- Today at 7:00 PM GMT, the Federal Reserve is scheduled to announce its interest rate decision.

- The market widely anticipates a 25 basis point rate cut.

- Crucially, the Fed will also release its latest macroeconomic projections, which may exert a greater influence on the market than the rate decision itself.

- At 7:30 PM GMT, Chairman Jerome Powell will commence the post-decision press conference.

- Today at 7:00 PM GMT, the Federal Reserve is scheduled to announce its interest rate decision.

- The market widely anticipates a 25 basis point rate cut.

- Crucially, the Fed will also release its latest macroeconomic projections, which may exert a greater influence on the market than the rate decision itself.

- At 7:30 PM GMT, Chairman Jerome Powell will commence the post-decision press conference.

Fed Rate Cut Anticipated

Economists and market participants are in consensus that the Fed will opt for a 25 basis point rate cut today. This would mark the third consecutive reduction, lowering the main policy rate to the 3.5-3.75% range. High confidence regarding today's cut has prevailed for some time, despite Powell mentioning a divergence of views among FOMC members during the October meeting, which was partly attributed to the lack of available data. Although the US government shutdown ended in early November, key economic figures, including NFP, CPI, and GDP, will only be published in the second half of December.

Nevertheless, other available mixed data provides sufficient justification for the Fed to implement another rate cut. The crucial element will be whether the Fed alters its forward guidance regarding subsequent policy moves.

Another important factor is the composition of the vote. During the last meeting, there were two dissenting votes: Schmidt voted to hold rates and Miran advocated for a 50 basis point cut. Some market observers suggest more votes in favor of holding rates may emerge, which could theoretically be perceived positively by the dollar. Conversely, future expectations and forthcoming changes within the Fed next year should be considered. Miran has indicated he plans to vote for a 25 basis point reduction to align with the majority, potentially suggesting that more hawkish votes for an unchanged policy might indeed appear.

