- Gas prices in Europe and Asia are extremely high

- The energy crisis can provoke reactions throughout the whole global market

- Increased demand in Europe and Asia will cause a greater deficit in other markets

- Higher energy prices point to the prospects of high and rising inflation (not temporary as indicated by central banks)

The genesis of the current energy crisis should be sought in previous years in policies aimed at reducing huge emissions of carbon dioxide into the atmosphere. The world wanted to withdraw from the use of coal and looked towards low-emission energy sources such as gas or renewable energy sources. To all this, we add Brexit, which has a huge impact on the current crazy situation in Great Britain, the economic slowdown caused by the coronavirus, which led to only a temporary reduction in the demand for energy resources, and the key and least predictable factor - the weather.

Harsh winter

The previous winter led to a decline of the inventories levels of gas and other raw materials used for heat production, to the lowest levels in years. The coronavirus has led to a reduction in economic activity in many sectors, which has led to a reduction in the demand for energy production and thus reduced the flow of raw materials around the world. Therefore, gas and coal reserves in Europe or Asia, during the period of increased activity, did not manage to rebuild.

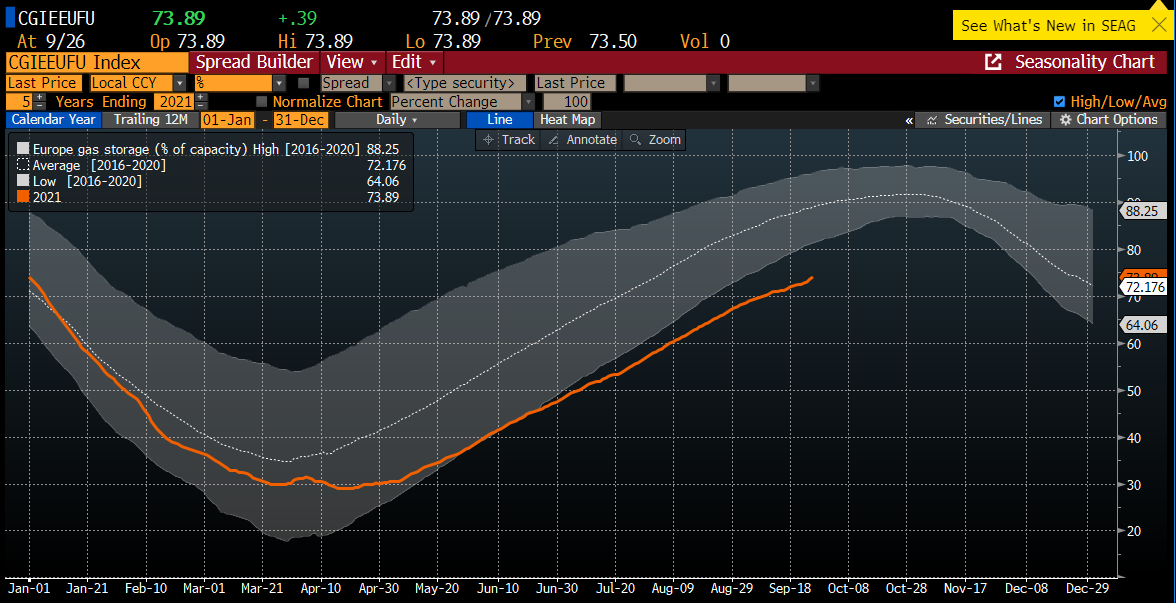

Gas storage utilization in Europe currently stands at only 74% with a 5-year average of 89%. According to the EIA, if the coming winter will be harsh, then some areas may face commodities shortages. This is currently the case in Great Britain, where inventories are depleted and the demand continues to increase. Source: Bloomberg

Gas storage utilization in Europe currently stands at only 74% with a 5-year average of 89%. According to the EIA, if the coming winter will be harsh, then some areas may face commodities shortages. This is currently the case in Great Britain, where inventories are depleted and the demand continues to increase. Source: Bloomberg

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Climate policy

The strong drive to reduce carbon dioxide emissions, mainly in Europe, but also increasingly seen in Asia, has led to a bias towards renewable energy production. Rising prices of carbon dioxide emission permits led to the abandonment of coal in favor of gas and renewable energy sources. Renewable sources, however, are dependent on the weather - there is no wind in the UK, while in Norway the low water level has led to an increased demand for conventional energy sources. Thus, the prices of not only gas, which currently is scarce on the market (due to earlier consumption and supply problems), are rising, but also coal. High energy prices are the result of the spiral related to the prices of emission permits and high prices of energy commodities.

Over the past months, the prices of energy commodities have increased by as much as several hundred percent. This is the effect of shortages, artificially limiting supply, but most of all, of dynamically rebounding demand. Energy prices will affect virtually every aspect of the economy. Source: Bloomberg

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

What does this mean for the financial markets?

Of course, it will largely depend on the weather forecast and the weather itself. Nevertheless, rising energy prices are pushing up bond yields. This is the effect of the expectation of higher inflation in connection with the constantly rising prices, but also the withdrawal of funds from bonds investments in favor of strongly rising commodity prices.

The correlation between the price of oil and bond yields peaked since October 2020. High oil prices reflect expectations of high inflation, the prospect of higher rates and a reduction in the attractiveness of government bonds. Source: Bloomberg

The correlation between the price of oil and bond yields peaked since October 2020. High oil prices reflect expectations of high inflation, the prospect of higher rates and a reduction in the attractiveness of government bonds. Source: Bloomberg

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

High energy prices increase inflation expectations which lead to higher bond yields. This, in turn, has a huge impact on the dollar (upward prospects), gold (downward prospects) and equities, especially technology (rather downward prospects).

Rising bond yields (declining TNOTE prices - blue chart) are bad news for gold, but also for technology companies. Gold is trading at its lowest since early August, while Nasdaq (US100) broke below 15,000 points. Source: xStation5

Rising bond yields (declining TNOTE prices - blue chart) are bad news for gold, but also for technology companies. Gold is trading at its lowest since early August, while Nasdaq (US100) broke below 15,000 points. Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

The energy crisis may push up oil prices even higher. The current situation is beginning to resemble 2010 and the second wave of growth in the oil market after the financial crisis. However, a lot may depend on the weather. Harsh winter also means increasing the demand for heating oil. The nearest strong resistance zone is located around $ 87-89 per barrel. The support is located at$ 70 and coincides with the lower limit of the ascending channel. Source: xStation5

The energy crisis may push up oil prices even higher. The current situation is beginning to resemble 2010 and the second wave of growth in the oil market after the financial crisis. However, a lot may depend on the weather. Harsh winter also means increasing the demand for heating oil. The nearest strong resistance zone is located around $ 87-89 per barrel. The support is located at$ 70 and coincides with the lower limit of the ascending channel. Source: xStation5

Please be aware that the presented data refers to the past performance data and as such is not a reliable indicator of future performance.

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Politics batter the UK bond market once more, as Starmer remains under pressure

NATGAS slides 6% on shifting weather forecasts

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.