The decision of the FOMC will be taken today at 7pm CET/6pM GMT. While investors generally expect the Fed to hold rates unchanged, the post-meeting conference will be very important. Here’s the background.

The US economy remains surprisingly resilient

The tightening cycle in the US has been the most dynamic in four decades. Not only rates were lifted by more than 5pp in less than 18 months but the Fed also keeps conducting QT (a reverse of QE, aka money printing). One would expect this sort of tightening to potentially hurt growth but while it’s not all roses, the economy remains surprisingly resilient.

It’s not even about the 4.9% Q3 GDP as it was partly inflated by inventory building and government spending. A wide range of indicators shows the economy halted a downward trajectory and actually shows some signs of improvement. Let’s take a look at few examples:

- Retail sales in real terms picked up in September and nominal y/y growth stood at 8 months high of 3.8%

- Durable orders are close to record high and annual growth accelerated to 7.8%

- Unemployment rate inched up to 3.8% but it’s partly due to people returning to the labour market and weekly jobless claims stay low at just above 200k

- New job offers (JOLTS) actually rose again in September

- Consumer sentiment remains stable

- Activity surveys were recovering somewhat but the latest ISM manufacturing is a clear downside surprise – the only real stain on this picture

This is in a strong contrast to weakness in Europe and signs of slowdown in Asia and while it increases odds of a soft landing it also means less comfort for the Fed

Retail sales seems to be edging up following a period of stagnation. Source: XTB Research, Macrobond

Progress on inflation but risks remain

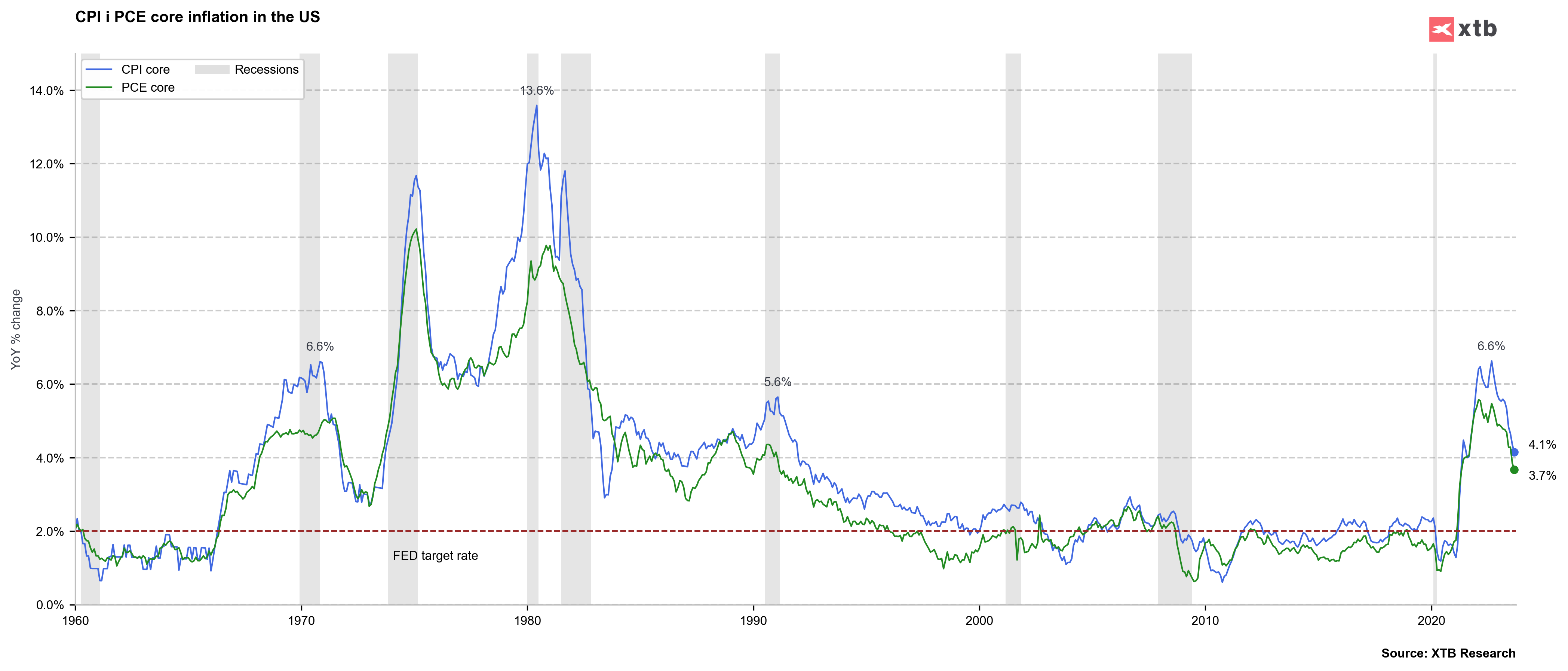

Inflation in the US has cooled considerably and is between 3.4 and 4.1% depending on the chosen (CPI/PCE) measure – less than a half from highs of 2022. Chances are that after some moderate statistical base related lift, inflation can cool down further in 2024, potentially even to the Fed’s target of 2%. But with such a strong economy, any new spark – say a further rise in OIL prices, could easily risk a second inflation wave. Just look at the University of Michigan latest survey where 1-year inflation expectations jumped to 4.2%. This is the risk that Chairman Powell pointed at over and over and it will affect the Fed policy.

Inflation outlook might be improving but risks remain. Source: XTB Research, Macrobond

Verdict: rates unchanged but hawkish Powell

One needs to give credit to the Fed for communicating their short term moves very transparently and Fed speakers turned more dovish (or less hawkish if you will) suggesting that barring some surprises the rates are unlikely to be increased again. Having said that markets would like to see rate cuts soon and we think Chairman Powell will want to fight that suggesting that if anything, rates could still go up. Therefore any joy of the end to tightening could be deflated during the post meeting conference.

Markets to watch

EURUSD

The pair has seen a correction attempt after a very decisive move down. Still this upward correction lacked momentum suggesting trend continuation and the EURUSD bears actually tried to end it even before the decision. A break lower could see the near-time test of 1.0450 with further levels much lower.

US500

The main US index is recovering following the third major leg down. This looks similar to the previous two recovery attempts and at least right now we are looking at the downward structure with impulse (down) moves much more dynamic. One needs to keep in mind that reactions to the FOMC can be very volatile and the final direction is sometimes only clear on the following day.

The main US index is recovering following the third major leg down. This looks similar to the previous two recovery attempts and at least right now we are looking at the downward structure with impulse (down) moves much more dynamic. One needs to keep in mind that reactions to the FOMC can be very volatile and the final direction is sometimes only clear on the following day.

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

US OPEN: War in Iran hits the markets

BREAKING: US Manufacturing data above expectations! 📈🏭

Market update: energy markets king, as US stock market sell off moderates

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.