1, The FTSE 100 outlook

The FTSE 100 had been a wall flower of the stock market during the Q1 market rally; however, it’s fighting back, and has finally made a fresh record high. The FTSE 100 is up by 0.1% so far on Tuesday, but it has made a fresh record high, the second consecutive high in two days.

This is a momentous occasion for the UK index, but the outperformance has been building for the past month. As market volatility has risen, the FTSE 100’s defensive qualities have boosted its attractiveness. It is higher by 1.6% in the past month, even though the S&P 500 has been down by 4.27% in the last four weeks. However, when you adjust for currency effects, the FTSE 100 is lower by 0.66% in the past month.

Thus, the performance of the FTSE 100 depends on what currency you are looking at. In sterling terms it is at a record high, in US dollar-adjusted terms its performance is weaker because of the underperformance of sterling vs, the USD in the long term, as you can see in the chart below. Thus, the FTSE 100 may be lagging its peers because US investors are not so interested in the UK index when returns are lower in USD.

Chart 1:

Source: XTB and Bloomberg

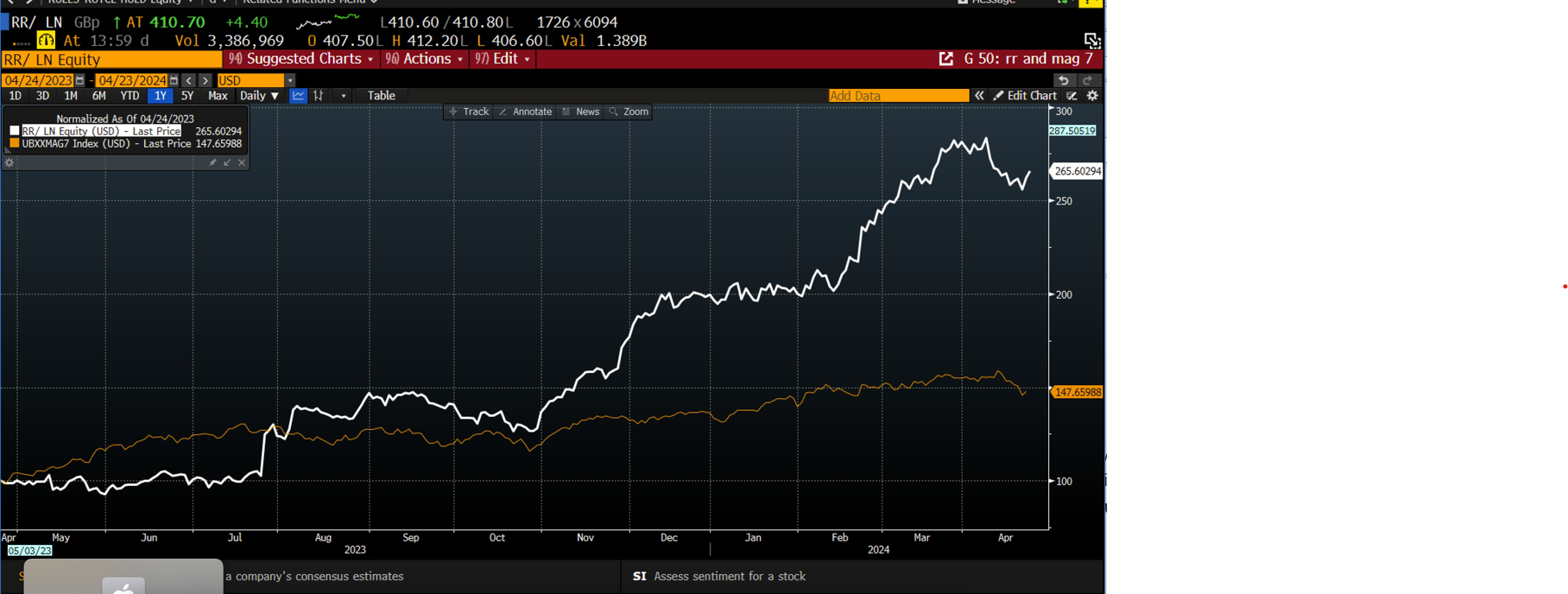

But, as we have mentioned in previous notes, there has been one star performer in the FTSE 100 in recent years: Rolls Royce. As geopolitical tensions have heated up, defense companies like RR are in demand. As you can see, even in dollar terms, Rolls Royce has outperformed the Magnificent 7 over the last 12 months.

