The most important highlights from FOMC minutes:

- Most Fed officials viewed cut as a mid-cycle adjustment

- Fed officials stressed need for fed flexibility

- Several officials favored keeping rates unchanged

- Only few bankers expressed concerns about curve inversion

- Several bankers saw uncertainties about efficiency of QE

- Bankers said that forward guidance and QE might not be enough to eliminate procrated risks at lower bound

The first statement is very bullish for the greenback, because shows that further cuts are rather uncertain. On the other hand, the last remark mentioned above shows that the Fed is considering new monetary policy tools which may be very supportive for the equity markets (for example ETF buying) oraz negative rates. The dollar was gaining at the beginning, but after a few minutes the dollar is close to the yesterday’s closing.

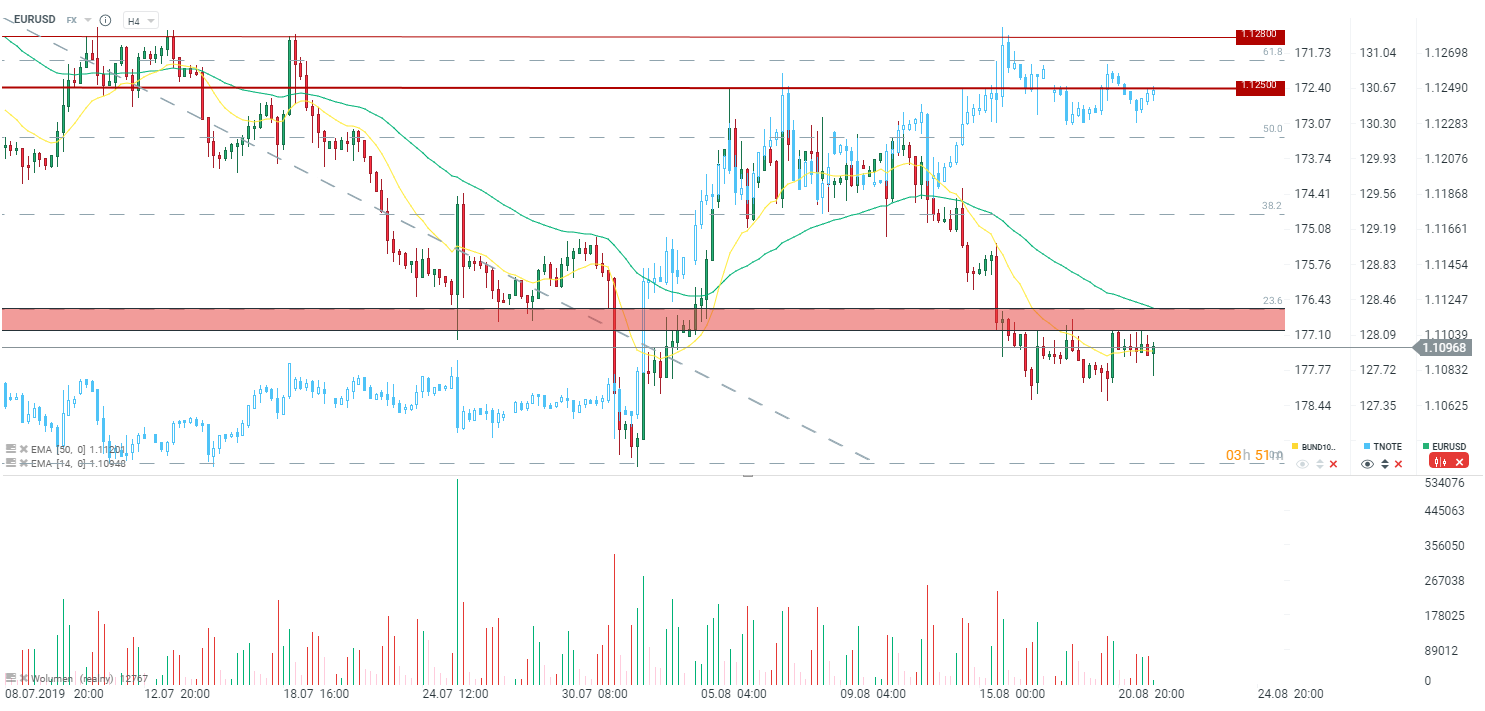

EURUSD is rebounding after first negative reactions. Source: xStation5

EURUSD is rebounding after first negative reactions. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.