European stock market indices are rallying today with all major benchmarks trading over 1% higher. UK FTSE 100 (UK100) is top performer with a 2% gain. German DAX and French CAC40 (FRA40) add 1.3% each while Spanish IBEX (SPA35) is a laggard with 0.8% gain. Meanwhile, EUR is taking a hit but the move is driven mostly by USD strength. There was no major news that could justify a strong upward move after the launch of the cash trading session. It looks like expectations of a significant slowdown in German inflation are driving equity markets higher, as it could allow the ECB to ease its hawkish stance. State-level readings from Bavaria, Brandenburg, Hesse and North-Rhine Westphalia all showed a significant deceleration in December with scale of drop suggesting that 9.1% median estimate for German release at 1:00 pm GMT is conservative and a downside surprise may be on the cards.

German state-level CPI readings for December

- North Rhine Westphalia: 8.7% YoY vs 10.4% YoY previously

- Bavaria: 9.2% YoY vs 10.9% YoY previously

- Brandenburg: 9.1% YoY vs 10.5% YoY previously

- Hesse: 8.1% YoY vs 9.7% YoY previously

- Saxony: 8.7% YoY vs 9.9% YoY previously

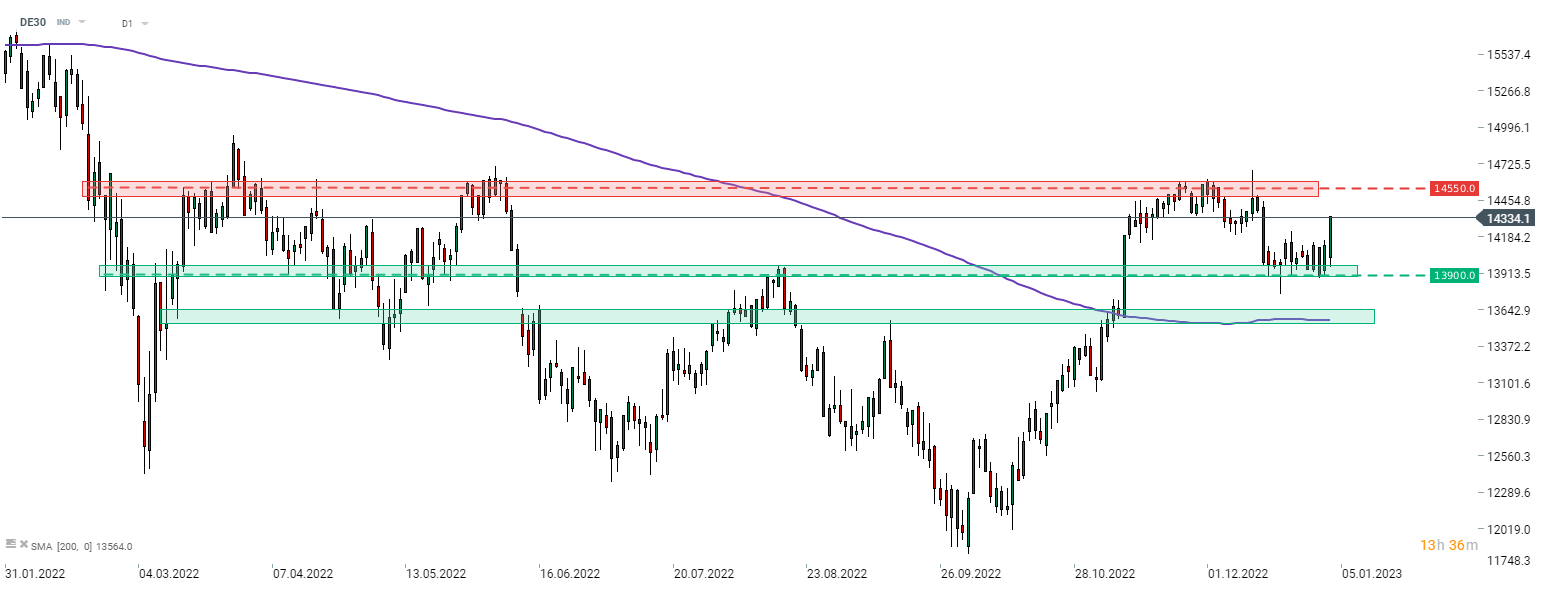

German DAX is rallying today with lower CPI readings from Germany helping support sentiment. DE30 bounced off the 13,900 pts support zone and is now looking towards a test of the 14,550 pts resistance zone, marked with recent highs as well as previous price reactions. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.