Summary:

-

Large gains seen in energy markets

-

Oil and WTI both rally around 3% from recent lows

-

NATGAS +12% as prices soar

After a prolonged period of declines it seems like longs in the oil markets are finally getting some respite today with strong gains seen across the energy complex. We earlier focused on these markets in our latest market alert (view here) which looked at the recent declines and asked whether the sell-off was overdone. There’s been an impressive bounce seen in both Oil and Oil.WTI today but their thunder has been stolen somewhat by NATGAS which has spiked higher by an incredible 12%!

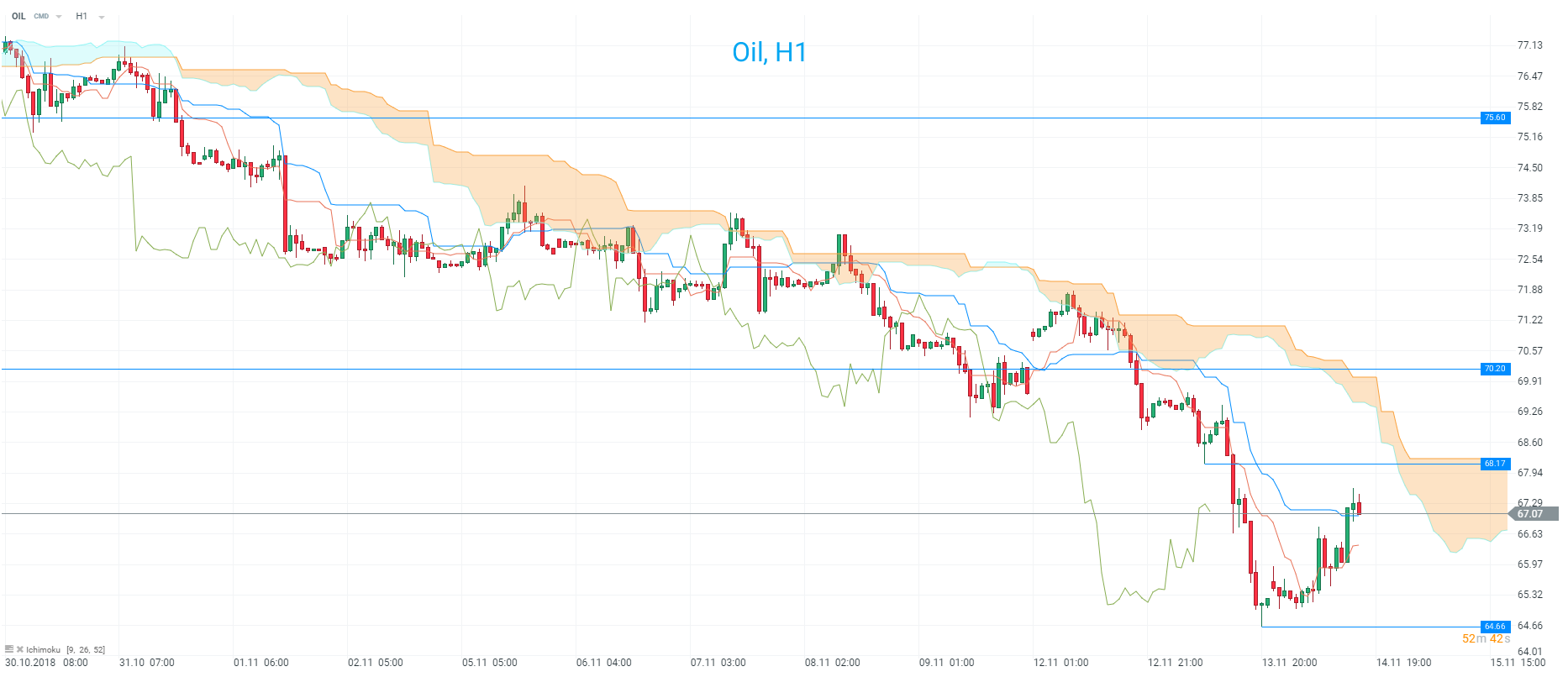

After a prolonged slump in the price of crude both Oil and Oil.WTI are rallying strongly today although the gains pale in comparison to those seen in NATGAS. Source: xStation

Tuesday actually marked the worst single-day decline for oil prices since July which added to the volatility of a week which has been dominated by fears of a slowdown in global demand. The catalyst for this bounce was comments from OPEC this morning with the cartel reportedly willing to reduce supply further. Price has clearly fallen into the threshold where OPEC are taking note and should the market fail to recover sufficiently then expect further jawboning in the coming weeks ahead of the group’s meeting in early December.

Even after today’s large bounce the market remains in a downtrend and is still clearly below the H1 Ichimoku cloud. Source: xStation

While Oil prices have been tumbling recently the same can’t be said for that of Natgas, with today’s rally coming after several days of gains. The market has surged strongly higher after the latest cold weather forecasts, which have raised fears that the US is heading for a potentially colder-than-expected winter with too little gas supply. Today’s spike appears to be a possible capitulation to the upside after a strong recent rally with price gaining around 40% to the peak in just over a week.

NATGAS has taken off today with the price surging strongly higher to a peak of 4.85 - higher by around 40% in the past week alone. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.