but not necessarily. Putin has an incentive to enter into talks without immediately agreeing to the terms of the agreement. Given that Ukraine has already shown a willingness to enter into talks, Russia has an interest in dragging out the negotiations in order to obtain greater concessions.

Let us also remember that even the 30-day partial ceasefire agreement reached in March was broken almost immediately. Therefore, even a peace agreement agreed upon by all parties may not survive the final test.

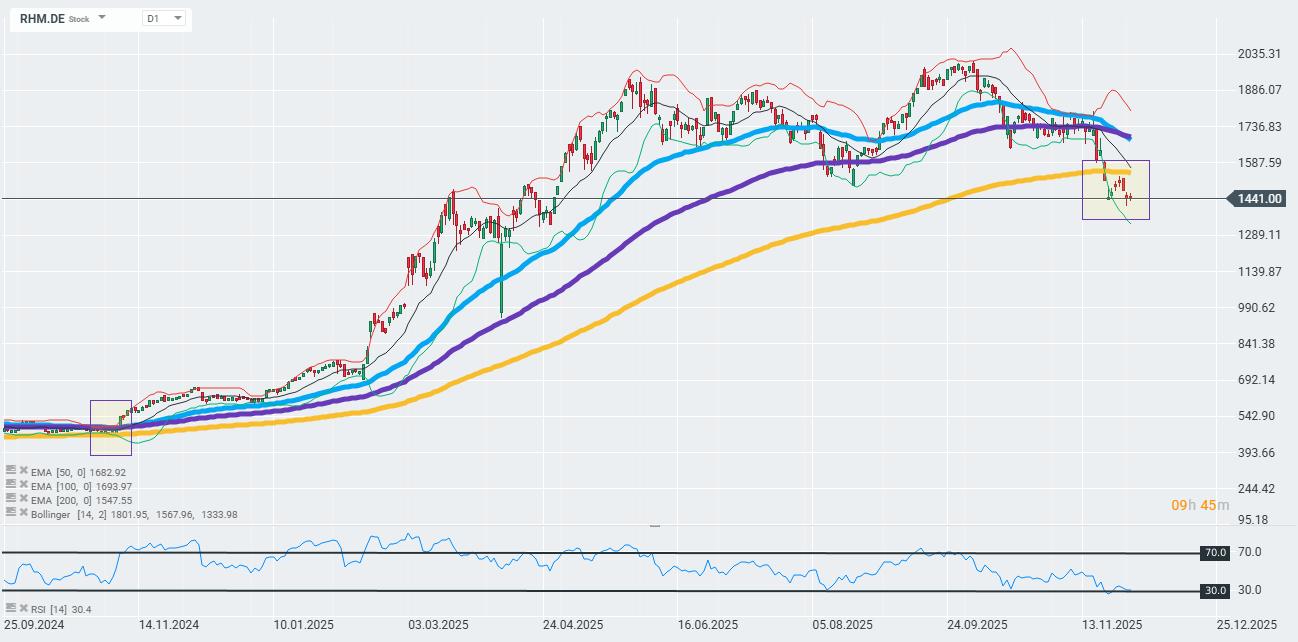

Shares in German defence giant Rheinmetall (RHM.DE) are losing ground during today's session and remain below the 200-day exponential moving average (gold curve on the chart). Interestingly, this technical level has not been tested by the market since November 2024. Source: xStation

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.