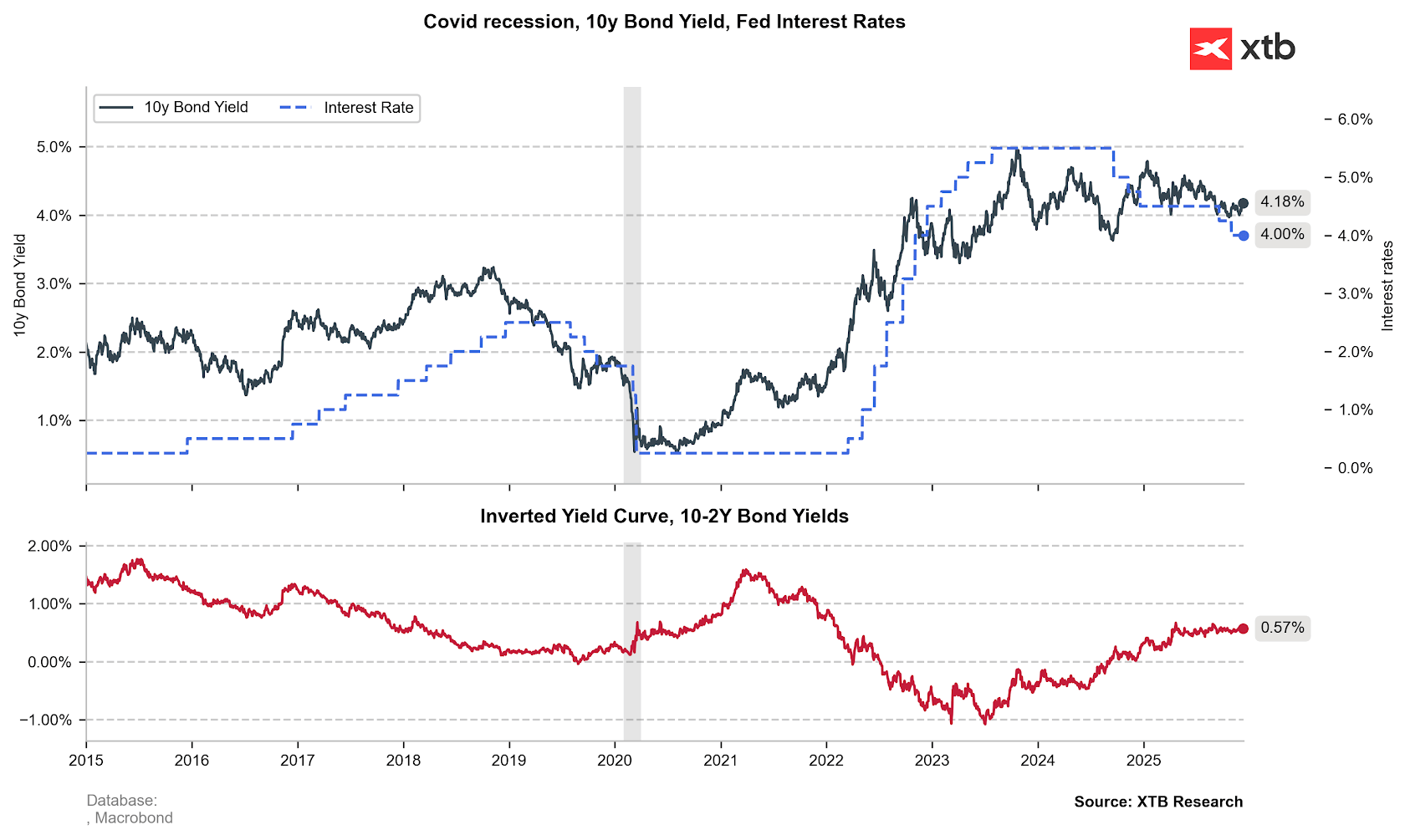

The Fed is expected to cut rates, yet 10-year Treasury yields remain at relatively elevated levels. The spread between 10- and 2-year bonds has remained stable throughout almost all of 2025. Source: Bloomberg Finance LP, XTB

The Fed is expected to cut rates, yet 10-year Treasury yields remain at relatively elevated levels. The spread between 10- and 2-year bonds has remained stable throughout almost all of 2025. Source: Bloomberg Finance LP, XTB

Future Expectations

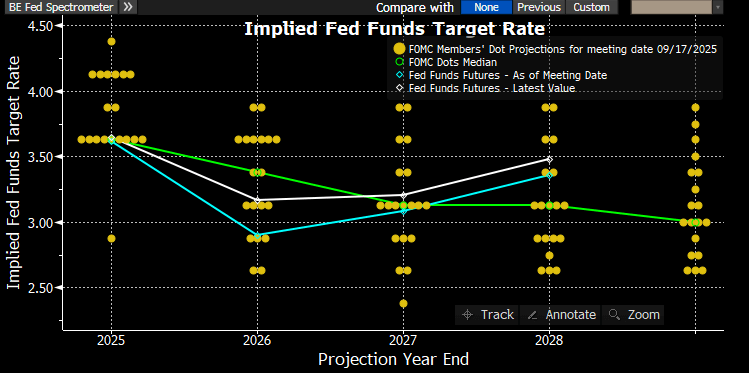

The current Fed consensus points to only one rate cut next year, while the market prices in two. The 'dot plot' itself shows a massive dispersion of expectations for 2026 and 2027. It is likely that the latest projections will be somewhat more cohesive and open the door to more cuts next year than just one. Bloomberg Economics suggests rates could be lowered by as much as 100 basis points next year, a scenario that could be realised with the appointment of a new, more dovish Fed Chair. The next cut is priced for April or June next year, but if data proves weak, there is a chance the reduction could come in March, or even January, which would deal a significant long-term blow to the dollar.

