Summary:

-

Italy bows to pressure from the EU and cuts its budget deficits for next years

-

Fed’s Powell doubts the low unemployment rate will spur a takeoff in prices forcing him to hike rates aggressively

The euro jumped during early European trading following the news that the Italian government is likely to cut its budget deficit targets for 2020 and 2021 bowing to pressure from the European Union. A Corriere della Sera report, citing a Cabinet meeting, stressed that while the deficit for 2019 will be remained at 2.4% of GDP, the targets for the next two years will be slashed to 2.2% and 2% respectively. These revelation were already confirmed by the League Party. In a knee-jerk reaction the shared currency rose as much as 0.4% approaching 1.16. Let us remind that in its initial budget outlined last week Deputy Prime Minister Luigi di Maio had stressed that the government would stick to its plan to a 2.4% deficit through 2021 in order to fund election pledges to cut taxes. Notice that in nominal terms Italy has the largest public debt in the European Union hence strict fiscal policy seems to be necessary to reduce this burden going forward.

Italy has the largest public debt among EU countries measured in nominal terms. Source: Bloomberg

Even as this year’s deficit is likely to stay unchanged at 2.4% the projected cuts for the next two years could bring relief to the Italian bond market. The 10Y yield shot up above 3.45% earlier this week reaching its highest level since the first quarter of 2014. Therefore, one may expect that today’s session will buoy debt prices all along the curve lowering a risk premium and thereby supporting the common currency. Although this is undoubtedly positive news for the European currency it appears to be unlikely that it could benefit from it for long time. Italy will remain a source of risks in the European Union - this is a highly probable assumption. Looking for any more important drivers for the euro one needs to keep a close eye on price developments (the latest wage data has been really encouraging and it is likely that this upbeat trend will be continued). On top of that we cannot forget about what is happening with the US dollar as it plays a crucial role as well. Given that we still expect the US currency to weaken in the medium-term, it should also buttress the euro.

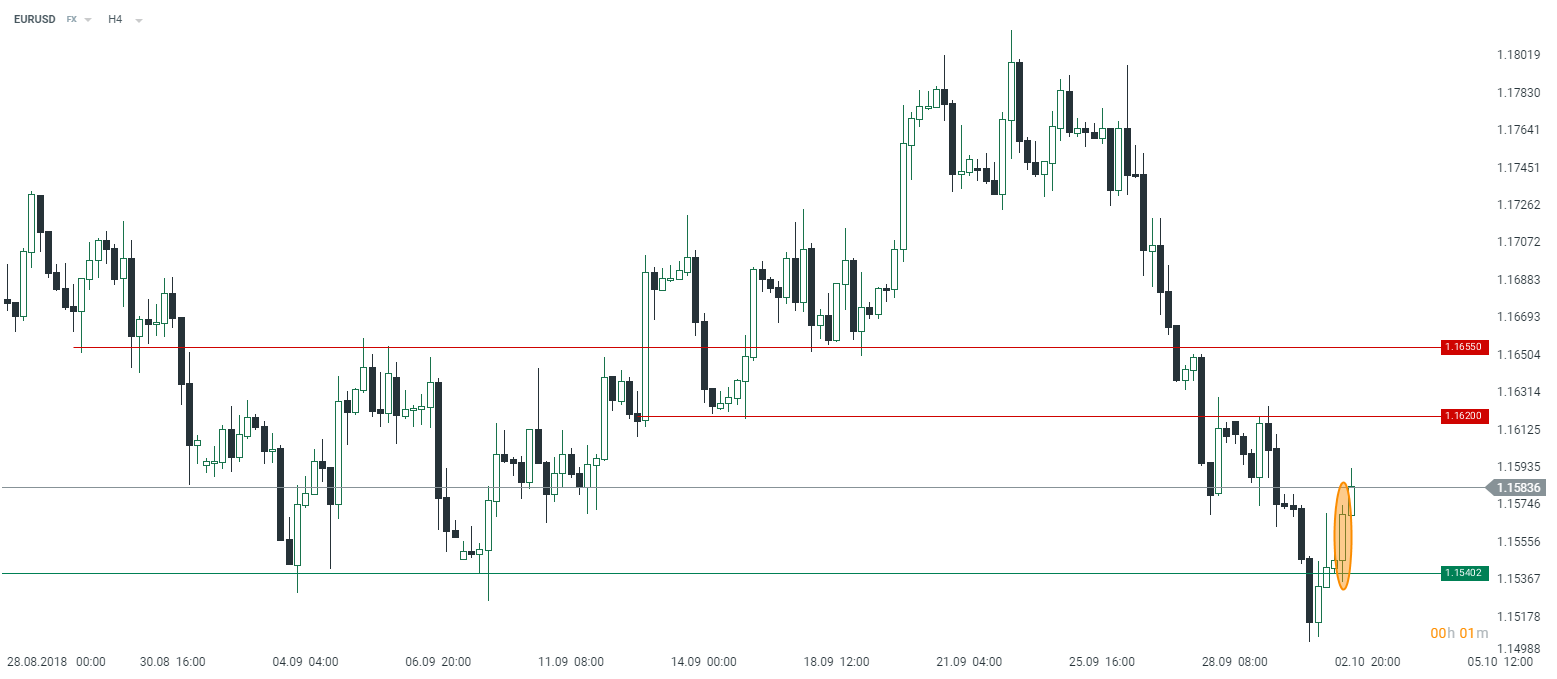

The EURUSD jumped immediately after the news on the Italian budget hit the wires. The pair bounced off 1.1540 and from a technical point of view it could keep on rising toward 1.1620 followed by 1.1655. Source: xStation5

