Summary:

-

Euro rises as Draghi speaks in Brussels; TRY gains on talk of Pastor release

-

Draghi: “domestic price pressures are rising”

-

EURUSD at 3-month high above 1.18; DE30 and Bund drop lower

There’s been a notable rise in the Euro in the past hour, with the single currency gaining across the board after some hawkish comments from Mario Draghi. The ECB president was speaking in Brussels, as the Italian testified on the economy and monetary policy and his remarks seem to have caused a bit of a reaction in the markets with not only the currency rising but also the German Dax (DE30 on xStation) and 10-year government bond (Bund10Y on xStation) falling lower.

The EURUSD rallied from around 1.1755 to a high of 1.1815 in less than 30 minutes from Draghi’s statement being released. The DE30 (overlaid with blue and transparent candles) fell on these hawkish remarks to trade near its lowest level of the day. Note the DE30 axis is inverted. Source: xStation

The EURUSD rallied from around 1.1755 to a high of 1.1815 in less than 30 minutes from Draghi’s statement being released. The DE30 (overlaid with blue and transparent candles) fell on these hawkish remarks to trade near its lowest level of the day. Note the DE30 axis is inverted. Source: xStation

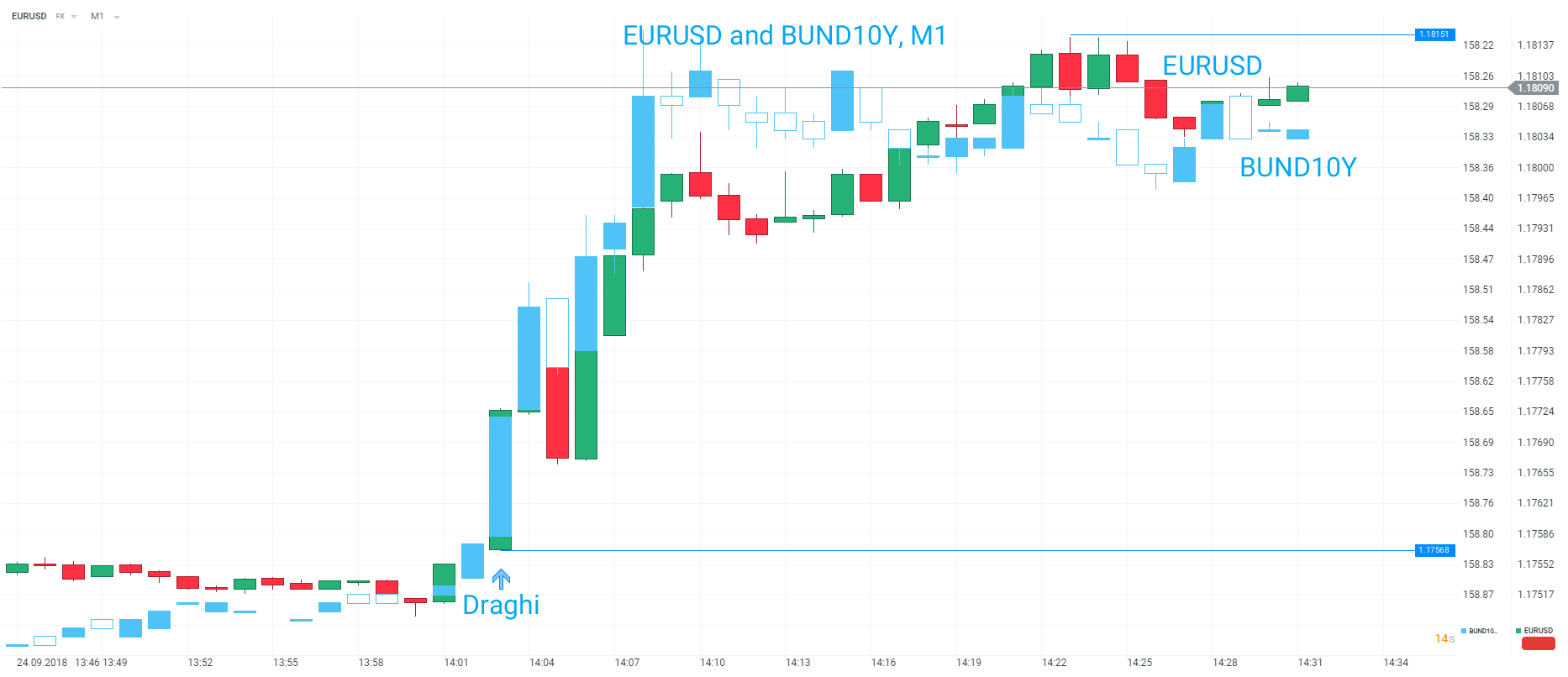

It’s a similar picture if we overlay the Bund10Y and invert the axis with the EURUSD rallying as the Bund10Y falls on the hawkish remarks. Source: xStation

Selected comments from Draghi are as follows:

-

Domestic price pressures are rising

-

Labour markets are tightening, shortages in some areas

-

Pick-up in wage growth will continue

-

Relatively vigorous pickup in underlying inflation

These are some pretty strong remarks from Draghi, and while expectations for a rate hike anytime soon remain very low, the odds of an October 2019 and a second hike in December 2019 have crept up following the statement.

Another factor which could be helping the Euro also today is the strong move high seen in the Turkish Lira with USDTRY down by more than 2%. The gains come after hopes have risen that the US Pastor Andrew Brunson, may be released as soon as next month. It was this diplomatic situation which tipped the Lira over the edge during August and saw the currency crash around 20% in a single day. Any further positive developments on this front could further support the Lira after the larger than expected recent hike from the CBRT and see some of the large losses in recent months recouped; the aversion of any further worsening of the currency crisis in Turkey would also be positive for the Euro.

The longer term picture for the EURUSD remains potentially constructive with price today hitting a 3-month high. Price breached a possible neckline of a inverted head and shoulders last week around 1.1700 but some may see the 1.1850 region as still representing possible resistance - and potentially a neckline in an inverted S-H-S - and unless price clears this then the upside is limited. Source: xStation

The longer term picture for the EURUSD remains potentially constructive with price today hitting a 3-month high. Price breached a possible neckline of a inverted head and shoulders last week around 1.1700 but some may see the 1.1850 region as still representing possible resistance - and potentially a neckline in an inverted S-H-S - and unless price clears this then the upside is limited. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.