The expectations of FOMC members for future years are not highly consistent. However, if the median projection for interest rates is lowered, it could weigh against the dollar. Maintaining the median unchanged would provide a pretext for extending the current downward correction on EUR/USD. Source: Bloomberg Finance LP

The expectations of FOMC members for future years are not highly consistent. However, if the median projection for interest rates is lowered, it could weigh against the dollar. Maintaining the median unchanged would provide a pretext for extending the current downward correction on EUR/USD. Source: Bloomberg Finance LP

Macroeconomic Projections

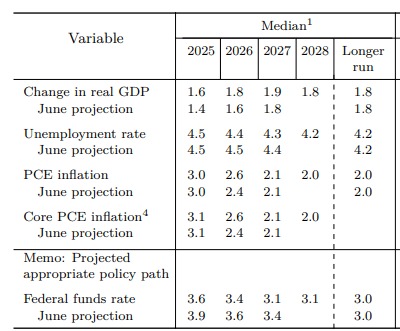

- The market anticipates a downward revision of the inflation projection for 2025. Core PCE inflation is expected to be lowered to 2.9% from 3.1%. This has limited relevance for today's decision but suggests slightly less inflationary pressure than initially anticipated.

- The market expects the Core PCE forecast for 2026 and 2027 to remain unchanged at 2.6% and 2.1% respectively.

- The unemployment rate forecast is expected to be minimally raised for 2026 to 4.5%. If the labor market indeed deteriorates, the Fed may decide on more rate cuts next year. Unemployment projections could be key to the interest rate outlook.

- GDP forecasts are expected to be raised, to 1.8% for 2025 and 2.0% for 2026.

- Bloomberg Economics does not anticipate changes to the median expectation for interest rates, pointing to one cut for 2026 and one cut for 2027.

The lack of an increase in inflation forecasts may weigh against the dollar in the longer term. Projections for the unemployment rate will also be important. An increase in this forecast for next year could signal further deterioration in an already weak labour market situation. Source: Fed

The lack of an increase in inflation forecasts may weigh against the dollar in the longer term. Projections for the unemployment rate will also be important. An increase in this forecast for next year could signal further deterioration in an already weak labour market situation. Source: Fed

What Will Powell Say?

The market will scrutinize the statement and the macroeconomic projections, but immense attention will be focused on Chairman Powell's press conference. Reports of mixed economic perspectives presented in the Beige Book are circulating in the market, a point Jerome Powell may address. The same applies to the ADP report, which indicated a decline in employment. His comments on inflation will also be watched closely. If he avoids sounding alarms about high risk, it could be interpreted dovishly by the market.

How Will the Market React?

The US dollar depreciated significantly in the final week of November and early December, amid increasing certainty regarding the Fed's decision and indications that the new Fed Chair would be Kevin Hassett, an economic advisor to Donald Trump and a proponent of low-interest rates. A key factor in the rate narrative for next year will be whether Powell steps down from his Board of Governors term.