Chart 2:

Source: XTB and Bloomberg

The UK could also benefit from economics. The bounce back in the April PMI reports suggest that Q2 growth could rise by 0.4%, as long as growth is not derailed in May and June. Added to this, inflation is set to fall sharply this month, which could leave the door open for BOE rate cuts, just as the market prices out the prospect of rate cuts in the US, again boosting the attractiveness of the UK index. For all of the doom and gloom we hear about the UK market and its imminent demise, these two charts suggest that there is still life in it yet.

2, Treasury auctions

The US is auctioning Treasuries thick and fast this week. There will be a record $69bn sale of 2-year notes later on Tuesday. The yield on 2-year Treasuries is currently 4.98%. Will this auction push the yield above 5%, will investors be attracted by this extra yield? So far, demand at Treasury auctions has been solid. A 6-month bill auction on Monday saw a bid to cover ratio of 2.8 times. If 2-year Treasury yields are to remain stable and below the crucial 5% mark, then Tuesday’s auction needs to go well.

A 5% yield is considered a line in the sand when it comes to Treasury yields. If they rise above this level, then it could signal a sharper rise towards 6%. Investors may hesitate before buying 2 -year Treasuries due to the risks of the Fed hiking rates rather than cutting them due to the persistence of inflation. On Thursday there is a record high auction of 5-year Treasury Notes. We expect this could see more demand, as this is currently a safer area of the Treasury curve to buy in, if you think that the Fed will delay rate cuts. Thus, expect volatility in the US sovereign debt market this week. If there is a ‘bad’ auction then it could knock the rally in stocks in the short term.

3, Meta and TikTok

Tech stocks are rallying on Tuesday ahead of some key earnings releases later this week. Meta will announce results on Wednesday, and analysts are bullish. They expect revenue of $36.12bn in Q1, net income is expected at $12.06bn, and the adjusted EPS is expected to be $4.55. Analysts have revised their estimates for Meta’s EPS by 2.82% in the past 4 weeks.

However, Meta’s share price is lower by nearly 5% in the past month, as the market sold tech and growth stocks amid a surge in volatility. However, Meta could be due a recovery rally, not least because it could be one of the big winners from the TikTok ban in the US. If it is banned, then it could add 2-5 minutes of extra viewing time per daily active user for Meta reels and other social media platforms. The scale of Meta platforms, with over 200 billion views a day, could also lead TikTok creators to Meta, which could also boost growth down the line. Thus, the demise of TikTok in the US could be good news for Meta.

4, Tesla earnings

Tesla opened higher on Tuesday, ahead of its earnings release later today, however, it is still lower by nearly 10% in the past week. We have mentioned the low expectations for Tesla’s Q1 performance. The market is expecting $22.3bn in revenues for Q1, with adjusted EPS expected to come in at $0.52, which is a 38% decline YoY. Its growth rate is weaker than its peers, and analysts have been revising down their expectations for Tesla Q1 earnings in the past 4 weeks.

The market will focus on forward guidance, which is expected to be weaker after the announcement in Q4, and also an explanation for the recent rush to cut staff numbers and slash global car prices, which was announced last weekend. In fairness, what happens to Tesla does not necessarily spell disaster for the rest of the Magnificent 7. It has transformed into the Magnificent 5 in the past year. As you can see in this chart, Alphabet and Tesla are notable under performers vs. the rest of the Magnificent 7 in the past year. This chart has been normalized to show how the Mag 7 move together.

Chart 3:

Source: XTB and Bloomberg

It is worth noting the bar is high for all S&P 500 companies this earnings season due to elevated valuations, especially for tech. The Magnificent 7 are expecting to see earnings growth of 38% for Q1. However, if you exclude Nvidia, this falls to 23%. Thus, a lot is still resting on Nvidia and it does not report results for another month.

Politics batter the UK bond market once more, as Starmer remains under pressure

The Week Ahead

Market update: recovery takes hold, but investors remain on edge

Is a recovery on the cards? A deep dive into why bitcoin is weighing on tech stocks

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.