The EURUSD jumped immediately after the news on the Italian budget hit the wires. The pair bounced off 1.1540 and from a technical point of view it could keep on rising toward 1.1620 followed by 1.1655. Source: xStation5

In the morning the US dollar index is trading roughly 0.2% lower reflecting in part the stronger euro. It is also worth mentioning a speech delivered by the Federal Reserve Chair Jerome Powell on Tuesday. Although he welcomed recent increases in wage growth he also voiced doubts that the low unemployment will spur a takeoff in prices forcing him to lift rates more aggressively. During his speech in Boston he also said that “this historically rare pairing of steady low inflation and very low unemployment is testament to the fact that we remain in extraordinary times”. Writing about inflation one needs to mention the yesterday decision of Amazon which decided to raise minimum wage for workers in the US to $15 an hour effective 1 November. This rise will be applied to over 350,000 full-time and seasonal workers. Let us recall that the company already increased a minimum wage for new workers to $12 an hour in September signalling this rate should rise further to $15 by 2020.

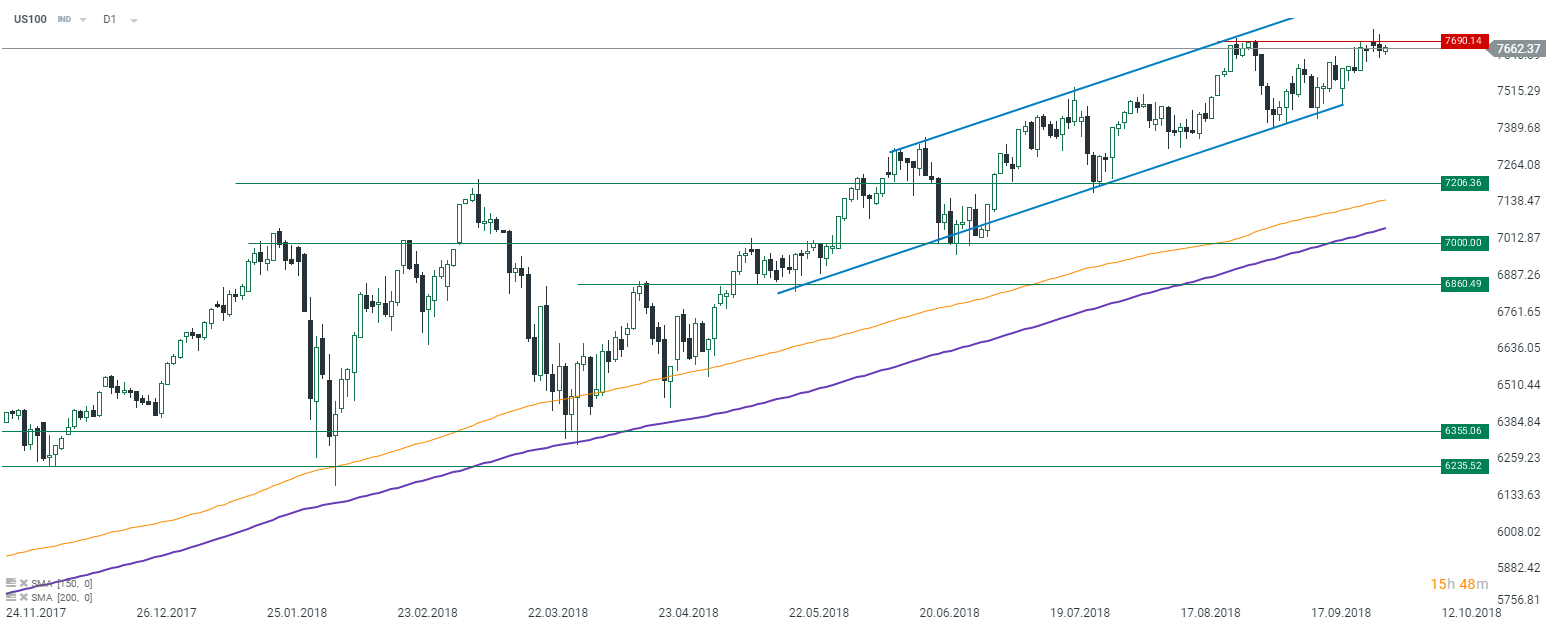

The NASDAQ (US100) struggled yesterday to break 7690 points but failed to do so closing almost 0.5% lower on the day. Until the index is unable to break this resistance one may suspect the price could move lower toward the lower upper of the channel. Source: xStation5

In the other news:

-

Japanese NIKKEI (JAP225) closes 0.65% lower while the the Hang Seng is barely changed

-

US 10Y yield trades a notch below 3.08%, German 10Y bund jumps 4 bps, Italian benchmark falls 11 bps in response to the Italian budget news

-

Australian building permits for August declined 13.6% YoY

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.