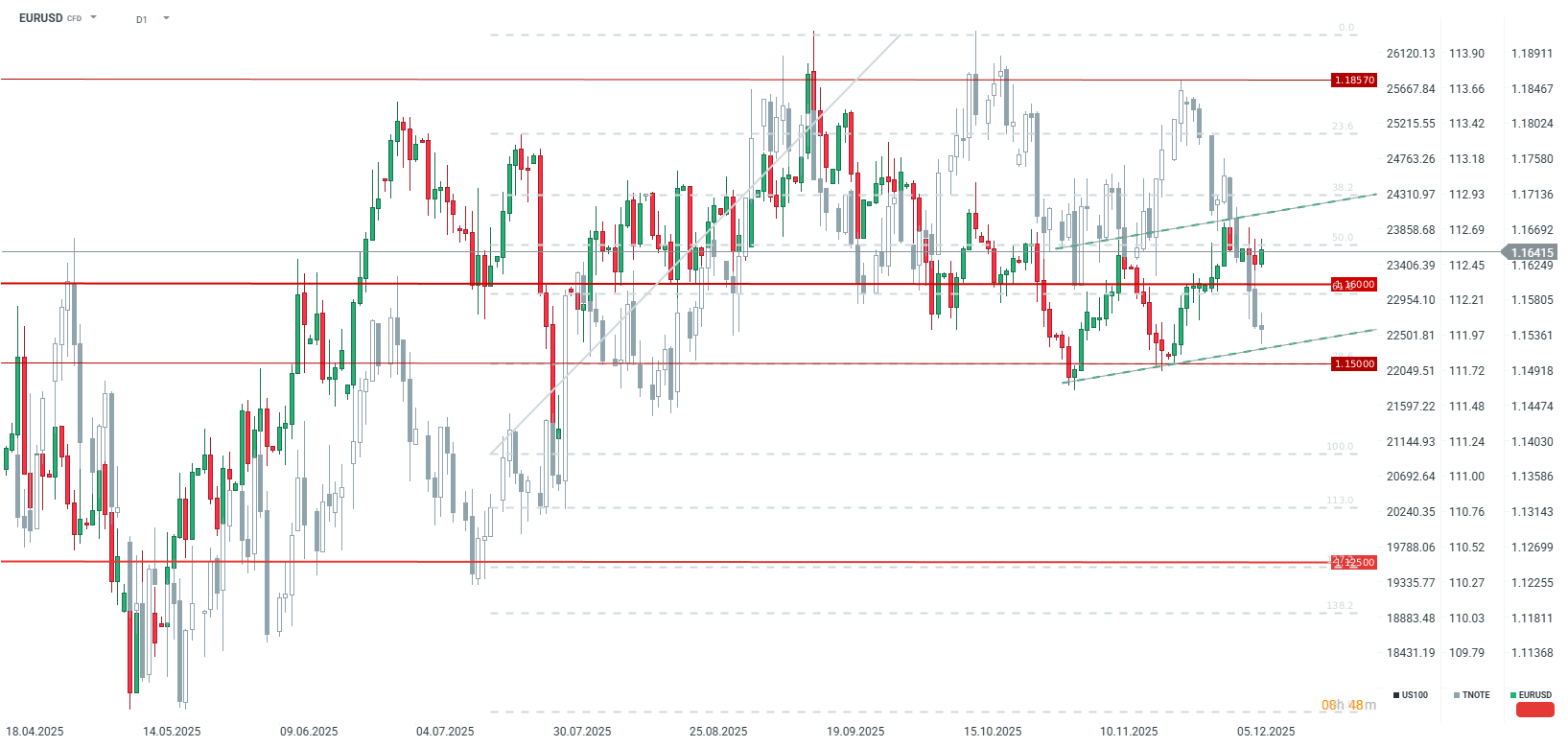

The dollar has gained some ground in the past few sessions, and even hawkish expectations regarding the ECB failed to trigger a larger euro rally. Consequently, if more votes to hold rates actually materialize and the median for interest rates remains unchanged for next year, the dollar could strengthen slightly against the euro, potentially pushing EUR/USD to test the 1.1600 vicinity. Over the longer term, however, a more dovish tilt is expected within the Fed, possibly linked to weaker economic data. In that scenario, EUR/USD could be heading towards the 1.20 level next year. Nonetheless, if Powell is markedly dovish during today's address, it could prompt a test of the recent local high from December 4 at 1.1680.

EURUSD has surrendered some of its recent gains. US bond yields currently suggest a slightly stronger dollar, but it is important to remember that the Fed is still expected to cut rates today. Yields are slightly below 4.2%, while long-term Fed rate expectations point to a 3.0% level, which should significantly lower yields over time, leading to an increase in bond prices. If the Fed begins executing the scenario of lowering rates towards the long-term expected rate, yields should also decline from current levels. Source: xStation5

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

US OPEN: War in Iran hits the markets

EU Suspends Landmark Trade Deal. Gold is up 2%

⛔ Trump’s tariffs ruled illegal: will companies receive billions of dollars in refunds?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.