Summary:

-

Canadian wholesale sales reading will take the stage in the early afternoon

-

Hungarian monetary authorities to make their interest rate decision today

-

API data expected to show a moderate decline

Taking a look at Tuesday’s economic calendar one can see that not many data releases have been scheduled. The Canadian wholesale sales reading may spur some additional volatility on the CAD tied FX pairs but the occurrence of any majors moves is rather unlikely. As it is the case on Tuesdays oil traders will be offered a weekly API oil stocks reading. Apart from that, the Hungarian central bank is scheduled to make its interest rate decision at 1:00 pm BST but the markets expect that it will leave the main interest rate unchanged at 0.9%. Last but not least, we remind you that the Festival of Sacrifice is taking place this week therefore stock exchanges in most Islamic countries will remain shut for the remainder of the week.

1:30 pm BST - Canada, Wholesale Sales for June. The last week’s CPI reading has shown a significant acceleration to the pace of 3% YoY. However, the core gauges barely moved therefore one may suspect that it could result from increases in prices of some volatile goods. Nevertheless, such a reading brought the Canadian price growth to the upper bound of the BoC target and may encourage central bankers to continue with monetary tightening. Today’s wholesale sales reading may hint at the strength of the demand in the economy. It is expected to show a 0.7% MoM advance against last month’s 1.2% increase.

9:40 pm BST - US, API weekly crude oil stocks. The oil prices have been moving in the stable downtrend since the peak at the turn of July and August. However, we have seen an undisrupted advance in the past couple of days. The API reading may spur some additional volatility but it is more likely that tomorrow’s DOE report will produce wilder swings. Nevertheless, today’s stocks reading may be used by some investors as an updated consensus. The market consensus expects a 1 million barrel decrease in the oil stockpiles.

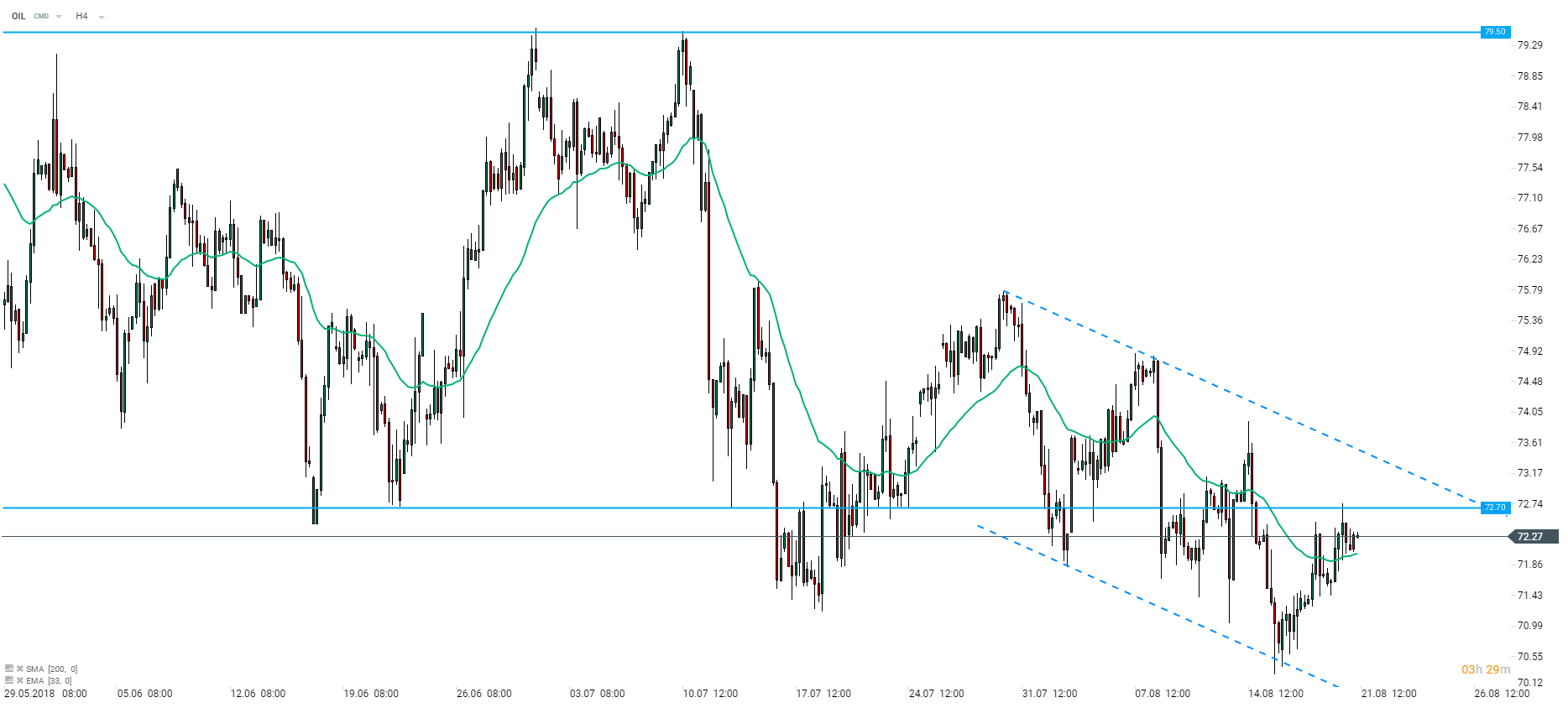

OIL price have fallen into the short-term downward price channel recently. Commodity bulls failed to break above the $72.70 handle yesterday but today’s data may allow them to perform another attack on this area. Source: xStation5

OIL price have fallen into the short-term downward price channel recently. Commodity bulls failed to break above the $72.70 handle yesterday but today’s data may allow them to perform another attack on this area. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.