Summary:

-

Semi-important readings from the US and Europe to be released in the afternoon

-

BoE Deputy Governor to speak in the evening

-

Central banks in the spotlight during the week

As usual Monday’s calendar is quite empty. In the afternoon investors will be offered two semi-important readings, one from the US and one from Europe. Existing home sales in the US are expected to move from 5.43 million in May to 5.45 million in June. When it comes to Europe preliminary consumer confidence reading is scheduled for release and it is forecasted to slide from -0.5 pts in June to -0.7 pts in July. Both readings will be published at 3:00 pm BST. Apart from that, GBP traders may want to stay on guard at 6:00 pm BST as Bank of England Deputy Governor Ben Broadbent will speak to the Society of Professional Economists in London.

Events to watch for the remainder of the week:

Even as trade tensions are unlikely to move away, investors’ focus will be particularly on monetary policy in the upcoming week. The Central Bank of Republic of Turkey will have another chance to save the lira from slumping further while the European Central Bank may make use of recent macroeconomic releases to put them in the context of a possible rate hike next year. Apart from that, traders will be offered a preliminary second quarter GDP reading from the US.

CBRT decision (Tuesday, 12:00 pm BST)

The Turkish lira has depreciated greatly over the recent few years. This downtrend on TRY market has accelerated after some unorthodox monetary policy comments from the President Erdogan as well as developments in domestic politics (i.e. the Erdogan’s son-in-law appointment to the post of economy minister). The emergency rate hike delivered by CBRT in May had halted the decline only for a while and a few days ago we saw TRY reaching new all-time-lows. The CBRT is anticipated to deliver a 100 bp rate hike during the upcoming meeting. However, this may not be enough to terminate the Turkish currency slide once and for all. Affected markets: EURTRY, USDTRY.

PMIs from Europe and ECB decision (Tuesday, 9:00 am BST and Thursday, 12:45 pm BST)

The latest ECB meeting brought a long-awaited announcement of the end of the QE programme. The programme will be phased out in the fourth quarter and terminated at the end of the year. Moreover, the central bankers announced that the rate hike would be data-dependant and would not take place until summer of the next year. Having said that, PMI readings scheduled two days ahead of the ECB meeting will be closely watched by investors to see whether they confirm another expected decline or not. Affected markets: DE30, EURUSD.

US Q2 GDP (Friday, 1:30 pm BST)

The US economy disappointed a bit in the first quarter of the year as it grew at the slower-than-expected pace. However, the median estimate as well as recent remarks from some of the US officials indicate that economic growth in the second quarter could have reached 4% on a quarter-over-quarter basis. If this scenario materializes it would mean that the US economy accelerated to the levels not seen since the third quarter of 2014. It would also enhance the Federal Reserve stance that the economy is strong and the gradual tightening might be proper. Affected markets: TNOTE, US500.

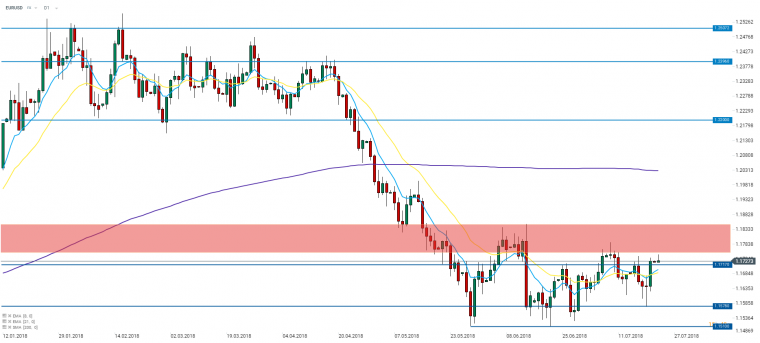

EURUSD has been locked in the consolidation ranging from 1.1510 to 1.1760 for the past two months. The pair is trading a notch below the resistance zone (1.1760-1.1850) at press time and hawkish ECB on Thursday may provide the pair with the long-awaited break higher. Source: xStation5

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.